Lynn Lake expected to provide additional low-cost growth starting in 2028 with construction decision announced

All amounts are in United States dollars, unless otherwise stated.

TORONTO, Jan. 13, 2025 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) ("Alamos” or the "Company”) today reported fourth quarter and annual 2024 production. The Company also provided updated three-year production and operating guidance and announced a construction decision on the Lynn Lake project in Manitoba.

"With the solid finish to the year, we met both our quarterly and increased annual production guidance. Production increased 7% from 2023 to a record 567,000 ounces and combined with strong margin expansion, we generated record revenues and free cash flow while investing in high-return growth,” said John A. McCluskey, President and Chief Executive Officer.

"This investment in growth is expected to drive our production 24% higher over the next three years. We are also pleased to announce the start of construction on Lynn Lake, another attractive project that will provide additional growth into 2028. All of this growth is in Canada, it is lower cost, and it is all fully funded providing Alamos with one of the strongest outlooks and lowest political risk profiles in the sector. This growth is underpinned by high-quality, long-life assets with significant upside potential that we expect to continue to unlock with our largest exploration budget ever,” Mr. McCluskey added.

Fourth Quarter and Full Year 2024 Operating Results

| Q4 2024 | Q4 2023 | 2024 | 2023 | 2024 Guidance1 | |||||

| Gold production (ounces) | |||||||||

| Young-Davidson | 45,700 | 49,800 | 174,000 | 185,100 | 180,000 - 190,000 | ||||

| Island Gold | 39,400 | 31,600 | 155,000 | 131,400 | 145,000 - 155,000 | ||||

| Magino | 16,200 | n/a | 33,000 | n/a | 40,000 - 50,000 | ||||

| Mulatos District | 38,900 | 48,100 | 205,000 | 212,800 | 185,000 - 195,000 | ||||

| Total gold production - Original guidance | 485,000 - 525,000 | ||||||||

| Total gold production - Revised guidance(1) | 140,200 | 129,500 | 567,000 | 529,300 | 550,000 - 590,000 |

- Met increased guidance with record annual production: produced a record 567,000 ounces, achieving the mid-point of revised guidance which was increased by 13% in September 2024. Full year production increased 7% from 2023, including a strong finish to the year with 140,200 ounces in the fourth quarter, in line with quarterly guidance

- Costs expected to meet 2024 guidance: costs have not been finalized for 2024 but all-in sustaining costs ("AISC”) are expected to be at the top end of the range of revised full year guidance at $1,300 per ounce. Fourth quarter costs are expected to be slightly lower than the third quarter, as previously guided

- Record financial performance: sold 141,257 ounces of gold at a realized price of $2,632 per ounce for revenues of $375 million, inclusive of silver sales. Full year sales totaled 560,234 ounces of gold at an average realized price of $2,379 per ounce for record revenues of $1.3 billion. The strong operational performance and higher realized gold prices are also expected to drive record annual cash flow from operations and free cash flow

- Strong balance sheet: ended the year with approximately $325 million of cash and cash equivalents, up from $225 million at the end of 2023 reflecting strong ongoing free cash flow generation, while continuing to reinvest in high-return growth. The Company remains in a net cash position with $250 million drawn on its credit facility. The proceeds from the credit facility were previously used to retire debt inherited from Argonaut Gold

| 2025 | 2026 | 2027 | |||

| Current | Previous | Current | Previous | Current | |

| Total Gold Production (000 oz) | 580 - 630 | 575 - 625 | 630 - 680 | 630 - 680 | 680 - 730 |

| Total Cash Costs(1) ($/oz) | $875 - 925 | $775 - 875 | $800 - 900 | $750 - 850 | $775 - 875 |

| All-in Sustaining Costs(1),(2) ($/oz) | $1,250 - 1,300 | $1,175 - 1,275 | $1,150 - 1,250 | $1,100 - 1,200 | $1,125 - 1,225 |

| Total Sustaining & growth capital(1)(3) | |||||

| Operating mines; ex. Exploration & Lynn Lake ($ millions) (4) | $460 - 510 | $425 - 475 | $370 - 415 | $345 - 390 | $215 - 245 |

| Lynn Lake ($ millions) | $100 - 120 | - | $250 - 275 | - | $235 - 260 |

| Total ($ millions) | $560 - 630 | - | $620 - 690 | - | $450 - 505 |

(2) All-in sustaining cost guidance for 2026 and 2027 includes the same assumptions for G&A and stock-based compensation as included in 2025.

(3) Sustaining and growth capital guidance excludes capitalized exploration.

(4) Previous sustaining and growth capital guidance is for producing mines only and excludes capital for Lynn Lake, other development projects, and capitalized exploration.

- 2025 production guidance increased; 7% growth expected in 2025 and 24% growth by 2027: production guidance for 2025 increased slightly from the previous guidance provided in September 2024 reflecting additional production from Mulatos through residual leaching. Production is expected to increase 24% by 2027, relative to 2024, driven by low-cost growth from Island Gold following the completion of the Phase 3+ Expansion in the first half of 2026

- Lynn Lake to drive additional growth in 2028 with construction decision announced: construction activities are expected to ramp up through 2025 with initial production expected during the first half of 2028. With average annual production of 176,000 ounces over its first ten years at first quartile mine-site AISC, Lynn Lake is expected to increase consolidated production to approximately 900,000 ounces per year

- Magino mill expansion provides additional longer-term upside potential: an evaluation of longer-term expansion of the Magino mill to between 15,000 and 20,000 tonnes per day ("tpd”) is underway and expected to be completed by the end of 2025. A larger expansion of the mill could support additional growth from the Island Gold District and increase consolidated production closer to one million ounces per year

- Total cash costs and AISC expected to decrease slightly in 2025 and approximately 10% by 2027, relative to 2024:

- Low-cost production growth in 2025 expected to more than offset inflationary pressures, driving AISC lower

- AISC expected to decrease approximately 10% by 2027 to between $1,125 and $1,225 per ounce: the completion of the Phase 3+ Expansion at Island Gold in 2026 is expected to drive costs lower through 2026 and 2027. A further decrease in costs is expected in 2028 through low-cost production growth from Lynn Lake

- AISC guidance for 2025 and 2026 has increased approximately 4% from previous guidance primarily reflecting ongoing labour inflation. The increase in 2025 AISC also reflects continued residual leaching at Mulatos, which carries higher reported costs

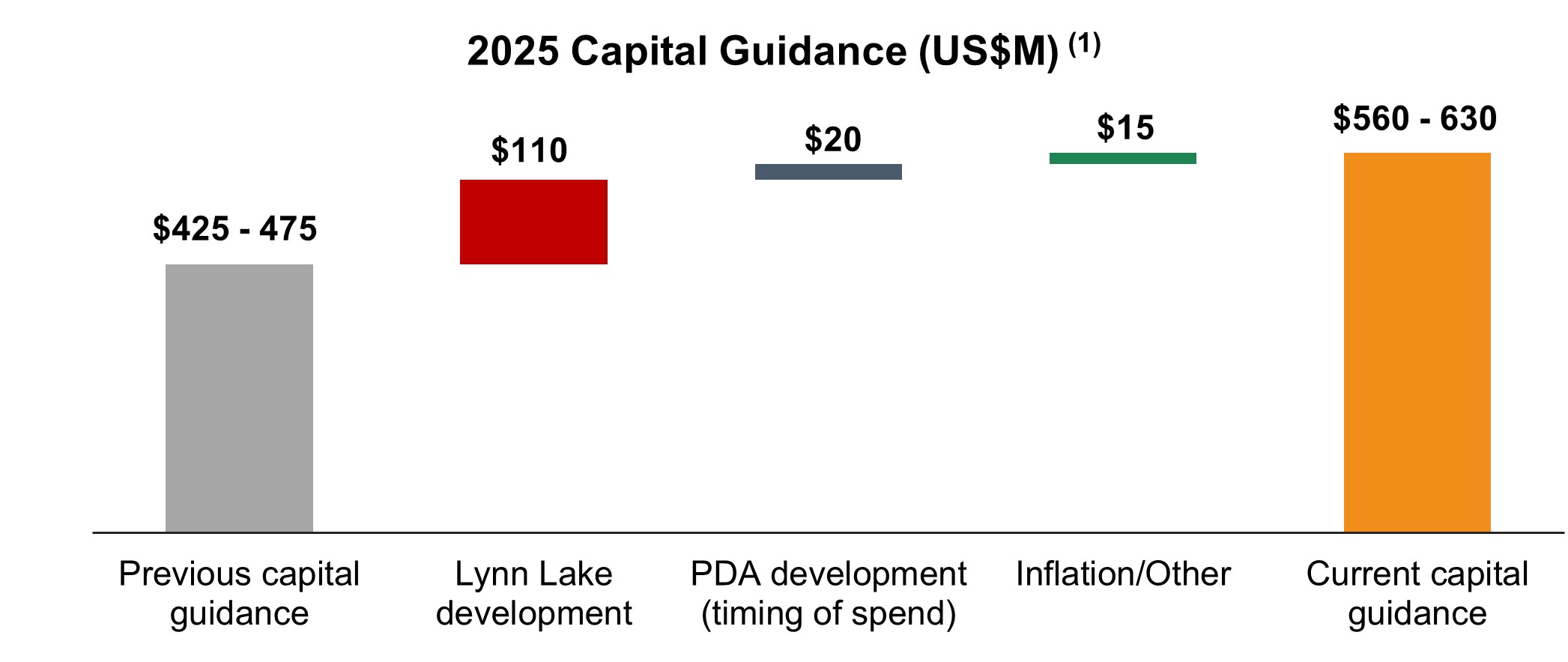

- Capital spending expected to decrease approximately 20% by 2027, relative to 2025: with the completion of the Phase 3+ Expansion in 2026, and PDA in 2027. Total capital (excluding capitalized exploration) is expected to range between $560 to $630 million in 2025, an increase from 2024 and previous guidance for 2025 reflecting the inclusion of construction capital for Lynn Lake (excluded from previous three-year guidance), accelerated spending on PDA development in the current year, as well as the impact of ongoing labour inflation. Total capital spending guidance for 2026 has increased relative to previous guidance for the same reasons

- The total capital budget for 2025 includes:

- Sustaining capital guidance of $138 to $150 million: up slightly from 2024 with further increases expected in 2026 and 2027, reflecting growing production rates within the expanded Island Gold District

- Growth capital guidance of $422 to $480 million: up from 2024 reflecting the inclusion of construction capital for Lynn Lake and PDA. Growth capital is expected to decrease by approximately 36% in 2027 with the completion of the Phase 3+ Expansion in 2026 and PDA in 2027

- Exploration budget increased to $72 million: a 16% increase from the 2024 budget with expanded budgets at the Island Gold District and the Qiqavik project in Quebec. The 2025 exploration program represents the largest exploration budget in the Company's history supporting broad based success across its asset base

- Fully funded growth supporting significant free cash flow growth 2026 onward: the Company expects to continue generating positive free cash flow while funding its high-return, low-cost growth projects at current gold prices. These projects are expected to drive significant free cash flow growth with the completion of the Phase 3+ Expansion in 2026, PDA in 2027, and Lynn Lake in 2028, reflecting growing production, and declining costs and capital

Upcoming 2025 catalysts

- Burnt Timber and Linkwood study (satellite deposits to Lynn Lake): Q1 2025

- 2024 year-end Mineral Reserve and Resource update: February 2025

- Island Gold District life of mine plan (base case): Mid-2025

- Island Gold District expansion study: Q4 2025

- Island Gold District, Mulatos District, and Young-Davidson exploration updates: ongoing

| 2025 Guidance | 2024 Guidance(1) | |||||

| Island Gold

District | Young-Davidson | Mulatos District | Lynn Lake | Total | Total | |

| Gold production (000 oz) | 275 - 300 | 175 - 190 | 130 - 140 | 580 - 630 | 567 (actual) | |

| Cost of sales, including amortization ($ millions)(2) | $805 | $745 | ||||

| Cost of sales, including amortization ($/oz)(2) | $1,330 | $1,310 | ||||

| Total cash costs ($/oz)(3) | $725 - 775 | $1,075 - 1,125 | $925 - 975 | - | $875 - 925 | $890 - 940 |

| All-in sustaining costs ($/oz)(3) | $1,250 - 1,300 | $1,250 - 1,300 | ||||

| Mine-site all-in sustaining costs ($/oz)(3)(4) | $1,100 - 1,150 | $1,390 - 1,440 | $1,025 - 1,075 | - | ||

| Capital expenditures ($ millions) | ||||||

| Sustaining capital(3)(5) | $80 - 85 | $55 - 60 | $3 - 5 | - | $138 - 150 | $128 - 145 |

| Growth capital(3)(5) | $270 - 300 | $15 - 20 | $37 - 40 | $100 - 120 | $422 - 480 | $227 - 255 |

| Total Sustaining and Growth Capital(3)(5) ($ millions) | $350 - 385 | $70 - 80 | $40 - 45 | $100 - 120 | $560 - 630 | $355 - 400 |

| Capitalized exploration(3) ($ millions) | $20 | $9 | $6 | $4 | $39 | $43 |

| Total capital expenditures and capitalized exploration(3) ($ millions) | $370 - 405 | $79 - 89 | $46 - 51 | $104 - 124 | $599 - 669 | $398 - 443 |

(2) Cost of sales includes mining and processing costs, royalties, and amortization expense, and is calculated based on the mid-point of total cash cost guidance.

(3) Refer to the "Non-GAAP Measures and Additional GAAP" disclosure at the end of this press release for a description of these measures.

(4) For the purposes of calculating mine-site all-in sustaining costs at individual mine sites the Company allocates a portion of share based compensation to the mine sites, but does not include an allocation of corporate and administrative expenses to the mine sites.

(5) Sustaining and growth capital guidance excludes capitalized exploration.

Gold production in 2025 is expected to range between 580,000 and 630,000 ounces, a 7% increase from 2024 (based on the mid-point) driven by the ramp up of production at Island Gold, and a full year from Magino. This represents an increase from the previous three-year guidance provided in September 2024 reflecting the ongoing benefit of residual leaching of the main Mulatos leach pad, partly offset by slightly lower production from Young-Davidson.

Total cash costs and AISC are expected to decrease slightly in 2025, with costs higher in the first half of the year and decreasing in the second half of the year. AISC are expected to decrease approximately 15% in the second half of 2025, relative to the first half of the year, driven by higher grades and mining rates at Island Gold, higher grades at La Yaqui Grande, as well as a lower contribution from residual leaching from Mulatos. Production from residual leaching carries higher reported costs though is very profitable from a cash flow perspective, with the majority of these costs previously incurred and recorded in inventory.

AISC guidance for 2025 has increased approximately 4% from previous guidance primarily reflecting ongoing cost inflation, as well as the increased contribution of production from Mulatos through residual leaching. Company-wide inflation is expected to be approximately 4% in 2025, consistent with 2024, with the largest driver being ongoing labour inflation.

2025 guidance - costs expected to decrease significantly in H2 2025

| H1 2025 | H2 2025 | 2025 Guidance | |

| Total gold production (000 oz) | 280 - 305 | 300 - 325 | 580 - 630 |

| Total cash costs(1) ($/oz) | $950 - 1,000 | $800 - 850 | $875 - 925 |

| All-in sustaining costs(1) ($/oz) | $1,350 - 1,400 | $1,150 - 1,200 | $1,250 - 1,300 |

| Total capital expenditures and capitalized exploration(1) ($ millions) | $295 - 330 | $304 - 339 | $599 - 669 |

Capital spending is expected to increase from 2024 reflecting the inclusion of development capital for Lynn Lake and PDA, with the start of construction on both projects in 2025, as well as continued spending on the Phase 3+ Expansion within the Island Gold District. The Phase 3+ Expansion remains on track for completion in the first half of 2026, with 2025 representing its final full year of construction capital spending.

The primary driver of the increase in capital relative to previous guidance for 2025 is the inclusion of development capital for Lynn Lake, following a construction decision, accelerated capital spending at PDA, as well as inflation. Previous guidance for 2025 excluded development capital for Lynn Lake and included $20 million of capital for the start of construction on PDA.

Capital spending on PDA is now expected to total $37 to $40 million in 2025 to progress underground development. There are no changes to the initial capital estimate of $165 million for PDA with some of the planned spending in 2026 and 2027 pulled forward into 2025. The Company expects to receive approval of an amendment to the existing environmental impact assessment ("MIA”) during the first half of 2025 allowing for the ramp up of construction activities by mid-year.

Capital spending is expected to be evenly split between the first and second half of the year though will vary by asset. Spending at the Island Gold District is expected to be weighted towards the first half of the year while spending at Lynn Lake and PDA is expected to ramp up into the second half of the year.

(1) Capital guidance excludes capitalized exploration.

2025 - 2027 Guidance

| 2025 | 2026 | ()[\]\\.,;:\s@\"]+)*)|(\".+\"))@((\[[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\])|(([a-zA-Z\-0-9]+\.)+[a-zA-Z]{2,}))$/;return b.test(a)}$(document).ready(function(){if(performance.navigation.type==2){location.reload(true)}$("iframe[data-lazy-src]").each(function(b){$(this).attr("src",$(this).attr("data-lazy-src"))});if($(".owl-article-body-images").length){$(".owl-article-body-images").owlCarousel({items:1,loop:true,center:false,dots:false,autoPlay:true,mouseDrag:false,touchDrag:false,pullDrag:false,nav:true})}var a=$("#display_full_text").val();if(a==0){$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:$("#cms_article_id").val()},dataType:"json",success:function(b){},error:function(b,d,c){}})}$(".read-full-article").on("click",function(d){d.preventDefault();var b=$(this).attr("data-cmsArticleId");var c=$(this).attr("data-productId");var f=$(this).attr("data-href");dataLayer.push({event:"paywall_click",paywall_name:"the_manila_times_premium",paywall_id:"paywall_article_"+b});$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:b,productId:c},dataType:"json",success:function(e){window.location.href=$("#BASE_URL").val()+f},error:function(e,h,g){}})});$(".article-embedded-newsletter-form .close-btn").on("click",function(){$(".article-embedded-newsletter-form").fadeOut(1000)})});$(document).on("click",".article-embedded-newsletter-form .newsletter-button",function(){var b=$(".article-embedded-newsletter-form .newsletter_email").val();var d=$("#ga_user_id").val();var c=$("#ga_user_yob").val();var a=$("#ga_user_gender").val();var e=$("#ga_user_country").val();if(validateEmail(b)){$.ajax({url:"/ajax/sendynewsletter",type:"POST",data:{email:b},success:function(f){$(".article-embedded-newsletter-form .nf-message").html(f);$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000);dataLayer.push({event:"newsletter_sub",user_id:d,product_name:"newsletter",gender:a,yob:c,country:e})},error:function(f,h,g){}})}else{$(".article-embedded-newsletter-form .nf-message").html("Please enter a valid email address.");$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000)}});$(document).on("click",".article-embedded-newsletter-form .nf-message",function(){$(this).removeClass("show");$(this).html("")});

| |||