TORONTO, March 31, 2025 (GLOBE NEWSWIRE) -- Revival Gold Inc. (TSXV: RVG, OTCQX: RVLGF) ("Revival Gold” or the "Company”) is pleased to announce compelling results from a Preliminary Economic Assessment ("PEA”) on the Company's Mercur Gold Project ("Mercur” or the "Project”) in Utah, U.S.A. Furthermore, the Project's favorable mineral tenure, straightforward design and existing infrastructure endowment are expected by Revival Gold and the Company's consultants to support a relatively short permitting timeline of approximately two years, putting Mercur on the fast track for potential re-development.

Mercur Heap Leach PEA Highlights1

- Life-of-mine ("LOM”) production of 65.6 million tonnes ("MT”) of mineralized material at 0.60 grams per tonne ("g/T”) and 75% average recovery generating an average of 95,600 ounces of gold per year over a 10-year mine life;

- After-tax NPV at a 5% discount rate ("NPV5%”) of $294 million and after-tax IRR of 27% at a gold price of $2,175 per ounce increasing to a $752 million NPV5% and 57% IRR at a gold price of $3,000 per ounce;

- After-tax payback period of 3.6 years at $2,175 per ounce of gold decreasing to 1.7 years at $3,000 per ounce of gold;

- Pre-production and working capital of $208 million and additional LOM sustaining capital of $110 million;

- LOM average cash cost of $1,205 per ounce of gold and all in sustaining cost of $1,363 per ounce of gold;

- PEA mine plan developed from Indicated Mineral Resources of 35.3 MT grading 0.66 g/T gold containing 746,000 ounces of gold and Inferred Mineral Resources of 36.2 MT grading 0.54 g/T gold containing 626,000 ounces of gold2; and,

- Expected timeline to complete applicable baseline studies and mine permitting of approximately two years.

"As a brownfield site, Mercur offers significant historical exploration and operational data, excellent logistics including paved access, water supply system, electrical power line and substation, and close proximity to a large, skilled workforce, with the added benefit of exemplary historical environmental performance that should translate into a shorter permitting schedule and lower technical and execution risk,” noted John Meyer, Vice President, Engineering & Development.

This PEA is preliminary in nature. In addition to Indicated Mineral Resources, it includes Inferred Mineral Resources that are considered too speculative geologically to apply economic considerations that would enable categorization as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

The PEA was prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101”) guidelines by Kappes, Cassiday & Associates ("KCA”) of Reno, Nevada and RESPEC Company LLC ("RESPEC”) of Reno, Nevada (the "Study Authors”) with an effective date of March 25th, 2025. The Company will file a technical report summarizing the PEA on www.revival-gold.com and on SEDAR+ at www.sedarplus.ca in accordance with NI 43-101 within 45 days.

Conference Call

Management will host a conference call later today to discuss the results of the Mineral Resource update and PEA. Call-in information is as follows:

| Scheduled Start: | March 31st, 2025, 10:00 am EST | |

| Call-In Number: | 289-514-5100 | |

| Toll Free in North America: | 800-717-1738 |

A playback of the conference call will be available for one week at 289-819-1325 or toll free in North America at 888-660-6264. Playback passcode 20300#.

Further Details

Mineral Resource Estimate

The Mineral Resource estimate is reported in accordance with NI 43-101 and was prepared by RESPEC with an effective date of March 13th, 2025.

Table 1 summarizes the pit optimization input parameters used to develop the Mineral Resource estimate and Table 2 presents the Mineral Resources for the Main and South Mercur deposits, which were estimated at a gold price of $2,000 per ounce.

Table 1: Mineral Resource Estimate Pit Optimization Input Parameters

| Mineral Resource Pit Optimization Parameters | Units | Main Mercur | South

Mercur |

| General | |||

| Mineral Resource Gold Price | $/oz Au | $2,000 | |

| Mining/Heap Leaching Rate | tonnes/day | 18,144 | |

| Average Leach Recovery | % | 74% | 79% |

| Operating Expenditures | |||

| Mining - Rock | $/tonne Mined | $2.76 | |

| Mining - Fill | $/tonne Mined | $2.36 | N/A |

| Incremental Haul to Crusher | $/tonne Processed | $0.35 | $0.90 |

| Heap Leaching | $/tonne Processed | $4.46 | |

| General & Administrative Costs | $/tonne Processed | $0.90 | |

| Other Costs | |||

| Refining & Freight | $/oz Au Recovered | $5.00 | |

| Royalties | Net Smelter Return | 2.1%1 | |

| Note: 1. Royalties for the property are variable and were calculated on a block-by-block basis. This value represents the block-weighted average net smelter return royalty for the Main and South Mercur PEA pits. | |||

Table 2: Mineral Resource Estimate

| Project Area | Indicated Mineral Resources | Inferred Mineral Resources | ||||

| Tonnage

(kT) | Gold Grade (g/T) | Gold (koz) | Tonnage (kT) | Gold Grade (g/T) | Gold (koz) | |

| Main Mercur | 28,629 | 0.63 | 581.0 | 33,179 | 0.53 | 567.0 |

| South Mercur | 6,670 | 0.77 | 165.0 | 3,066 | 0.60 | 59.0 |

| Total Mercur | 35,299 | 0.66 | 746.0 | 36,246 | 0.54 | 626.0 |

| Notes: 1. The Mineral Resource estimates were developed by Michael S. Lindholm, CPG of RESPEC in Imperial units, and the results and optimization parameters were converted into metric units. 2. In-situ Mineral Resources are classified in accordance with CIM Standards. 3. Mineral Resources for all model blocks were calculated within optimized pits at a cut-off gold grade of 0.005 oz/ton (0.17 g/tonne). 4. The average gold grades of the Mineral Resources are comprised of the weighted average of block-diluted grades within the optimized pits. Alluvium and historical waste rock and backfill materials are not included in the Mineral Resources. 5. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. 6. Mineral Resources potentially amenable to open pit mining methods are reported using a gold price of US$2,000/oz, a throughput rate of 20,000 tons/day (18,144 tonnes/day), variable metallurgical gold recoveries that average 74% for Main Mercur and 79% for South Mercur, variable net smelter return royalties with a block-weighted average of 2.1%, mining costs of US$2.50/ton (US$2.76/tonne) mined, heap leach processing costs of US$4.05/ton (US$4.46/tonne) processed, and general and administrative costs of US$0.82/ton (US$0.90/tonne) processed. The gold commodity price was selected based on an analysis of the three-year trailing average at the end of February 2025. 7. The effective date of the Mineral Resource estimate is March 13, 2025. 8. Rounding may result in apparent discrepancies between tons, grade, and contained metal content. | ||||||

Table 3 illustrates the sensitivity of the Main and South Mercur Mineral Resources to changes in the gold price from $1,600 per ounce up to $2,400 per ounce. All sensitivity cases are tabulated at a cutoff gold grade of 0.005 oz/ton (0.17 g/tonne). All tabulations at gold prices lower than the base case of $2,000/oz represent subsets of the current Mineral Resources. All tabulations at gold prices higher than the base case reflect potential future increases in Mineral Resources and are provided for information only.

Table 3: Mineral Resources Sensitivity to Gold Price

| Mineral Resource Category & Gold Price | Resource Tonnage (kT) | Contained Gold Grade (g/T) | Contained Gold (koz) |

| Mineral Resource Sensitivity at $1,600/oz Gold | |||

| Total Indicated | 28,641 | 0.69 | 636 |

| Total Inferred | 27,611 | 0.58 | 514 |

| Mineral Resource Sensitivity at $1,800/oz Gold | |||

| Total Indicated | 31,560 | 0.67 | 683 |

| Total Inferred | 31,507 | 0.55 | 562 |

| Base Case Mineral Resource $2,000/oz Gold | |||

| Total Indicated | 35,299 | 0.66 | 746 |

| Total Inferred | 36,246 | 0.54 | 626 |

| Mineral Resource Sensitivity at $2,200/oz Gold | |||

| Total Indicated | 37,089 | 0.65 | 779 |

| Total Inferred | 39,022 | 0.52 | 654 |

| Mineral Resource Sensitivity at $2,400/oz Gold | |||

| Total Indicated | 40,238 | 0.64 | 822 |

| Total Inferred | 43,901 | 0.53 | 743 |

| Notes:1. The Mineral Resource estimates were developed by Michael S. Lindholm, CPG of RESPEC in Imperial units, and the results and optimization parameters were converted into metric units. 2. In-situ Mineral Resources are classified in accordance with CIM Standards. 3. The base case reported Mineral Resources at a gold price of $2,000/oz Au is shown in bold and has an effective date of March 13, 2025. 4. Tabulations at gold prices higher and lower than the base case are presented to demonstrate sensitivities to fluctuating gold prices. 5. Tabulations comprise all model blocks at a cutoff gold grade of 0.005 oz/ton (0.17 g/tonne) for all material within optimized pits at variable gold prices. Pit optimizations used a throughput rate of 20,000 tons/day (18,144 tonnes/day), assumed variable metallurgical gold recoveries that average 74% for Main Mercur and 79% for South Mercur, variable net smelter return royalties with a block-weighted average of 2.1%, mining costs of US$2.50/ton (US$2.76/tonne) mined, heap leach processing costs of US$4.05/ton (US$4.46/tonne) processed, general and administrative costs of $0.82/ton (US$0.90/tonne) processed. 6. Tabulations at gold prices lower than the base case of $2,000/oz Au represent subsets of the current Mineral Resources. 7. Tabulations at gold prices higher than the base case reflect the potential for increased Mineral Resources and are provided for information only. 8. The average grades of the tabulations are comprised of the weighted average of block-diluted grades within the optimized pits. Alluvium, dump and backfill materials are not included in the tabulations. 9. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. 10. Rounding may result in apparent discrepancies between tons, grade, and contained metal content. | |||

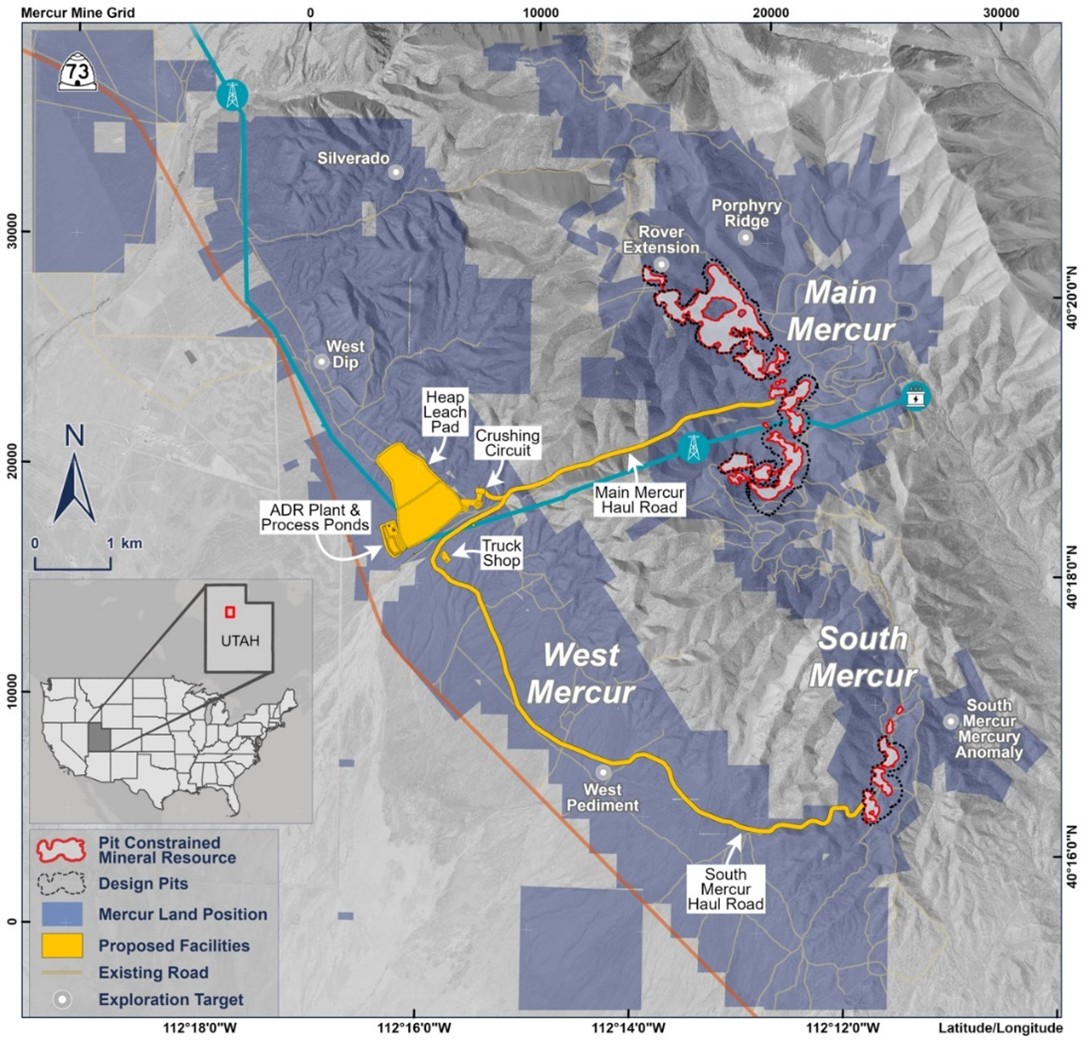

Figure 1 presents an overview map for the Mercur Project area and the location of reported Mineral Resources, exploration targets, key existing infrastructure, and proposed new facilities on the property.

Figure 1: Overview Map

Open Pit Heap Leach PEA

The PEA was developed using conventional open pit hard rock mining methods at a nominal rate for mineralized material of 18,144 tonnes/day. The PEA mine fleet is conventional with loading accomplished by a 22 m3 hydraulic shovel and a 23 m3 front loader matched to up to sixteen 136-tonne class haul trucks.

During the initial four years of operations, mining would be expected to be undertaken concurrently at both the Main Mercur and South Mercur pits. The run-of-mine ("ROM”) mineralized material would be hauled to the proposed West Mercur plant site area then crushed, conveyor stacked and leached on a dedicated leach pad. During the last six years of operations, mining would be expected to be undertaken at Main Mercur only. The LOM average strip ratio for the Project is 2.8.

ROM mineralized material from the open pits would be processed in a conventional stationary three-stage crushing circuit to achieve a particle size of 100% passing 13 mm (0.5 inch). Crushed-product would be stacked in 10-meter-high lifts on a heap leach facility located at West Mercur and leached with a low-concentration cyanide solution using a buried drip irrigation system. The resulting pregnant leach solution would be processed in an adsorption-desorption-recovery ("ADR”) plant for the recovery of gold resulting in the production of a final doré product.

LOM average metallurgical recovery for the Project is approximately 75% of contained gold and the estimated average annual gold production would be 95,600 ounces per year. The estimated average recovery reflects average recoveries of 74% for Main Mercur and 79% for South Mercur. Table 4 presents the mine and gold production schedule.

Table 4: Mining and Heap Leaching Schedule

| Parameter | Units | Yr -1 | Yr 1 | Yr 2 | Yr 3 | Yr 4 | Yr 5 | Yr 6 | Yr 7 | Yr 8 | Yr 9 | Yr 10 | Totals | ||||||||||||

| Mineralized Rock | Pit to Stockpile | M tonnes | 0.9 | 2.5 | 2.7 | 2.6 | 2.9 | 3.7 | 2.8 | 2.6 | 3.5 | 2.3 | 1.6 | 28.2 | |||||||||||

| Pit to Crusher | M tonnes | - | 4.3 | 4.0 | 3.9 | 4.2 | 5.4 | 2.8 | 4.8 | 3.8 | 3.0 | 1.2 | 37.5 | ||||||||||||

| Total Mined | M tonnes | 0.9 | 6.8 | 6.7 | 6.5 | 7.2 | 9.2 | 5.6 | 7.4 | 7.3 | 5.3 | 2.8 | 65.6 | ||||||||||||

| Crusher to Heap | M tonnes | - | 6.3 | 6.6 | 6.6 | 6.6 | 6.6 | 6.6 | 6.6 | 6.6 | 6.6 | 6.3 | ()[\]\\.,;:\s@\"]+)*)|(\".+\"))@((\[[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\])|(([a-zA-Z\-0-9]+\.)+[a-zA-Z]{2,}))$/;return b.test(a)}$(document).ready(function(){if(performance.navigation.type==2){location.reload(true)}$("iframe[data-lazy-src]").each(function(b){$(this).attr("src",$(this).attr("data-lazy-src"))});if($(".owl-article-body-images").length){$(".owl-article-body-images").owlCarousel({items:1,loop:true,center:false,dots:false,autoPlay:true,mouseDrag:false,touchDrag:false,pullDrag:false,nav:true})}var a=$("#display_full_text").val();if(a==0){$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:$("#cms_article_id").val()},dataType:"json",success:function(b){},error:function(b,d,c){}})}$(".read-full-article").on("click",function(d){d.preventDefault();var b=$(this).attr("data-cmsArticleId");var c=$(this).attr("data-productId");var f=$(this).attr("data-href");dataLayer.push({event:"paywall_click",paywall_name:"the_manila_times_premium",paywall_id:"paywall_article_"+b});$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:b,productId:c},dataType:"json",success:function(e){window.location.href=$("#BASE_URL").val()+f},error:function(e,h,g){}})});$(".article-embedded-newsletter-form .close-btn").on("click",function(){$(".article-embedded-newsletter-form").fadeOut(1000)})});$(document).on("click",".article-embedded-newsletter-form .newsletter-button",function(){var b=$(".article-embedded-newsletter-form .newsletter_email").val();var d=$("#ga_user_id").val();var c=$("#ga_user_yob").val();var a=$("#ga_user_gender").val();var e=$("#ga_user_country").val();if(validateEmail(b)){$.ajax({url:"/ajax/sendynewsletter",type:"POST",data:{email:b},success:function(f){$(".article-embedded-newsletter-form .nf-message").html(f);$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000);dataLayer.push({event:"newsletter_sub",user_id:d,product_name:"newsletter",gender:a,yob:c,country:e})},error:function(f,h,g){}})}else{$(".article-embedded-newsletter-form .nf-message").html("Please enter a valid email address.");$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000)}});$(document).on("click",".article-embedded-newsletter-form .nf-message",function(){$(this).removeClass("show");$(this).html("")});

| ||||||||||||