Highlights

- Large-scale, C$20M technical program to be completed during 2025.

- Transforming Haib into a top-tier, high quality, low risk copper development project.

- Multi-phase, >55,000m drill program to be completed during 2025.

- Drilling underway with 3 drill rigs ramping up to 6 rigs and double shifting to maximize drilling rates.

- Phase 2 metallurgical test work underway, with results expected in Q1 2025.

- DRA Global Limited, an international engineering and project delivery group appointed as study consultant to produce an updated PEA before Q3 2025.

- Study schedule remains on track to complete PFS by the end of 2025 and complete DFS in 2026.

- Mining and environmental baseline studies underway for permitting to commence Q3 2025.

- Large investor & sell-side analyst site visit to Haib confirmed for 1-2 February 2025

- Zambia exploration & work program planning ongoing - press release to follow

This 2025 technical strategy comprises an intensive drill and study program, including more than 55,000m of growth and quality improvement drilling, aiming to increase the size and grade of the Haib Mineral Resource Estimate ("MRE”) as well as multiple technical, environmental and metallurgical studies. This program will result in an updated Preliminary Economic Assessment ("PEA”) and Pre-Feasibility Study ("PFS”) for Haib, both to be published before the end of 2025.

This fast-tracked technical strategy of drilling, study, infrastructure and permitting activities represents a major step-change in the development of Haib and is geared towards the rapid development of the Project to the bankability stage, with major permitting and all technical studies to be concluded by the end of 2026.

Heye Daun, Koryx Copper's President and CEO commented: "We are very excited to have ended 2024 with a strong treasury of more than C$17 million in cash, no liabilities and a clean share structure. With new leadership and a top-tier technical team in place, we have hit the ground running and spent the latter part of 2024 preparing for and planning this transformative work program, which is already underway at Haib.

As part of the 2025 work program, we are planning to 1) execute the largest drill program at Haib since its discovery, aiming to improve the grade and size of the mineral resource whilst 2) proving the economic feasibility of a much larger conventional flotation concentrate process as well as subsequent heap leaching for the lower grade material.

This work program will for the first time bring together all of the quality work that was completed historically and combine it with the updated and much more detailed work which Koryx is carrying out this year, thereby delivering an integrated Haib project approach with much larger planned copper production than was contemplated historically. Under this scope Haib will produce both clean copper concentrate and refined copper cathodes. Right-sizing and optimizing the Haib Project is what our 2025 work program will achieve.

Owing to its low altitude (500m amsl), its proximity to world-class infrastructure, and the very favorable permitting and mining-friendly jurisdiction of Namibia, Haib has the genuine potential to become a high quality, low-risk global copper development project. Given our track record of execution and value creation in mining in Namibia, in addition to our blue-chip shareholder base, we believe we are perfectly placed to achieve this during 2025 and beyond.”

The updated PEA is designed to replace the outdated historical PEA from 2021 and to describe the scope of the new Haib project, thereby serving as the basis for the mine permitting process (described further down). This is to be followed up with a Definitive Feasibility Study ("DFS”) planned to be published before the end of 2026.

2025 Planning Objectives for Haib

Koryx's vision is to turn Haib into Namibia's next major mine development. This will require high-class leadership, drive, innovation and technical expertise, coupled with significant funding. To achieve this, the Company is aiming to fulfil the following key objectives during 2025:

- Reinforcing the team and establishing the infrastructure to execute a large-scale, multi-year drilling and technical study program. The program will be completed by multiple local and international service providers and overseen by Koryx' own team of competent professionals, aiming to right-size (grow) and optimize (improve quality) Haib and to fast-track the completion of a PFS by the end of 2025, followed by the completion of a DFS and mine permitting before the end of 2026.

- Significantly improve the quality of the MRE by increasing the mineral resource size and copper equivalent grade.

- Proving the techno-economic feasibility of a conventional flotation concentrate process flow sheet for the higher grade material, in parallel with an innovative leaching process for the lower grade material.

- This includes integrating the mine plan with the two parallel process flow sheets to maximize value (LOM, NPV, annual copper production rate).

- De-risking and advancing the environmental and mine permitting, infrastructure, utilities and project delivery aspects of the Project.

2025 Development Study Approach

The PEA will describe an integrated and enhanced process flowsheet for Haib, comprising flotation and concentrate production for the higher-grade ROM material, and a hydrometallurgical process including heap leaching and solvent extraction / electrowinning (SX/EW) for the lower grade ROM material.

As a part of the PEA, Koryx will evaluate alternative metallurgical process flow sheets and carry out infrastructure related trade-off studies. The Company is confident that a high degree of confidence can be ascribed to the trade-off studies as the input data will be based on actual test results and/or benchmarked data from similar projects.

The PEA will be followed up immediately by a PFS, aiming to right-size and optimize the project definition so that the team can focus on engineering the unit processes and infrastructure requirements which would generate the optimal economic outcomes for Haib.

A key aspect of the 2025 PEA is right-sizing the operation to optimise the life-of-mine (multi decade) whilst maximizing copper production. Koryx is evaluating a processing plant throughput operating range of 15 to 25mtpa crushed material (run-of-mine). Applying industry average copper recovery factors, the project could produce 50 - 100ktpa of copper (combination of copper contained in concentrate and refined copper cathode) over a life of mine of 15 - 30 years.

In developing a credible project implementation plan, Koryx will consider a staged implementation model wherein the conventional comminution and flotation processing facilities will be constructed and operated as Stage 1, followed by construction and operation of the leaching and hydrometallurgical facilities in Stage 2.

Phase 2 Drilling (Q1 2025) and Mineral Resource Planning for 2025

During 2024 the Company completed a small (3,500m), but highly successful Phase 1 drill program at Haib. The program specifically targeted higher grade, more structurally controlled areas of the Haib mineralisation with inclined drilling, which are not typical for a porphyry-type of deposit, and which had been missed by Rio Tinto's prior vertical drilling. These areas were previously identified by Koryx geologists through extensive fieldwork campaigns and were successfully traced through the 2024 Phase 1 drill program.

This 2024 drilling culminated in the publication of a new MRE for Haib, reflecting a 13% increase in Cu grade (from 0.31 to 0.35% Cu, refer to the press release dated September 10, 2024), and was immediately followed up with a larger Phase 2 drill program.

The objectives of the Phase 2 program are as follows:

- Extending and further targeting the structurally controlled, higher grade mineralisation which was identified and drilled during the 2024 Phase 1 drill program.

- Drilling and assaying for by-products, specifically molybdenum and gold, which both have the potential to be recovered in the updated mineral processing flowsheet now envisaged for Haib. The aim is to generate a sufficient sample density to be able to reflect the byproducts in the next MRE update, thereby assisting in further improving the Haib Cu equivalent grade instead of reporting just a pure Cu grade for the Haib mineralisation, as was done previously.

- Refining the geological model wireframes and improving the resolution of waste, low grade and high grade interfaces through in-fill drilling of the current 150m x 150m drill grid.

Phase 3 and 4 Drilling (Q2 and Q3 2025)

Planning for the follow-on Phase 3 drill program (29,000m) has been completed and drilling will commence immediately after the completion of the Phase 2 program late in Q1 2025. This drilling has been planned to further extend the higher grade areas (10,000m) plus infill and mineral resource extension drilling (19,000m).

A further 20,000m of Phase 4 infill drilling (reducing average drill spacing from 150m down to 75m) will be required to convert at least 80% of the mineral resource to the "Indicated” category. This drilling is expected to be completed during Q3 of 2025, thereby allowing for inclusion into the planned PFS to be published at the end of 2025. This will likely also fulfil the minimum confidence level required for the follow-on DFS study to be published at the end of 2026, although a significant quantum of additional infill and expansion drilling will likely be completed before then.

The increase in planned drill metres has resulted in 3 additional rigs being mobilised to site in Q1 2025 and the Company expects to have 5 of the 6 rigs planned on site by the end of February 2025, with at least 3 of them on double shift operations, aiming to maximize drilling rates to achieve the targeted PEA and PFS publication dates from mid and late 2025 respectively.

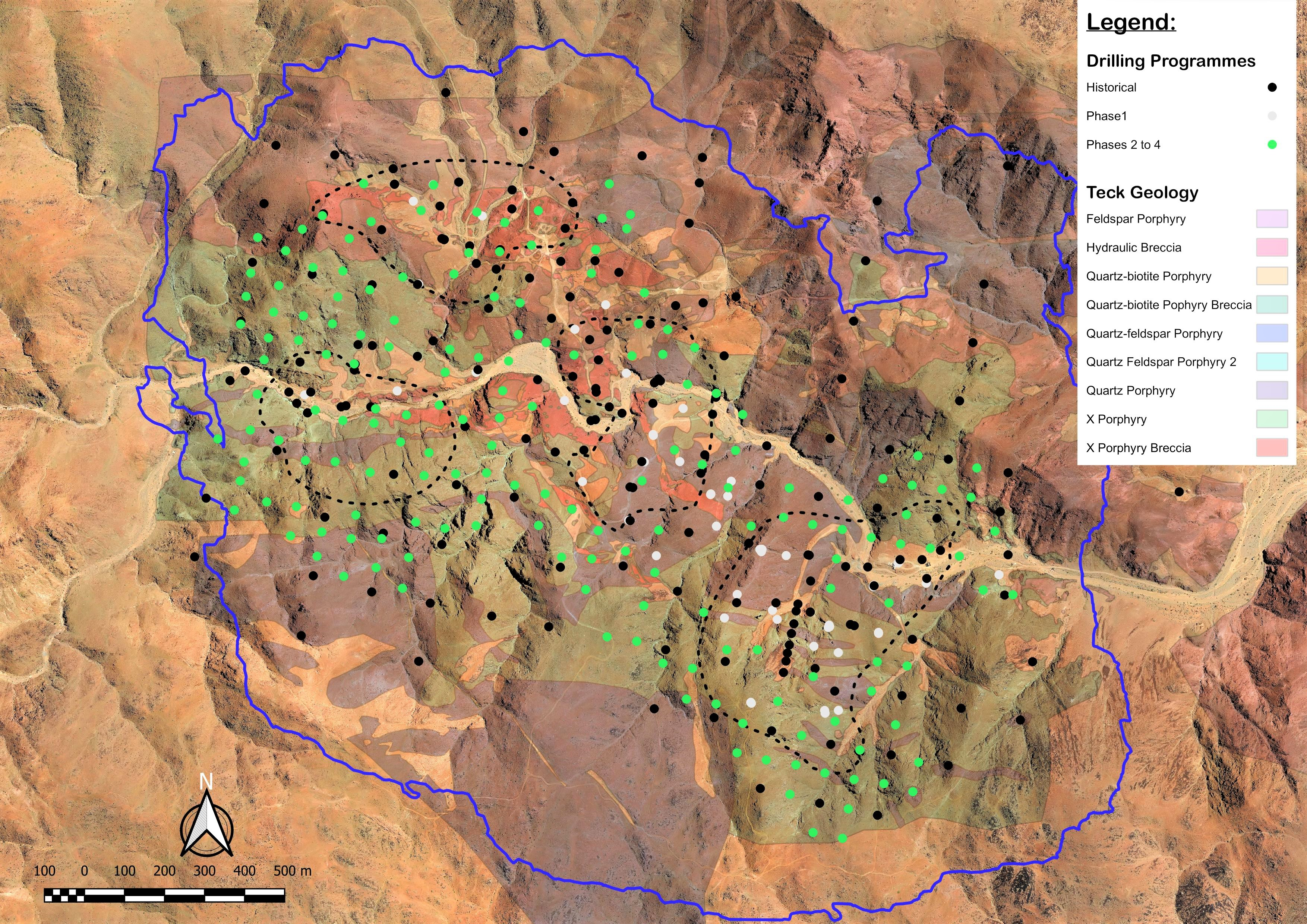

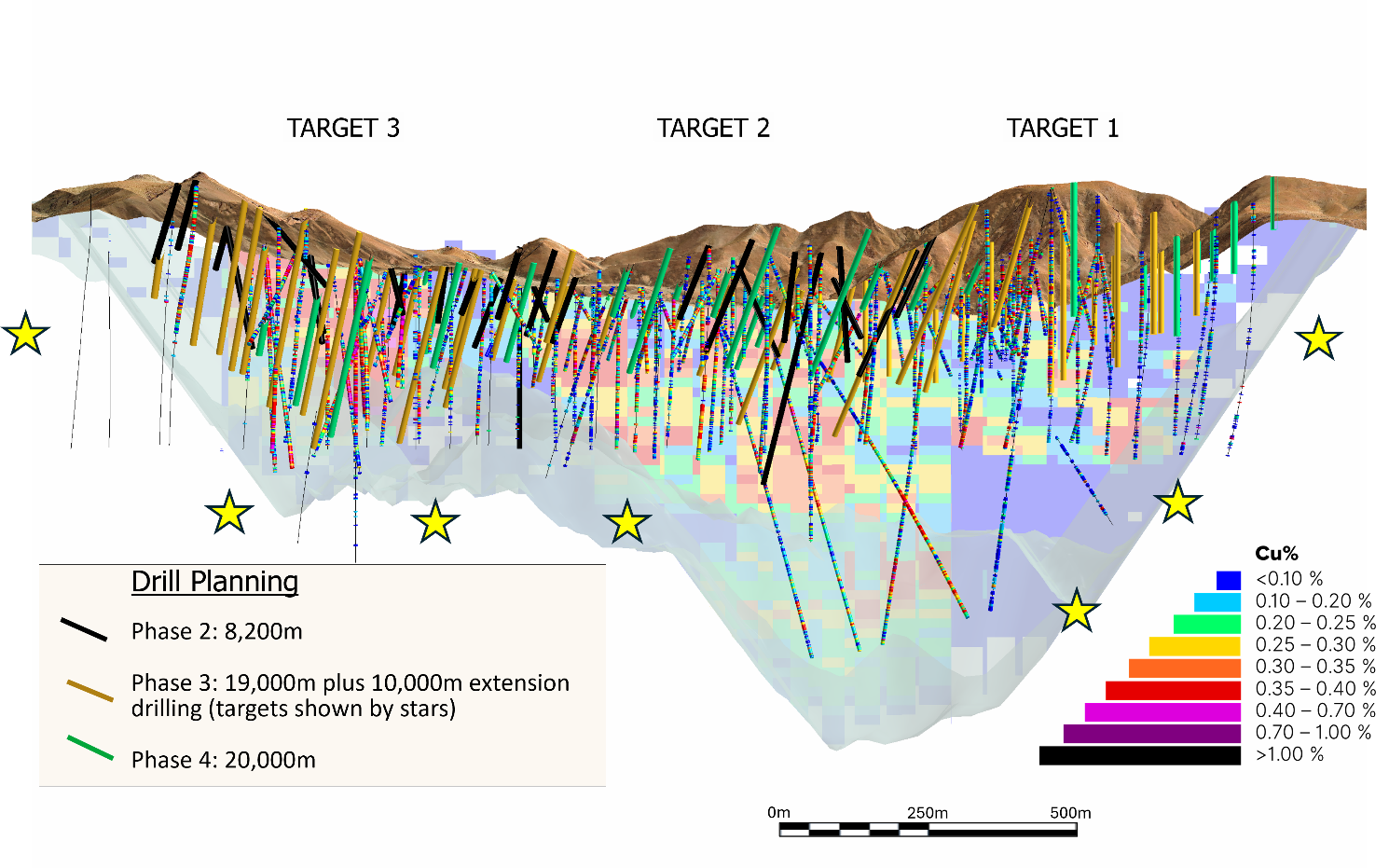

The figures below show the planned drilling for Phase 2, 3 & 4. Phase 3 drilling is expected to be completed at half year and Phase 4 drilling by the end of 2025.

Figure 1: Plan view showing historical drill collar locations and drill collars for Koryx actual 2024 and planned 2025 drilling

Figure 2: Long section showing the planned future drill programs. Detailed planning of the extension drilling program as part of Phase 2 is currently underway and target areas are indicated by yellow stars

Metallurgical Testwork Including Innovative Technologies

Koryx's metallurgical test work campaign is well advanced and builds on the high-quality work done by others since 1996, which built on the exploration activities completed by Rio Tinto and Teck Resources since the 1970's and 1990's respectively.

The objective of Koryx's metallurgical testing is to a) demonstrate the feasibility of a conventional processing route (crushing, grinding, flotation), producing a high quality clean concentrate from the higher grade material at Haib (>0.275% Cu) and b) demonstrating the feasibility of a heap-leach processing route to treat the lower grade material (<0.275% Cu) in parallel with, but staged after the conventional flotation process.

There are several innovative and relatively novel technologies with laboratory test, site demonstration plant or small-scale commercial references, that have the potential to be applicable to the Haib mineralised material. In this context, preliminary discussions have taken place with Mintek, CSIRO, Jetti, Ceibo, Nuton and MJOI in respect of the planned leach tests, and we expect to test at least two alternatives with the assistance of the technology suppliers and test laboratories as well as independent consultants specialising in chalcopyrite leach processes.

These technologies are relevant because of their ability to overcome the passivation challenge associated with leaching of the chalcopyrite mineral which is the dominant form of copper mineralisation at Haib. The Koryx study team has also evaluated the potential for bacterial heap leaching with or without the addition of catalytic reagents, as well as nitrate or chloride based chemical heap leach processes.

Composited borehole core samples for a total of about 4 tonnes of material have been selected. These samples exhibit a range of copper, gold and molybdenum grades as well as some variation in mineralogical composition.

Samples amounting to about 2 tonnes have already been despatched to Maelgwyn in Johannesburg for minerals processing tests on materials containing above 0.275% Cu. Testwork has begun to confirm or enhance the results of laboratory and pilot tests carried out in 1996, with the following tasks to be performed in the laboratory:

- Crushing and milling tests to support comminution circuit modelling.

- Mineralogical examination for pre-concentrate, concentrate and tailings samples.

- Chemical analyses to include copper, molybdenum and gold.

- Bulk sorting tests and simulations of both low- and high-grade mineralisation, to enable modelling of pre-concentration after primary crushing.

- Dense medium separation ("DMS”) tests to enable modelling of pre-concentration

- Coarse particle flotation with and pre-concentration test aiming potentially significantly reduce tonnage to regrind and cleaner flotation.

- Conventional milling and flotation tests of fresh sulphide and oxide/transitional material.

- Dewatering and transportability tests of final flotation concentrate and tailings

- Geochemical column leach tests of low grade, waste rock and filtered tailings to determine potential for acid generation and acid rock drainage.

- Geotechnical tests of filtered tailings to confirm likely stability.

- Acid heap leaching of oxide/transitional material samples.

- Crushing tests to confirm differences in physical characteristics from higher grade material.

- Mineralogical and chemical analyses of material.

- Bacterial acclimatisation, compatibility and culture development tests.

- Bacterial heap leach tests using 1m or 6m diameter columns for about 9 months.

- Chemical heap leach tests in columns, using 2-3 different commercial techniques intended to overcome chalcopyrite passivation.

- Geotechnical and geochemical tests of residue from the column leach tests.

Trade-off Studies and Additional Technical Assessments

At this early stage of this type of mining and processing project, there are many possible alternatives in each link of the value chain. It is rarely immediately clear which of these alternatives will provide a combination of low technical risk and high value, especially when the links are combined into the entire chain. At the PEA stage of project development, it is relatively inexpensive to consider the techno-economic potential of most alternatives. We plan to do this, with a subsequent significant reduction in the number of alternatives to be considered in more depth when the project proceeds to the PFS stage.

The metallurgical test results will be used to support or confirm the expected results of the following process trade-off studies:

- Comparison of different pre-concentration flowsheets including rock sorting, DMS and coarse particle flotation.

- Assessment of optimal crushing and milling configuration.

- Concentrator plant capacity revenue versus cost trade-offs.

- Technical comparison of alternative leach processes to recover copper from chalcopyrite mineralisation.

- Techno-economic comparison of sale or toll treatment of flotation concentrate versus on-site leaching and refining of concentrate with copper metal being transported to market.

- Site assessment for alternative metallurgical plant location including civils geotechnical evaluation and impact analysis.

- Mining and processing value chain optimisation, to identify how best to increase head grade and revenue in early years of production.

- Stockpile optimisation (strategic and tactical use of low grade stockpiles)

- Process equipment and tailings storage facility ("TSF”) comparisons, based on thickened, paste and filtered tailings.

- Cost and modes of transport for concentrate from mine to customer/smelter.

- Electrical power supply and self-generation using renewable energy sources and battery storage technology.

- Consideration of alternative water supply sources with conceptual design and costing.

Environmental studies specific to the Haib area began in 2024 to evaluate the wider area which is being targeted for development. A screening study has confirmed that there are no fatal flaws impeding the project development and have made recommendations for specialist studies to take place during 2025. Some of the studies will commence as the results of certain technical trade-off studies listed above provide more detail on the specific mine design:

- Conceptual site wide water balance and stormwater management plan for the proposed pit and infrastructure areas, including sizing of key cost areas.

- Specialist baseline studies to include;

- Biodiversity specialist field assessment

- Aquatic specialist study to focus on riparian environments including the Orange River proximal to the site.

- Hydrogeology ground water modelling

- Geochemistry study to utilise tailings material from ongoing met lab testwork, stockpile materials and waste rock dump material determined by mine planning.

- Update to Archaeological study completed in 2024 which will confirm specific infrastructure footprint.

- Air quality and noise specialist study will be performed at chosen receptor sites to create a pre-project baseline.

- Social specialist study will investigate key areas to be addressed to inform IFC requirements.

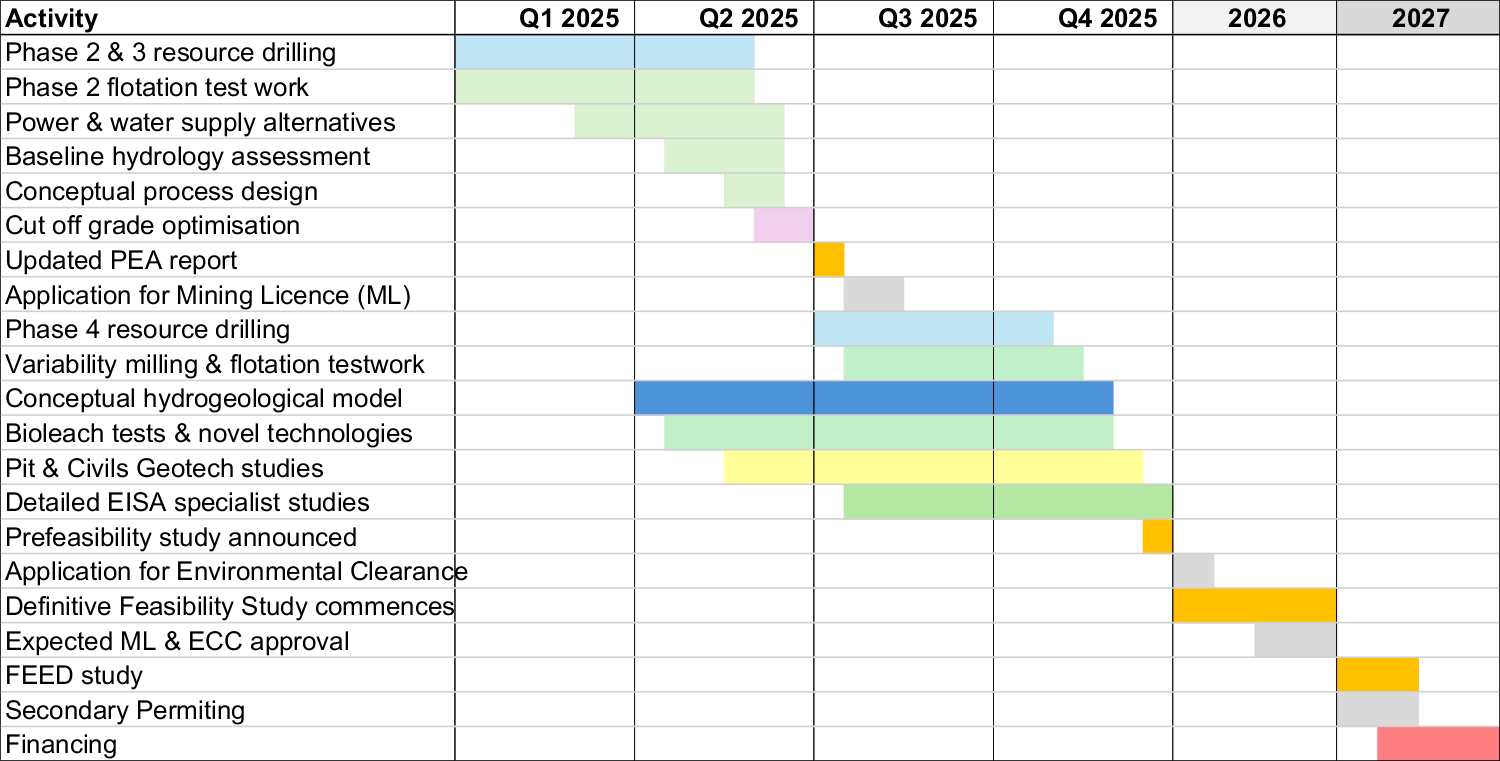

The Haib project team will continue to fast track the development studies throughout 2025 with the intension to update the PEA by the second half of the year and announce the PFS by the end of the year.

Figure 3: Drilling, Studies & Permitting Activity Schedule for 2025-2027

This will put the project in a strong position to execute the DFS in 2026 and progress to Front End Engineering and Design ("FEED”) in conjunction with project financing in 2027.

Budget

The budgeting process is ongoing and is expected to be concluded before the end of January 2025. It is anticipated that this work program will cost up to C$20 million, which is expected to be covered with Koryx current treasury plus expected warrant exercises between now and the end of the year. This budget is expected to be approved at Koryx next Board of Directors meeting to be held before the end of January 2025.

Qualified Person

Mr. Dean Richards Pr.Sci.Nat., MGSSA - BSc. (Hons) Geology is the Qualified Person for the Haib Copper Project and has reviewed and approved the scientific and technical information in this news release and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No. 400190/08) and a Qualified Person for the purposes of National Instrument 43-101.

About Koryx Copper Inc.

Koryx Copper Inc. is a Canadian copper development Company focused on advancing the 100%-owned Haib Copper Project in Namibia whilst also building a portfolio of copper exploration licenses in Zambia. Haib is a large and advanced (PEA-stage) copper/molybdenum porphyry deposit in southern Namibia with a long history of exploration and project development by multiple operators. More than 70,000m of drilling has been conducted at Haib since the 1970's with significant exploration programs led by companies including Falconbridge (1964), Rio Tinto (1975) and Teck (2014). Teck remains a strategic and supportive shareholder.

In addition to extensive drilling and metallurgical testing various technical studies have been completed at Haib to date. Haib has a current mineral resource of 414Mt @ 0.35% Cu for 1,459mt of contained copper in the Indicated category and 345Mt @ 0.33% Cu for 1136Mt of contained copper in the Inferred category (0.25% Cu cut-off). Mineralisation at Haib is typical of a porphyry copper deposit. Porphyry copper deposits are a major global source of copper with the best-known examples being concentrated around the Pacific Rim, North America and South America.

Haib is one of a few examples of a Paleoproterozoic porphyry copper deposit in the world and one of only two in southern Africa (both in Namibia). Due to its age, the deposit has been subjected to multiple metamorphic and deformation events, but still retains many of the classic mineralisation and alteration features typical of these deposits. The mineralisation is dominantly chalcopyrite with minor bornite and chalcocite present and only minor secondary copper minerals at surface due to the arid environment.

Further details are available on the Company's website at https://koryxcopper.com and under the Company's profile on SEDAR+ at www.sedarplus.ca.

More information is available by contacting the Company:

Julia Becker

Corporate Communications

+1-604-785-0850

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information includes, without limitation, statements regarding the use of proceeds from the Company's recently completed financings and the future or prospects of the Company. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect ", "is expected ", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results, performance, or achievements to be materially different from those expressed or implied by forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, other factors may cause results not to be as anticipated, estimated, or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Other factors which could materially affect such forward-looking information are described in the risk factors in the Company's most recent annual management discussion and analysis. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c0b388ab-95f8-41e2-a9a7-0af0e410676a

https://www.globenewswire.com/NewsRoom/AttachmentNg/e6c37c38-d270-4c41-9367-221e68904cbd

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ad2de10-4437-4b13-8b0a-c345460b851d