HIGHLIGHTS

- Novo has sold 38% of its shareholding in privately-owned San Cristobal Mining (San Cristobal) for gross proceeds of A$11.5 million (C$10.5 million). The San Cristobal Share Sale exceeds the current internal fair value per San Cristobal share on Novo's balance sheet as of September 30, 2024.

- The San Cristobal Share Sale implies that Novo's remaining shareholdings in San Cristobal would have an estimated value A$19 million (C$17 million).

- The funds received from the San Cristobal Share Sale will support Novo's current exploration programs across Western Australia and Victoria, enable Novo to focus on identifying additional exploration opportunities, and be used to repay the first portion of the deferred consideration owed to IMC Holdings of A$3 million due in late December 20241.

- Following the partial sale of its San Cristobal shareholding, Novo has a cash balance of A$16.7 million (C$15.3 million), as at December 04, 2024.

Commenting on this transaction, Mike Spreadborough, Executive Co-Chairman and Acting Chief Executive Officer, said: "We are very pleased to complete this sale of our investment in San Cristobal which has resulted in approximately A$11.5 million being added to our cash holding. This is an excellent outcome for the Company and our shareholders. Importantly, this sale highlights the value of our investment portfolio which is valued at ~A$19 million (~C$17 million).

With a cash balance of A$16.7 million (C$15.3 million), we are well positioned to continue advancing our exploration plans for 2025. Furthermore, we will continue to progress work to identify value accretive exploration opportunities to enhance our exploration portfolio.”

The receipt of funds from the San Cristobal Share Sale will support Novo's current exploration programs across Western Australia and Victoria and Novo's focus on identifying additional exploration opportunities and will also be used to repay the first portion of the deferred consideration owed to IMC Holdings ("IMC”) of A$3 million due in late December 2024 (originally entered into upon the acquisition of Millennium Minerals Ltd in 2020)1. Following this repayment, the outstanding amount owing to IMC will be A$12.6 million (C$13.8 million) which is repayable by 2026, with early repayment options.

In connection with the completion of the San Cristobal Share Sale, the Company paid finders' fees in respect of certain San Cristobal shares sold totalling US$90,000.

The San Cristobal Share Sale is expected to result in capital gains tax payable in Q1 2025 of A$1.4 million (C$1.3 million).

Advisors

Haywood Securities Inc. acted as financial advisor to Novo in connection with the San Cristobal Share Sale. Owen Bird Law Corporation acted as legal counsel to Novo in connection with the San Cristobal Share Sale.

Authorised for release by the Board of Directors.

CONTACT

| Investors: Mike Spreadborough +61 8 6400 6100 info@novoresources.com | North American Queries: Leo Karabelas +1 416 543 3120 leo@novoresources.com | Media: Cameron Gilenko +61 466 984 953 cameron.gilenko@sodali.com |

Dr Christopher Doyle (MAIG) and Dr Simon Dominy (FAusIMM CPGeo; FAIG RPGeo), are the qualified persons, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, responsible for, and having reviewed and approved, the technical information contained in this news release. Dr Doyle is Novo's Exploration Manager - Victoria and Dr Dominy is a Technical Advisor to Novo.

ABOUT NOVO

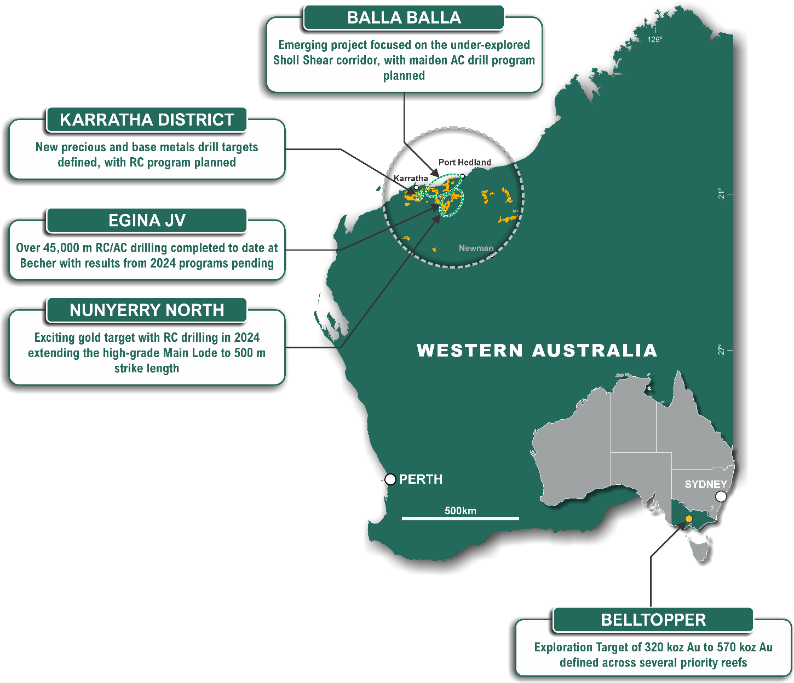

Novo is an Australian based gold explorer listed on the ASX and the TSX focused on discovering standalone gold projects with > 1 Moz development potential. Novo is an innovative gold explorer with a significant land package covering approximately 5,500 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia2.

Novo's key project area is the Egina Gold Camp, where De Grey Mining is farming-in to form a JV at the Becher Project and surrounding tenements through exploration expenditure of A$25 million within 4 years for a 50% interest. The Becher Project has similar geological characteristics as De Grey's 12.7 Moz Hemi Project3. Novo is also advancing gold exploration at Nunyerry North, part of the Croydon JV (Novo 70%: Creasy Group 30%), where 2023 exploration drilling identified significant gold mineralisation. Novo continues to undertake early-stage exploration across its Pilbara tenement portfolio.

Novo has also formed A lithium joint venture with SQM Australia Pty Ltd in the Pilbara which provides shareholder exposure to battery metals.

Novo has a significant investment portfolio and a disciplined program in place to identify value accretive opportunities that will build further value for shareholders.

Please refer to Novo's website for further information including the latest corporate presentation.

_______________

1 Refer to announcement dated 20 December 2024 - Sale of Nullagine Gold project to Calidus Resources (released to ASX on 21 December 2023).

2 An Exploration Target as defined in the JORC Code (2012) is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. Accordingly, these figures are not Mineral Resource or Ore Reserve estimates as defined in the JORC Code (2012). The potential quantities and grades referred to above are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. These figures are based on the interpreted continuity of mineralisation and projection into unexplored ground often around historical workings. The Exploration Target has been prepared in accordance with the JORC Code (2012). as detailed in the Company's ASX announcement released on 25 September 2024 (available to view at www.asx.com.au). The Tonnage range for the exploration target is 1.5Mt to 2.1Mt, the Ounces range from 320Koz Au to 570Koz Au and the Grade range is 6.6g/t Au to 8.4g/t Au. The Company confirms that it is not aware of any new information that material affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the original market announcement continue to apply and have not materially changed

3 Refer to De Grey ASX Announcement, Hemi Gold Project Resource Update, dated 21 November 2023 No assurance can be given that a similar (or any) commercially viable mineral deposit will be determined at Novo's Becher Project

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/28148873-e4f0-44ba-adc2-66d161ba0364