2024 Surface exploration program delivers further high-grade gold drill results including 29m @ 7.1 g/t Au from surface, gold rock samples up to 141 g/t Au, and high-grade antimony rock samples up to 56.7% Sb

U.S. grant applications for antimony development progressing

Sale of Snow Lake and extinguishment of the Nebari loan strengthens the Company's balance sheet

Caufield, Australia, Jan. 17, 2025 (GLOBE NEWSWIRE) -- Nova Minerals Limited ("Nova” and the "Company”) (NASDAQ: NVA) (ASX: NVA), (FRA: QM3), a gold and critical minerals exploration stage company focused on advancing the Estelle Gold and Critical Minerals Project in Alaska, U.S.A.

Highlights

Estelle Project

- During the quarter Nova received assay results from the 2024 exploration program for the RPM drilling, and for surface samples taken from the Muddy Creek, Styx, and Stibium prospects. Assay results still outstanding from the Stoney, Wombat, and regional RPM surface sampling are expected back shortly.

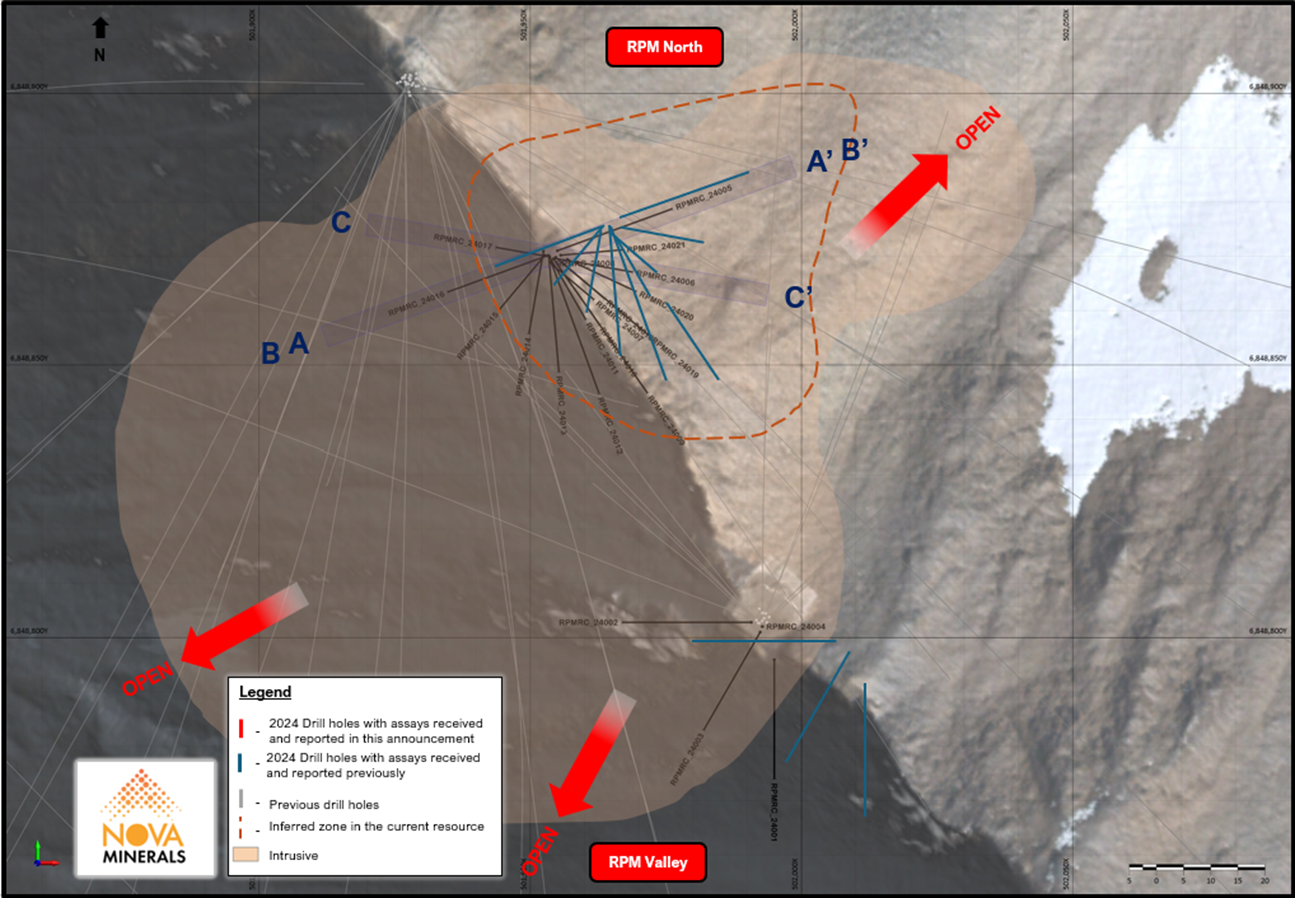

High-Grade Gold Continues at RPM

- The 2024 drill program, which comprised of 21 holes and used the Company owned Reverse Circulation (RC) rig to keep costs to a minimum, was a highly targeted program focused on Pre-Feasibility stage drilling at the high-grade RPM deposit to continue to increase and prove-up resources to the higher confidence Measured and Indicated categories. The majority of the shallow drilling was allocated to advance the high-grade RPM starter pit area (Figure 5).

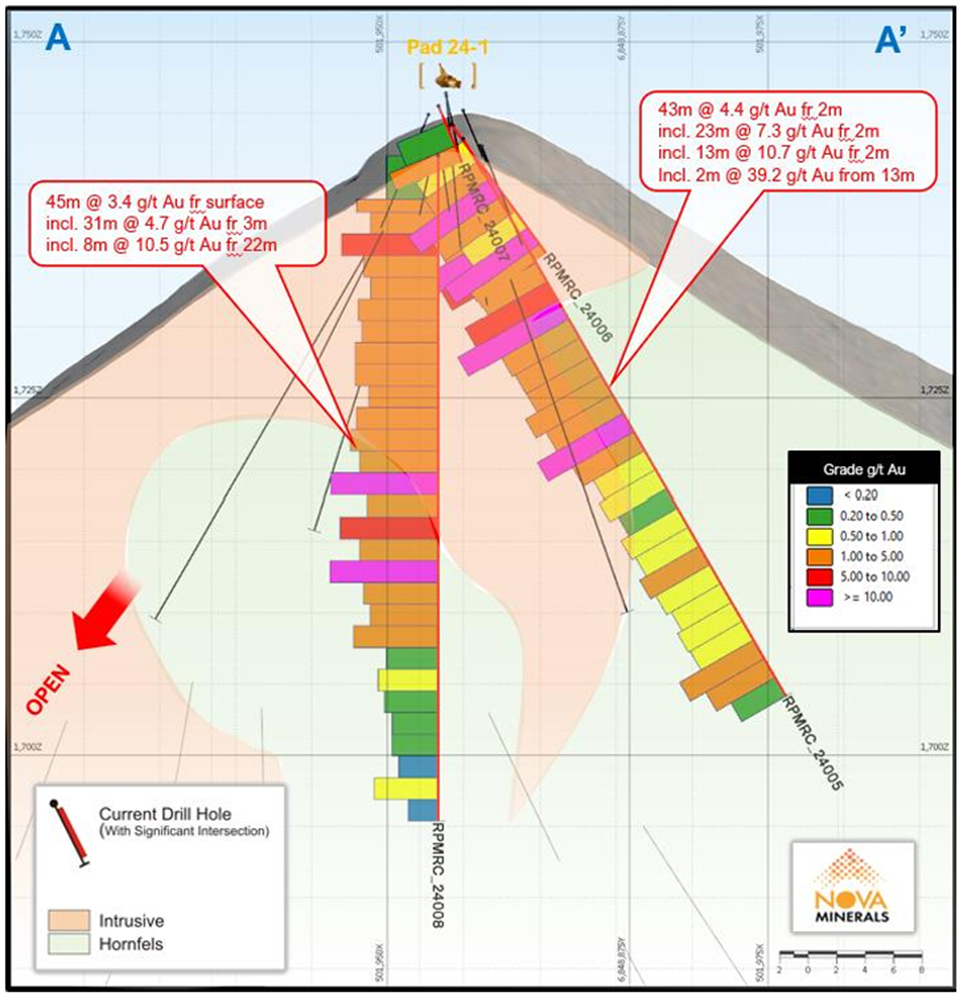

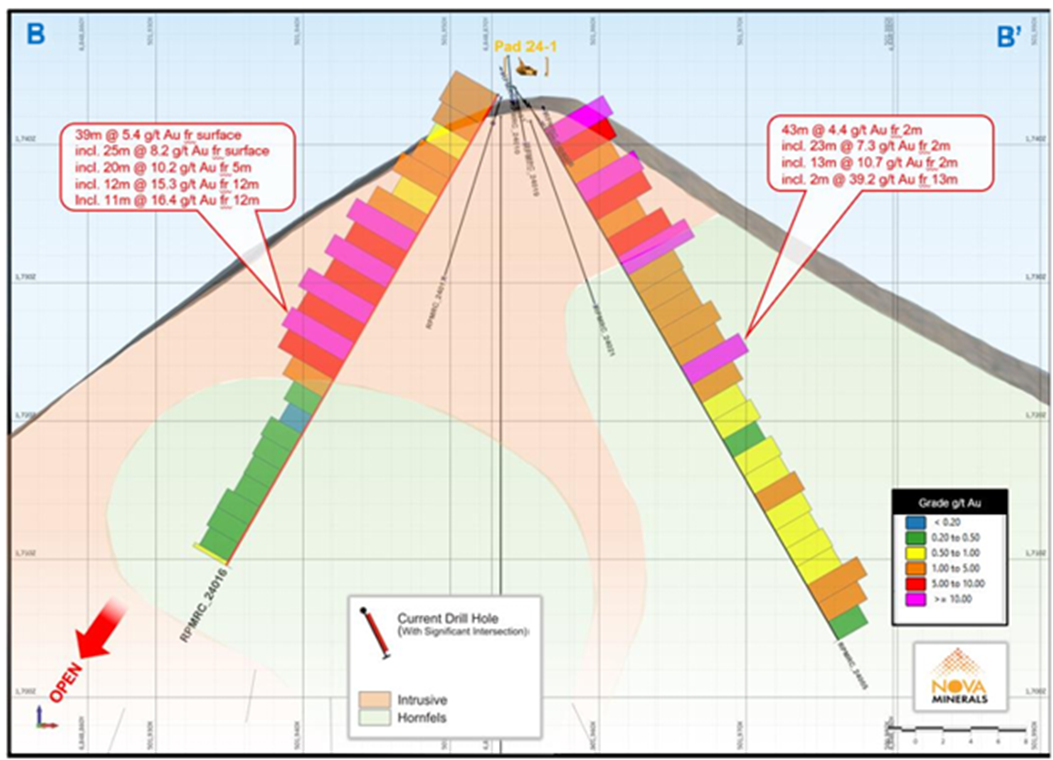

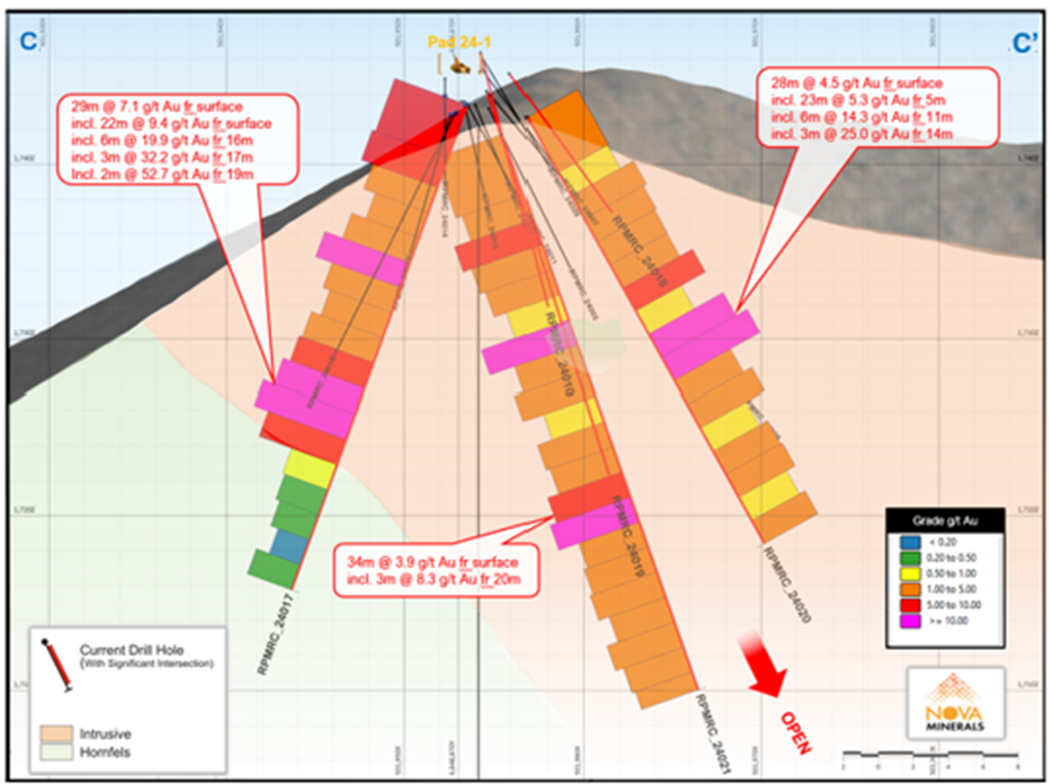

- Results confirmed the continuity of the near surface high-grade mineralization at RPM North with multiple broad intersections grading > 5 g/t Au from surface and sample interval grades up to 52.7 g/t Au. All holes ended in mineralization with highlight results including (ASX Announcements: 9, 16 & 23 October 2024 and Figures 1 to 4):

- RPMRC-24005: 43m @ 4.4 g/t Au from 2m, including 13m @ 10.7 g/t Au from 2m, and 2m @ 39.2 g/t Au from 13m.

- RPMRC-24008: 45m @ 3.4 g/t Au from surface, including 31m @ 4.7 g/t Au from 3m and, 8m @ 10.5 g/t Au from 22m.

- RPMRC-24016: 39m @ 5.4 g/t Au from surface, including 20m @ 10.2 g/t Au from 5m, and 11m @ 16.4 g/t Au from 12m.

- RPMRC-24015: 26m @ 3.7 g/t Au from surface, including 18m @ 4.8 g/t Au from 8m, and 5m @ 14.0 g/t Au from 19m.

- RPMRC-24017: 29m @ 7.1 g/t Au from surface, including 22m @ 9.4 g/t Au from surface, and 2m @ 52.7 g/t Au from 19m.

- RPMRC-24020: 28m @ 4.5 g/t Au from surface, including 23m @ 5.3 g/t Au from 5m, and 3m @ 25 g/t Au from 14m.

- Extensive surface exploration sampling program was conducted around the wider RPM area to potentially extend existing and delineate additional high-grade mineralized zones, with results expected back shortly.

- 2024 follow-up sampling at Muddy Creek reveals further high-grade gold with 6 rock samples > 10 g/t Au, including a high of 128.5 g/t Au, and 8 soil samples > 2 g/t Au, including a high of 6.3 g/t Au (ASX Announcement: 27 November 2024).

- The Muddy Creek high-grade zone now measures 800m x 400m (Figure 6).

- Follow-up rock sampling at Stibium reveals high-grade gold over 800m long by 400m wide zone with 7 samples greater than 20 g/t Au, including 16 samples greater than 5 g/t Au, and a high of 141 g/t Au (ASX Announcement: 11 December 2024 and Figure 7).

Stibium Antimony Results up to 56.7% Sb

- Follow-up rock sampling at Stibium revealed high-grade antimony (Sb) over 800m long by 400m wide zone with 11 samples greater than 30 Sb, and a high of 56.7% Sb (ASX Announcement: 5 December 2024 and Figure 8).

- Broad structurally controlled gold and antimony zones identified at Stibium for a 2025 resource drill program.

- Nova Minerals, through our 100% owned subsidiary Alaska Range Resources LLC, is a member of the Defense Industrial Base Consortium (DIBC), and as an early mover is well advanced with the Dept of Defense (DoD) grant application process.

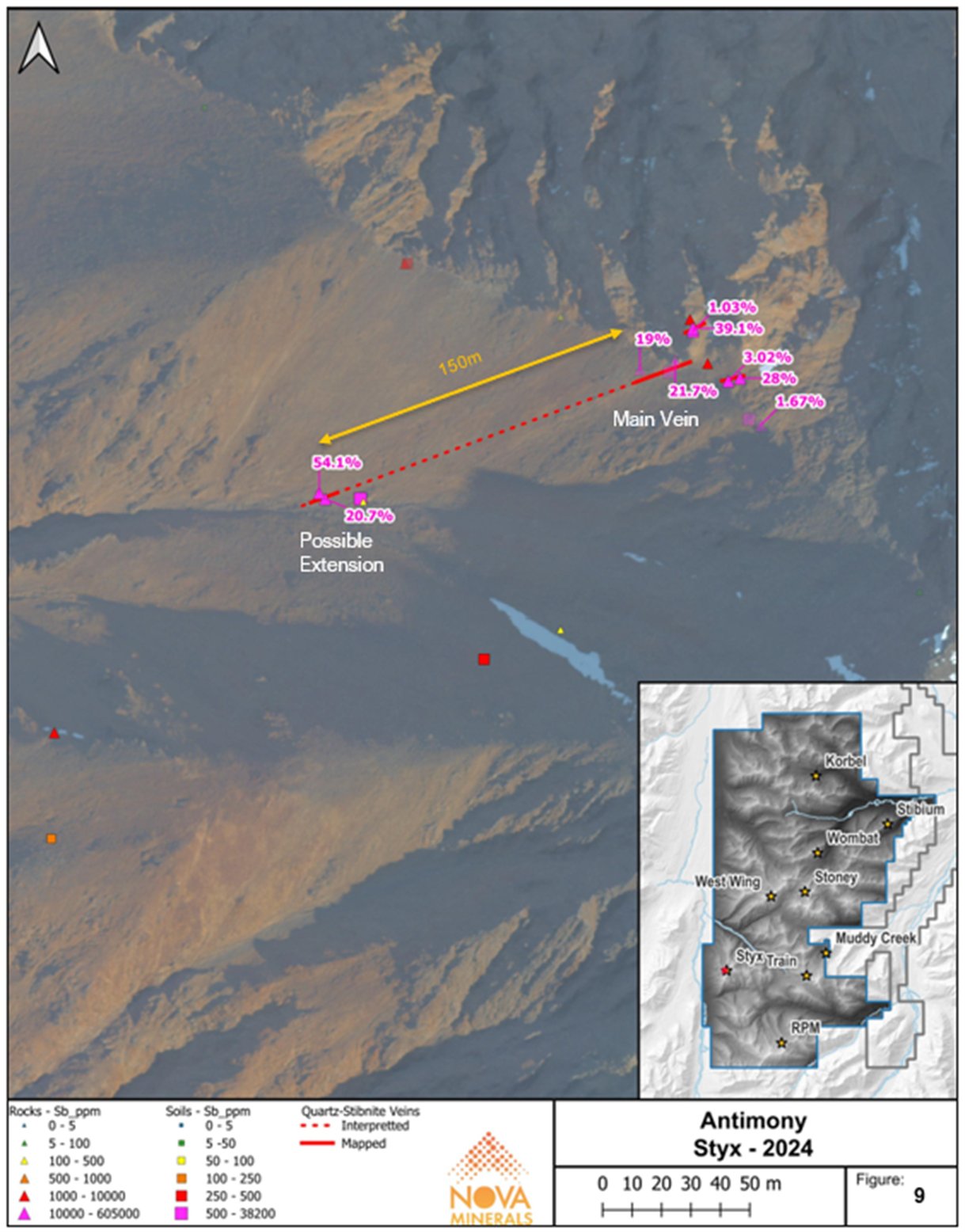

- Follow-up sampling at Styx revealed high-grade antimony in outcrop with 4 samples greater than 20% Sb, and a high of 54.1% Sb (ASX Announcement: 20 November 2024 and Figure 9)

- The main Styx occurrence is a ~1m thick quartz-stibnite vein (50% stibnite) with excellent outcrop exposure over 20m. Samples from the main vein occurrence in 2023 measured 19% and 21.7% Sb (ASX Announcement 10 October 2023).

- Additional sampling of splays around this occurrence show the anomaly likely extends over a 150m strike length.

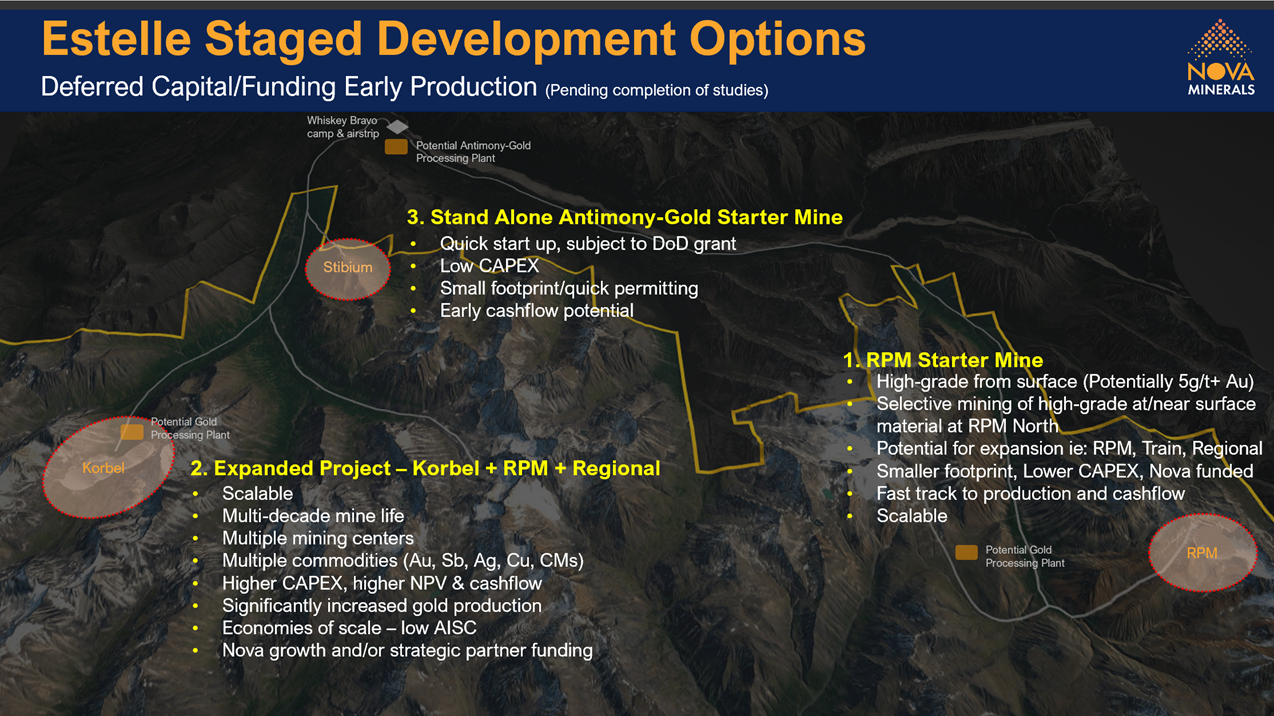

- Estelle is a major mineralized trend, hosting gold, antimony, silver, copper, and other critical elements and Nova is working to begin production as early as possible with the potential to operate for decades supplying the minerals the world needs.

- The Pre-Feasibility Study (PFS) currently underway is considering a strategy to achieve production as soon as possible with a scalable operation, subject to market conditions and strategic partners (Figure 10), by;

- Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit for potential near term cashflow at high margins to self-fund expansion plans; and/or

- Develop the higher capex larger mining operation with increased gold production, cash flow, and mine life, which is of interest to potential future large gold company strategic partners.

- With China announcing export restrictions on antimony, the Company is also investigating the possibility to fast track the Stibium gold-antimony prospect development option with potential U.S. Dept. of Defense (DoD) support.

Snow Lake Resources

- At the end of the quarter Nova sold its entire 6.6 million shares in non-core investment Snow Lake Resources for US$6.73 million (A$10.85 million) gross proceeds. The proceeds from this sale were received a few days into the new year and so have been shown as a subsequent event in the December 2024 cashflow report.

- At the end of the December 2024 quarter, Nova had $A4.085 million in cash. Following the sale of the Snow Lake shares as noted above, and further proceeds from the exercise of NASDAQ warrants in early January 2025, Nova currently has ~ A$16 million (~US$10 million) in cash.

- Following the quarter end on 8 January 2025 the Company advised that it has reached an agreement with Nebari Gold Fund 1, LLP for the elimination of its existing convertible debt-facility, by way of a conversion of the full outstanding balance of US$5.42 million into ordinary shares, making the Company now debt free.

- In October, Nova engaged Whittle Consulting to begin project wide optimization for the upcoming economic studies and RPM starter mine Pre-Feasibility Study. This consulting was partially paid in shares in support of the project.

- The Company held its Annual General Meeting (AGM) on Thursday, 14 November 2024.

- Non-executive director Rodrigo Pasqua resigned from the Company on 12 November 2024 and the Company has commenced a search for a high calibre independent director based in the U.S. with experience in funding and building projects.

- Notable investing and operating cash flow items during the quarter included: Exploration and evaluation costs of $1.9m principally related to the 2024 drilling and surface exploration program, $610k administration and corporate expenses, the majority of which are related to marketing, software subscriptions, and share registry costs, and $338k for audit, tax and legal fees.

- Payments to related parties in Q2 FY25 were $364K and included CEO and Executive remuneration and non-executive director fees.

- Surface sample assay results for Stoney, Wombat, and regional RPM areas

- Updated Mineral Resource Estimate (MRE) to both JORC and S-K 1300

- Potentially secure U.S. Department of Defense funding for antimony supply

- Material PFS test work results and trade-off studies as they become available

- Metallurgical test work ongoing

- Environmental test work ongoing

- West Susitna Access Road updates

- Infrastructure permitting

- 2025 exploration program plan

Figure 1. RPM North Section A-A'_070azi showing continuity of mineralization

Figure 2. RPM North Section B-B'_250azi showing continuity of mineralization

Figure 3. RPM North Section C-C'_280azi showing continuity of mineralization

Figure 4. RPM North plan view with all drill holes to date, including the 2024 drilling and section view lines for figures 1 to 3.

Figure 5. RPM area showing potential RPM starter pit

2024 Surface Exploration Program Results

Figure 6. Muddy Creek gold results (2023 sampling shown as transparent)

Figure 7. Stibium gold rock sample results (2023 sampling shown as transparent)

Figure 8. Stibium antimony rock sample results (2023 sampling shown as transparent)

Figure 9. Styx Antimony Results

Figure 10. Estelle development optionality

New Videos Released on the Company's Website During the December 2024 Quarter

- Redchip Small Stocks, Big Money TV Interview

- Nova Minerals CEO, Chrisopher Gerteisen Talks about the 2024 RPM Drill Results

- Nova Minerals Redchip Advert on Fox Business and CBNC

- 2 October 2024 - Whittle Consulting Engaged for Estelle Optimization

- 9 October 2024 - RPM Continues to Deliver with 43m @ 4.4 g/t Au from Surface

- 16 October 2024 - Nova Drills 39m @ 5.4 g/t Au from Surface at RPM

- 23 October 2024 - Nova Drills 29m @ 7.1 g/t Au from Surface at RPM

- 22 November 2024 - 2024 Sampling Finds up to 54.1% Antimony at Styx

- 27 November 2024 - Muddy Creek Gold Anomaly Extended 400m with up to 128.5 g/t Au

- 5 December 2024 - Antimony up to 56.7% from Latest Rock Samples at Stibium

- 11 December 2024 - Stibium Antimony-Gold Prospect Results up to 141 g/t Au

| NOVA | Top 20 Holders | |||

| MINERALS | As at 14 January 2025 | |||

| Rank | Name | A/C designation | 1/14/2025 | %IC |

| 1 | HSBC CUSTODY NOMINEES (AUSTRALIA) LIMITED1 | 53,605,623 | 16.65% | |

| 2 | NEBARI GOLD FUND 1 LP | 38,205,938 | 11.87% | |

| 3 | BNP PARIBAS NOMS PTY LTD | 15,906,546 | 4.94% | |

| 4 | BNP PARIBAS NOMINEES PTY LTD | 8,360,196 | 2.60% | |

| 5 | SL INVESTORS PTY LTD | 6,441,393 | 2.00% | |

| 6 | CITICORP NOMINEES PTY LIMITED | 6,239,541 | 1.94% | |

| 7 | BNP PARIBAS NOMINEES PTY LTD | 5,839,819 | 1.81% | |

| 8 | SWIFT GLOBAL LTD | 5,669,833 | 1.76% | |

| 9 | KUSHKUSH INVESTMENTS PTY LTD | 5,300,000 | 1.65% | |

| 10 | MR JAGDISH MANJI VARSANI | 4,100,000 | 1.27% | |

| 11 | KAOS INVESTMENTS PTY LIMITED | 3,252,692 | 1.01% | |

| 12 | MR MAHMOUD EL HORR | 2,600,000 | 0.81% | |

| 13 | KREN ENTERPRISE PTY LTD | 2,450,000 | 0.76% | |

| 14 | MURTAGH BROS VINEYARDS PTY LTD | 2,440,000 | 0.76% | |

| 15 | MR JUSTIN BRUCE GARE & MRS KRISTIN DENISE PHILLIPS | 2,325,568 | 0.72% | |

| 16 | MR CRAIG EDWIN BENTLEY | 2,259,669 | 0.70% | |

| 17 | MURTAGH BROS VINEYARDS PTY LTD | 2,167,380 | 0.67% | |

| 18 | LETTERED MANAGEMENT PTY LTD | 2,050,000 | 0.64% | |

| 19 | KIKCETO PTY LTD | 2,028,924 | 0.63% | |

| 20 | PATRON PARTNERS PTY LTD | 1,983,214 | 0.62% | |

| Total - Top 20 | 173,226,336 | 53.80% | ||

| Balance of Register (5,516 holders) | 148,751,081 | 46.20% | ||

| Grand Total | 321,977,417 | 100.00% | ||

Qualified Persons

Vannu Khounphakdee, Professional Geologist and member of Australian Institute of Geoscientists contracted by Nova Minerals to provide geologic consulting services. Mr. Khounphakdee holds a Master of Science in Mine Geology and Engineering. He is a qualified person with at least 5 years experience with this type of project. By reason of education, affiliation with a professional association, and past relevant work experience, Mr. Khounphakdee fulfills the requirements of Qualified Person (QP) for the purposes of SEC Regulation SK-1300 for data QA/QC checks relevant to this announcement.

Hans Hoffman is a State of Alaska Certified Professional Geologist contracted by Nova Minerals to provide geologic consulting services. Mr. Hoffman is a member of the American Institute of Professional Geologists and holds a Bachelor of Science degree in Geological Engineering with a double major in Geology and Geophysics. He is a qualified person with at least 5 years of experience with these types of projects. By reason of education, affiliation with a professional association, and past relevant work experience, Mr. Hoffman fulfills the requirements of Qualified Person (QP) for the purposes of SEC Regulation SK-1300 for the technical information presented in this announcement.

Christopher Gerteisen, Chief Executive Officer of Nova Minerals, is a Professional Geologist and member of Australian Institute of Geoscientists, and has supervised the preparation of this news release and has reviewed and approved the scientific and technical information contained herein. Mr. Gerteisen is a "qualified person" for the purposes of SEC Regulation S-K 1300.

About Nova Minerals Limited

Nova Minerals Limited is a Gold, Antimony and Critical Minerals exploration and development company focused on advancing the Estelle Project, comprised of 514 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 advanced Gold and Antimony prospects, including two already defined multi-million ounce resources, and several drill ready Antimony prospects with massive outcropping stibnite vein systems observed at surface. The 85% owned project is located 150 km northwest of Anchorage, Alaska, USA, in the prolific Tintina Gold Belt, a province which hosts a >220 million ounce (Moz) documented gold endowment and some of the world's largest gold mines and discoveries including, Barrick's Donlin Creek Gold Project and Kinross Gold Corporation's Fort Knox Gold Mine. The belt also hosts significant Antimony deposits and was a historical North American Antimony producer.

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations, presentations, and videos, all available on the Company's website. www.novaminerals.com.au

Forward Looking Statements

This press release contains "forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate,” "believe,” "contemplate,” "could,” "estimate,” "expect,” "intend,” "seek,” "may,” "might,” "plan,” "potential,” "predict,” "project,” "target,” "aim,” "should,” "will” "would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited's current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled "Risk Factors” in the final prospectus related to the public offering filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law.

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

M: +61 414 714 196

Tenement Holdings as at 31 December 2024

A list of Nova's Tenement Holdings, as at the end of the Quarter, is presented in the schedules below, with additional notes.

| Tenement/Claim/ADL Number | Location | Beneficial % Held | |

| 725940 - 725966 | Alaska, USA | 85 | % |

| 726071 - 726216 | Alaska, USA | 85 | % |

| 727286 - 727289 | Alaska, USA | 85 | % |

| 728676 - 728684 | Alaska, USA | 85 | % |

| 730362 - 730521 | Alaska, USA | 85 | % |

| 737162 - 737357 | Alaska, USA | 85 | % |

| 740524 - 740621 | Alaska, USA | 85 | % |

| 733438 - 733598 | Alaska, USA | 85 | % |

| 741364 - 741366 | Alaska, USA | 85 | % |

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

| Name of entity | ||

| Nova Minerals Limited (ASX: NVA) | ||

| ABN | Quarter ended ("current quarter”) | |

| 84 006 690 348 | 31 December 2024 |

| Consolidated statement of cash flows | Current quarter $A'000 | Year to date (3 months) $A'000 | ||||||

| 1. Cash flows from operating activities | ||||||||

| 1.1 Receipts from customers | ||||||||

| 1.2 Payments for | ||||||||

| (a) exploration & evaluation | (217 | ) | (470 | ) | ||||

| (b) development | ||||||||

| (c) production | ||||||||

| (d) staff costs (directors/consultants) | (424 | ) | (677 | ) | ||||

| (e) administration and corporate costs | (610 | ) | (977 | ) | ||||

| (f) audit, tax, and legal fees | (338 | ) | (1,211 | ) | ||||

| (g) other professional fees | (255 | ) | (450 | ) | ||||

| (h) US listing fees | (15 | ) | (255 | ) | ||||

| 1.3 Dividends received (see note 3) | ||||||||

| 1.4 Interest received | 2 | 22 | ||||||

| 1.5 Interest and other costs of finance paid | (161 | ) | (327 | ) | ||||

| 1.6 Income taxes paid | ||||||||

| 1.7 Government grants and tax incentives | ||||||||

| 1.8 Other (provide details if material) | ||||||||

| (a) GST, Withholding tax & Payroll tax | 54 | 18 | ||||||

| 1.9 Net cash from / (used in) operating activities | (1,964 | ) | (4,327 | ) | ||||

| Consolidated statement of cash flows | Current quarter $A'000 | Year to date (3months) $A'000 | ||||||

| 2. Cash flows from investing activities | ||||||||

| 2.1 Payments to acquire or for: | ||||||||

| (a) Entities | ||||||||

| (b) Tenements | ||||||||

| (c) property, plant and equipment | - | (51 | ) | |||||

| (d) exploration & evaluation | (1,893 | ) | ||||||