NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE U.S.

HIGHLIGHTS:

- Increased Reserves Life Of Mine ("LoM”): Mineral Reserves increased by 442,000oz or 46% to 1.41 million ounces from Kiniero's 2023 Feasibility Study ("2023 FS”);

- Potential to grow Mineral Reserves: Kiniero has Indicated Mineral Resources (inclusive of Mineral Reserves) at 2.2Moz @ 0.96g/t Au, plus Inferred Mineral Resources of 1.53Moz @ 1.05g/t Au (effective September 1 2024); More than 25,000 metres of drilling completed since the database cut off. An updated Reserve Statement to include this drill data is scheduled to be released in Q2 2025;

- Improved economics: The updated study demonstrates increase in pre-tax Net Present Value at a discount rate of 5% (NPV5%)

- Base Case (Gold Price US$1,800/oz)

- Pre-tax NPV: US$480M,

- Pre-tax IRR: 47%.

- Post-tax NPV: US$322M,

- Post-tax IRR: 36%.

- Consensus Case (Gold Price: US$2,330/oz): Pre-tax NPV of US$940M, Pre-tax IRR of 79%, Post-tax NPV of US$647M, Post-tax IRR of 61%.

- Stronger economic metrics compared to the 2023 FS (US$1650/oz gold price), which demonstrated pre-tax NPV5% of US$251M and IRR of 42%; post-tax NPV5% of US$170M with IRR of 31%;

- Base Case (Gold Price US$1,800/oz)

- Average annual gold production: Kiniero expected to produce 139,000 ounces gold per year over 9-year mine life with average production of 154,000oz over the first six years;

- Costs in line with Budget: LoM All-In Sustaining Costs ("AISC”) of US$1,066 /oz, increasing by 9% from 2023 FS (US$980/oz);

- Improved strip ratio: LoM Strip Ratio of 2.0:1, from 2.8:1 in the 2023 FS; helping to lower mining costs.

Using a base case gold price of US$1800/oz, the Study demonstrates Kiniero's ability to produce an average of 139,000oz of gold per year at a US$1,066/oz AISC over the 9-year LoM, with an average gold production of 154,000oz per year in the first six years. Mine plan optimization efforts prioritized a stable, long mine life, rather than peak upfront production.

Robex is on track to pour first gold at Kiniero in Q4 2025, with construction already underway on the 5 million tonne per annum (Mtpa) processing plant, with a 6Mtpa capacity on early year high oxide blends and associated infrastructure. The company will continue its near-mine exploration efforts to extend the LoM rapidly in conjunction with the annual production. Robex is still in advance discussions with lenders for a debt facility which is expected to close in Q1 2025.

Robex Managing Director Matthew Wilcox commented: "Updating the feasibility study for our Kiniero Gold Project in Guinea is a major milestone in our journey towards project development, as the FS optimizations and updated Mineral Resource Estimate have delivered increased Mineral Reserves and stronger economics for the project. The base case gold price of US$1,800/oz post-tax NPV now stands at US$322 million with an IRR of 36%, which have both improved +89% on the 2023 FS results within a very short period. At consensus price of US$2,330/oz the post tax NPV5% stands at US$647m or A$1bn.

In addition, with the high prospectivity of our property we will be growing the current production and LoM very rapidly. We expect to average gold production of nearly 140,000oz of gold a year over the project's 9-year life, with early gold production of 153,000oz a year over the first six years ideally timed to benefit from the current high gold price environment.

An additional 25,000m of drilling has been completed and it will be part of an updated MRE to potentially further increase the resources and reserves which should be released in Q2, 2025.

With construction now progressing well at Kiniero we issue market updates frequently; we look forward to our ASX listing in coming months and becoming West Africa's newest gold producer before the end of 2025.”

The FS was prepared in accordance with Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101”).

The independent NI 43-101 technical report supporting the Kiniero Gold Project Feasibility Study Update will be published on SEDAR at www.sedar.com within the next 45 days.

The FS was prepared in accordance with Canadian Securities Administrators' National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101”).

The independent NI 43-101 technical report supporting the Kiniero Gold Project Feasibility Study Update will be published on SEDAR at www.sedar.com within the next 45 days.

Table 1 compares the results of the updates study with the 2023 FS.

Table 1: 2024 Improvements on from 2023 FS results

| Item | Units | 2023 FS @ US$1,650/oz gold price | 2024 FS @

US$1,800/oz gold price | Variation | |

| Probable Mineral Reserves (incl. legacy stockpiles) | Moz | 0.968 | 1.41 | +46% | |

| LoM | Year | 9.5 | 9 | -5.2% | |

| Average annual production LoM | koz | 90 | 139 | +54% | |

| Pre-production Capital | US$M | 160 | 243 | +52% | |

| LoM AISC | US$/oz | 980 | 1,023 | +4% | |

| Pre-tax NPV5%* | US$M | 251 | 480 | +91% | |

| Pre-tax IRR | % | 42% | 47% | +12% | |

| Post-tax NPV5% | US$M | 170 | 322 | +89% | |

| Post-tax IRR | % | 31% | 36% | +16% | |

Update on Construction Activities at Kiniero

The Kiniero Gold Project construction has commenced with civil (concrete) works on the process plant, the erection of the Carbon-in Leach/Gravity ("CIL”) tanks, and the clearing of the tailings dam basin.

The Project engineering is approximately 75% complete, all long lead items have been purchased, and 95% of other equipment has been tendered.

The Project is currently on track to pour first gold by the end of calendar year 2025.

Highlights of Updated Feasibility Study

Ore mined from the Kiniero deposit is expected to be processed through a standard 5Mtpa nominal capacity CIL plant. The mine is expected to be an open pit using conventional mining methods.

Table 2: Kiniero 2024 FS Highlights

| Units | Value | |

| Plant, size and CAPEX | ||

| Plant capacity (@35% Fresh) | Mtpa | 5 |

| Plant capacity (@18% Fresh) | Mtpa | 6 |

| Upfront capital from January 1, 2023 | US$M | 243 |

| Mineral Reserves and Resources (incl. legacy stockpiles) | ||

| Probable Mineral Reserves | Moz | 1.41 |

| Indicated Resources (incl. Reserves) | Moz | 2.203 |

| Inferred Resources | Moz | 1.52 |

| Mining Operations | ||

| LoM total tonnes mined | Mt | 119 |

| LoM waste tonnes mined | Mt | 80 |

| LoM ore tonnes mined ex pit | Mt | 39 |

| Average grade mined | g/t Au | 1.04 |

| LoM strip ratio | W:O | 2.0 |

| Processing Operations | ||

| LoM tonnage processed | Mt | 45 |

| Average grade processed | g/t Au | 0.97 |

| Average recovery LoM | % | 86.2% |

| Production and Costs Summary | ||

| LoM production | koz/Au | 1,215 |

| Average first three years of production pa | koz/Au | 153 |

| Average LoM production pa | koz/Au | 139 |

| AISC | US$/oz | 1,066 |

Table 3: Summary of NPV, IRR and payback at $1800/oz and consensus forward gold price

| Units | US$1,800/oz (Reserve Gold Price) | US$ ~2,330/oz (2024 Consensus gold price*) | |

| Pre-tax returns | |||

| NPV5% | US$M | 480 | 940 |

| IRR | % | 47% | 79% |

| Payback period | year | 2.1 | 1.3 |

| Post-tax returns | |||

| NPV5% | US$M | 322 | 647 |

| IRR | % | 36% | 61% |

| Payback period | year | 2.6 | 1.6 |

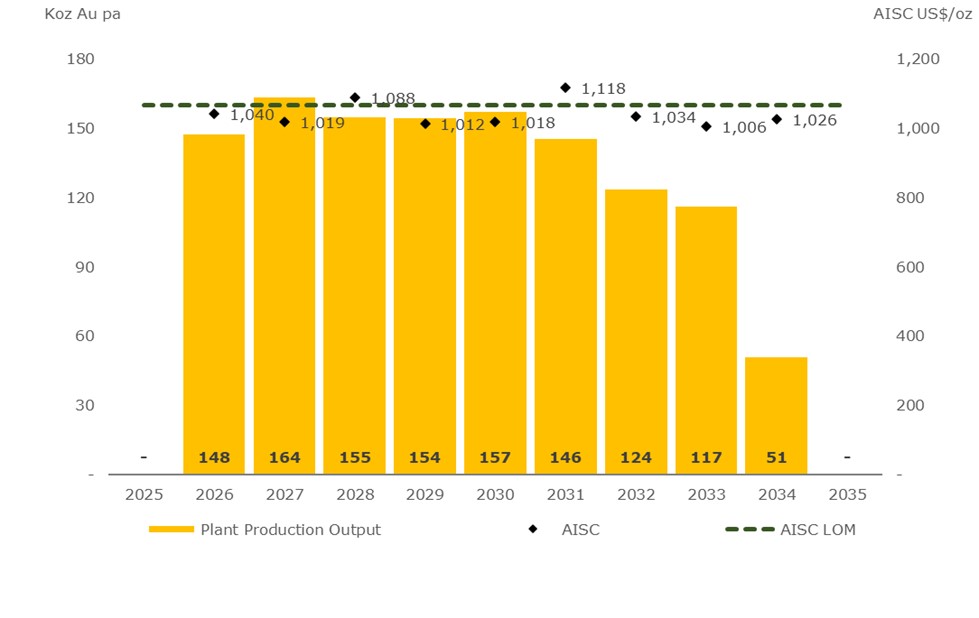

As shown in Figure 1 below, the Study demonstrates Kiniero's ability to deliver an average of 139koz of gold per annum at an AISC of US$1,066/oz over the LoM at consensus gold price, as mine plan optimization efforts prioritized a stable, long mine life, rather than peak upfront production. Over the coming years, Robex intends to continue its exploration efforts to continue to extend the LoM and increase annual production.

Figure 1: Gold Production and AISC Summary across the LoM

FEASIBILITY STUDY DETAILS

Overview

The Project is located in eastern Guinea in the Kouroussa Prefecture. It is situated 27km southeast of the town of Kouroussa and 546km from Conakry, the capital of Guinea (Figure 2: Regional Locality of the Kiniero Gold Project and Regional Infrastructure of Guinea).

The Kiniero Gold Project is a 470.48km² exploitation and exploration land package that consists of the adjoining Kiniero exploitation Licence Area and Mansounia exploitation Licence Area. The Kiniero Gold Project is one of the largest gold licences in Guinea.

Figure 2: Regional Locality of the Kiniero Gold Project and Regional Infrastructure of Guinea

Kiniero gold deposits, located in the prolific gold-producing Siguiri Basin, were discovered in the early 1900s and were subsequently explored until 2002 when gold production began under the ownership of SEMAFO Inc and its subsidiary SEMAFO Guinée SA.

The historical Kiniero gold mine comprised an open pit mining operation that produced 418,000 ounces of gold during its 12-year operational history. The mine was placed on care and maintenance in early 2014.

Given the strong exploration potential, a combination of near plant brownfields infill and known extension, as well as greenfield large-scale targets, Robex is targeting (i) the discovery of Mineral Resources across the Kiniero exploration permit area over the next few years, and (ii) the conversion of Mineral Resources into Mineral Reserves.

An extensive drilling program is ongoing on the numerous identified deposits to increase the resource base and extend the LoM at Kiniero predominately through extending the drilling density at depth and along known strike extensions.

Since the beginning of the construction, Robex has been committed to involve village communities in the mine's development, as well as exploring sustainable power energy source to reduce and limit its environmental footprint.

Geology

The property is located within the Kiniero Gold District of the Siguiri Basin, which is situated in north-eastern Guinea, extending into central Mali. Geologically, the Siguiri Basin comprises a portion of the West Africa Birimian Greenstone Belt, including intrusive volcanics (ultramafics to intermediate) and sediments largely deposited through the period 2.13 Ga to 2.07 Ga.

The volcanic and sedimentary lithologies comprise fine-grained sedimentary rocks (shales and siltstones), with some intercalated volcanic rocks. Sandstone-greywacke tectonic corridors have been preferentially altered and locally silicified, supporting extensive brittle fracture networks. These in turn have provided host environments for ascending mineralized hydrothermal fluids.

The deposits located on the property are associated with the Proterozoic Birimian orogeny of West Africa. Most gold mineralization in the West African Craton is shear-zone-hosted and structurally controlled, with lithology having a minor, local influence. The mineralization developed in the Kiniero Gold District conforms to this general style of mineralization.

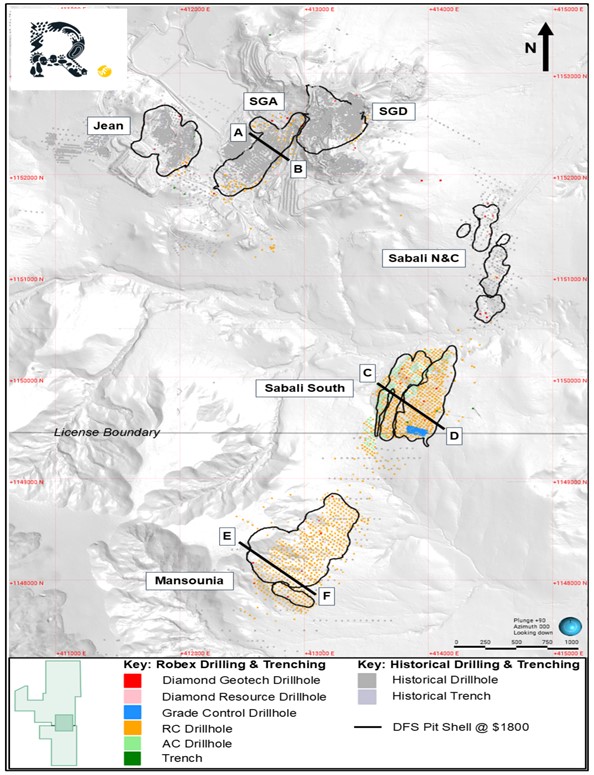

A total of 47 gold anomalies have been identified on the property, of which five clusters of deposits (Sabali, Mansounia, SGA, Jean, and Balan) have been explored sufficiently to enable the estimation of Mineral Resources.

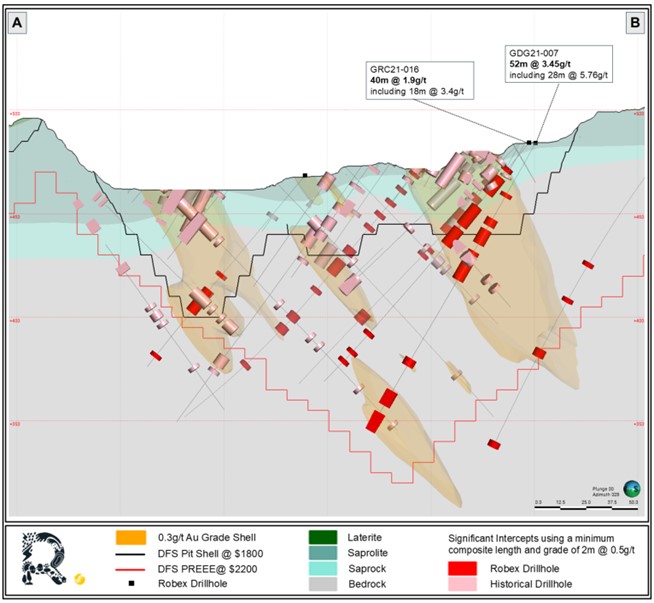

Figure 3: Location of the main Kiniero deposits and cross sections (A-B, C-D) and Figure 4: Cross sections through the SGA (A-B) Sabali South (C-D) deposits illustrate the location of the main Kiniero deposits and cross sections through the SGA and Sabali South deposits. The selected cross sections display the 0.3g/t gold grade shell, Pit and RPEE (Reasonable Prospects of Economic Extraction) Shells, significant gold intercepts (minimum of 2m @ 0.5g/t), and regolith profiles across each deposit. Section A-B, across SGA, demonstrates the deposit's significant northeast strike and depth extension. Section C-D, across Sabali South, shows the deposit's deep weathering saprolite and saprock profile in the east (beyond 100m in areas).

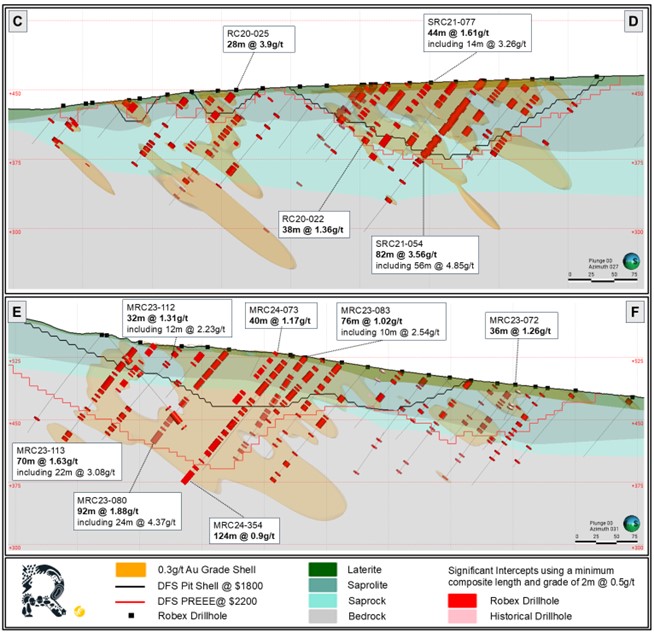

Section E-F, across Mansounia Central, shows the depth extension of the northeast strike.

Figure 3: Location of the main Kiniero deposits and cross sections (A-B, C-D, E-F)

Figure 4: Cross sections through the SGA (A-B), Sabali South (C-D) and Mansounia Central (E-F) deposit

Mineral Reserves and Resources

The January 2025 FS update is based on the updated Mineral Resources Estimate ("MRE”), as shown in Table 4 below, which has a resource-to-reserve conversion ratio for the in-situ estimate of 66%. The MRE includes the Mineral Reserves.

Table 4: Mineral Reserves and Resources Summary

| 100% basis | Tonnage (Mt) | Grade (Au g/t) | Content (koz) |

| Probable Mineral Reserves (in-situ) | 39.3 | 1.04 | 1,320 |

| Probable Mineral Reserves (Legacy Stockpiles) | 6.3 | 0.48 | 100 |

| Total Probable Mineral Reserves | 45.5 | 0.97 | 1,410 |

| Indicated Mineral Resources (in-situ) | 59.62 | 1.08 | 2,064 |

| Indicated (Legacy Stockpiles) | 11.61 | 0.37 | 139 |

| Total Indicated Mineral Resources (incl. of. Mineral Reserves) | 71.23 | 0.96 | 2,203 |

| Inferred Mineral Resources (in-situ) | 45.10 | 1.05 | 1,519 |

| Inferred (Legacy Stockpiles) | 0.19 | 1.31 | 8 |

| Total Inferred Mineral Resources | 45.29 | 1.05 | 1,527 |

Notes:

- The effective date of the Mineral Resource and Reserves is 30 November 2024.

- The date of closure for the sample database informing the in situ Mineral Resources excluding Mansounia, is 17 August 2022. The date of database closure for the Mansounia MRE is 16 October 2024.

- Cut-off grades for Mineral Resource reporting are:

- SGA, Jean and Banfara: laterite 0.3 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.3 g/t Au, fresh 0.4 g/t Au.

- Sabali South: laterite 0.3 g/t Au, mottled zone/saprolite/lower saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.5 g/t Au, fresh 0.6 g/t Au.

- Sabali North and Central: laterite 0.3 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.6 g/t Au, fresh 0.6 g/t Au.

- West Balan: laterite 0.3 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.3 g/t Au, fresh 0.5 g/t Au.

- Mansounia Central: laterite 0.4 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.5 g/t Au, fresh 0.5 g/t Au.

- Stockpiles reported as Mineral Resources have been limited to those dumps which exhibit an average grade >0.3 g/t Au for the entire stockpile assuming no selectivity.

- These are based on a gold price of US$2,200/oz and costs and recoveries appropriate to each pit and type of feed.

- The QP for this MRE is Mr Ingvar Kircher.

- Mineral Resources are reported inclusive of Mineral Reserves.

- Open-pit Mineral Resources were constrained using optimum pit shells based on a gold price of US$2,200/oz.

- CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014) were used for reporting the Mineral Reserve.

- Mineral Reserve was estimated using a long-term gold price of US$1,800 per troy oz for all mining areas.

- Mineral Reserve is stated in terms of delivered tonnes and grade before process recovery.

- Mineral Reserve was defined by pit optimization and pit design and is based on variable break-even cut-offs as generated by process