TORONTO, Dec. 03, 2024 (GLOBE NEWSWIRE) -- Lithium Ionic Corp. (TSXV: LTH; OTCQX: LTHCF; FSE: H3N) ("Lithium Ionic” or the "Company”) is pleased to announce positive new drill results from its flagship Bandeira Lithium Project ("Bandeira”, the "Project”), located within the prolific "Lithium Valley”, in northern Minas Gerais State, Brazil. These intercepts are part of an ongoing drill program aimed at increasing mineral resource definition and expanding the mineralized footprint. These latest results demonstrate strong potential for continued mineral resource growth, intersecting meaningful extensions of high-grade mineralized pegmatites.

Bandeira Drill Results Highlights:

Hole ITDD-24-280:

- 16.00m grading 1.77% Li₂O from 137.41m, incl. 9.00m grading 2.36% Li₂O

- 19.60m grading 1.33% Li₂O from 83.74 meters, incl. 8.47m grading 1.81% Li₂O

- 14.00m grading 1.81% Li₂O from 105.10m

- 14.00m grading 1.54% Li₂O from 157.87m

- 14.00m grading 1.30% Li₂O from 138.05m

- 11.07m over 1.34% Li₂O from 200.75m

- 6.67m grading 2.11% Li₂O from 70.65m

- 12.00m grading 1.09% Li₂O from 110.03m

- 7.78m grading 1.58% Li₂O from 176.45m

- 8.96m grading 1.32% Li₂O from 206.21m

- 4.75m grading 2.28% Li₂O from 88.72m

Bandeira Project Overview & Feasibility Study Highlights

The Bandeira property spans 175 hectares in northeastern Minas Gerais State, Brazil, representing just ~1% of Lithium Ionic's large ~17,000-hectare land package. Despite this footprint, Bandeira accounts for ~70% of the 60.1Mt* global lithium mineral resource estimate, making it the cornerstone of the Company's development strategy (see press release dated April 12, 2024).

In May 2024, Lithium Ionic released a robust Feasibility Study for Bandeira, which outlined a 14-year mine life producing an average of 178,000 tonnes of high-quality 5.5% Li₂O spodumene concentrate annually. The study demonstrated a low CAPEX of US$266 million, delivering a post-tax NPV of US$1.3 billion and an IRR of 40%.

The Feasibility Study underscored the low-cost nature of Bandeira, with on-site operating costs estimated at US$444/t, and an all-in delivered cost of approximately US$557/t (CIF, Shanghai), positioning it as a competitive operation despite current lithium price environments. The spot price for spodumene concentrate (min. 6% Li2O; CIF China) is currently approximately 840$/t (Fastmarkets' Battery Raw Material Price Update, as of Dec. 2, 2024). These figures not only reflect the Project's efficient design but also the cost efficiencies that result from the region's excellent infrastructure, including low-cost hydroelectric power, access to dependable water resources, well-established transport infrastructure, and access to foreign markets via nearby ports. These advantages collectively enhance the Project's cost efficiency and its resilience to fluctuating market conditions.

Permitting & Development Progress

The Company's Licença Ambiental Concomitante (LAC) application, submitted in late 2023, is currently in the final stages of review by the Minas Gerais State Secretariat for the Environment and Sustainable Development (SEMAD). Final information requests have been submitted with an approval review currently being scheduled.

On October 22, 2024, Lithium Ionic announced the launch of Engineering, Procurement, and Construction Management ("EPCM”) services in partnership with Hatch and Reta Engenharia, an important milestone marking the transition to the construction and development phase of the Project.

On November 27, 2024, the Company announced that it secured a non-binding Letter of Interest ("LOI”) from the Export-Import Bank of the United States ("EXIM”) to provide up to US$266 million in debt financing for Bandeira; a major achievement that provides a clear pathway to fund the development of the Project.

*See NI 43-101 compliant technical report related to the Bandeira Bandeira MRE titled "NI 43-101 Technical Report - Mineral Resource Update on Bandeira Project, Araçuaí and Itinga, Minas Gerais State, Brazil” (effective date of March 5, 2024; QP: Leonardo Soares of GE21); See NI 43-101 compliant technical report related to the Salinas MRE titled "Independent Technical Report on Mineral Resources Estimate” (effective date of January 4, 2024; QP: Leonardo Soares, P.Geo., M.Sc., of GE21); and the NI 43-101 compliant technical reports related to the Outro Lado deposit titled "Mineral Resource Estimate for Lithium Ionic, Itinga Project” (effective date of June 24, 2023; authored by Maxime Dupéré, B. Sc., P.Geo. and Faisal Sayeed, B. Sc., P.Geo).

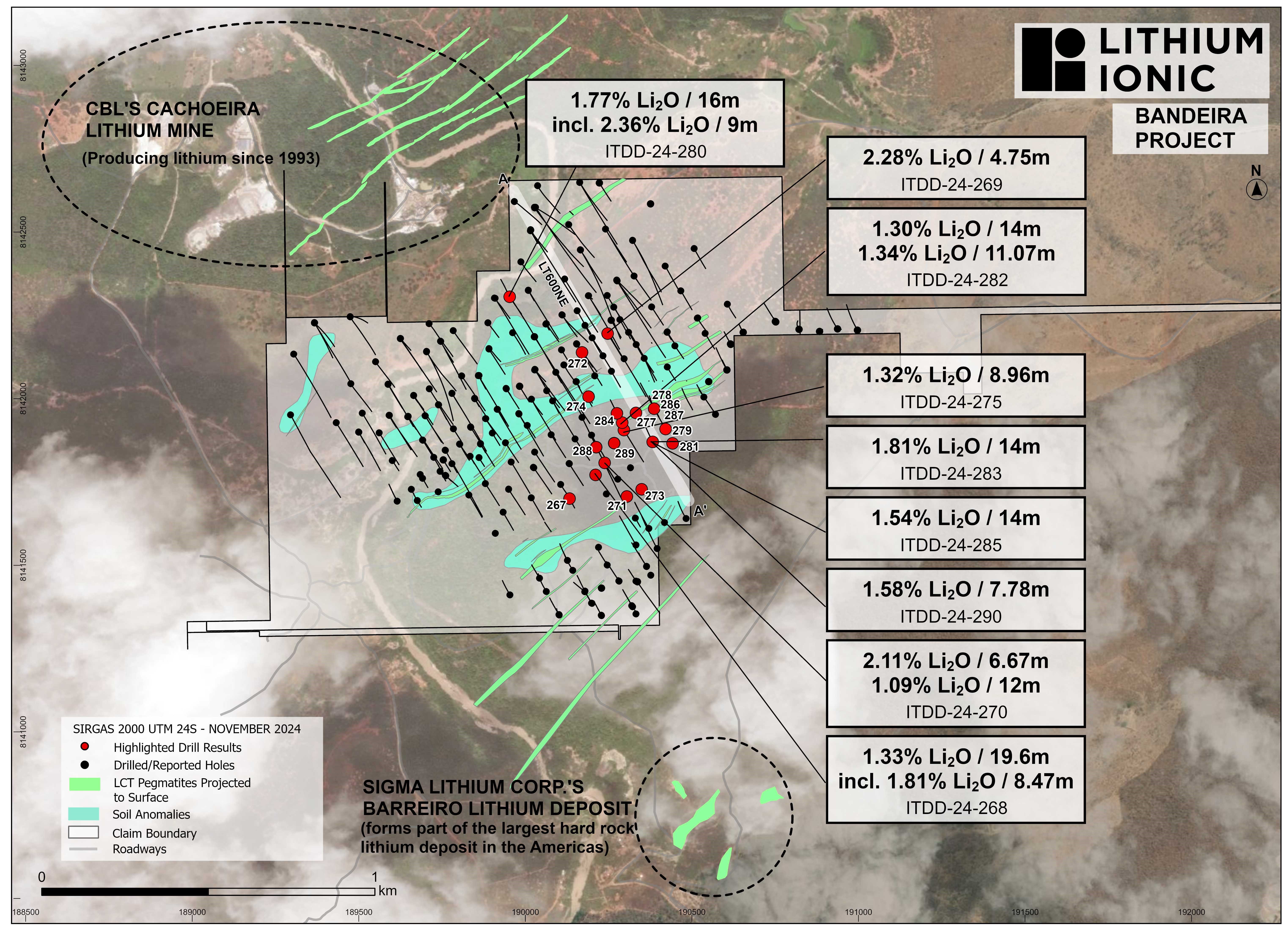

Figure 1. Plan map of Bandeira showing new drill intercepts

View Figure 1 here: https://www.globenewswire.com/NewsRoom/AttachmentNg/9a00f4e0-f4ee-4b96-9883-264920eb7bfa

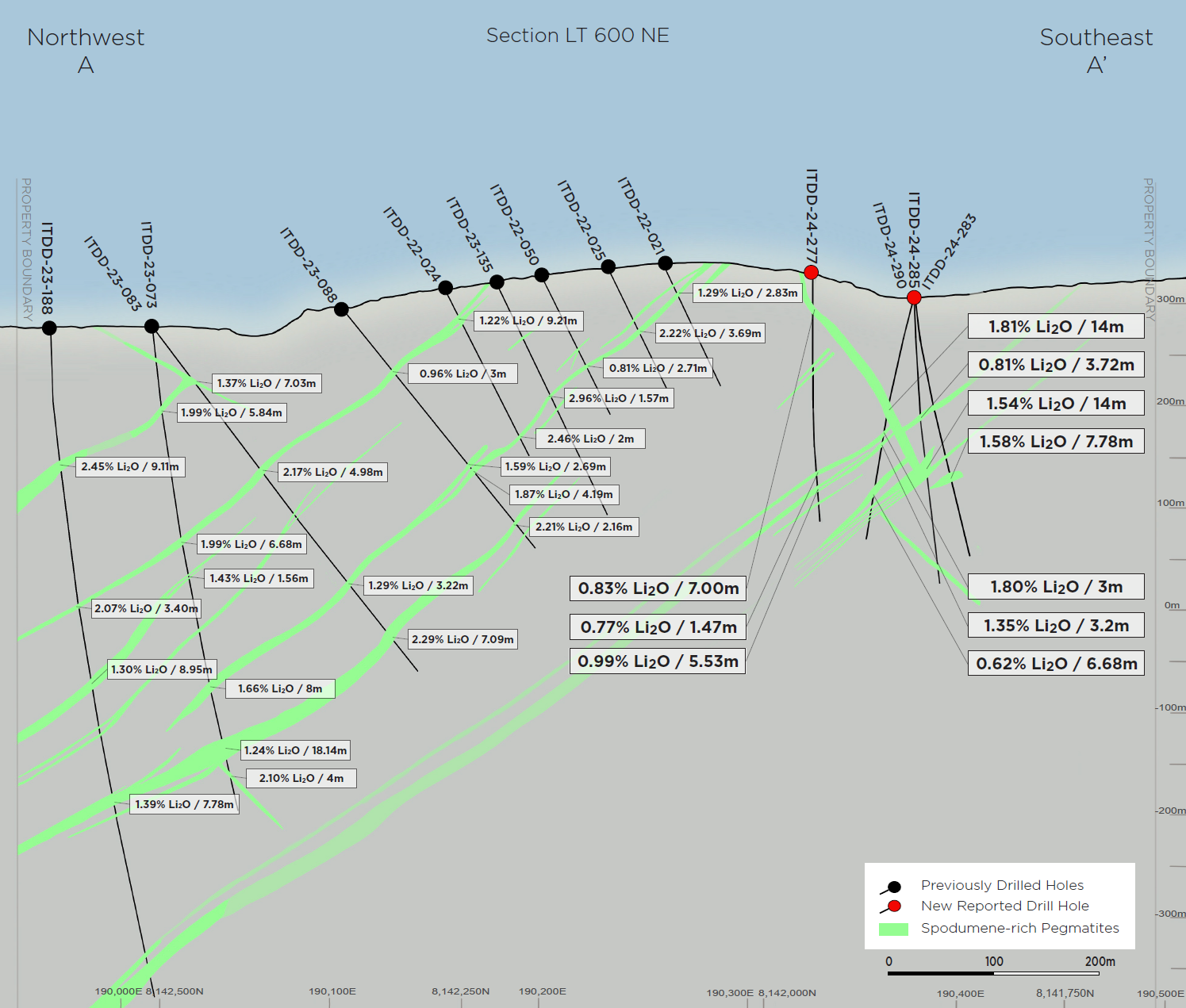

Figure 2. Section LT 600 NE, Showing New Drill Holes ITDD-24-277, ITDD-24-283, ITDD-24-285 and ITDD-24-290

View Figure 2 here: https://www.globenewswire.com/NewsRoom/AttachmentNg/d091a06d-ff4f-4b52-a61c-401267966211

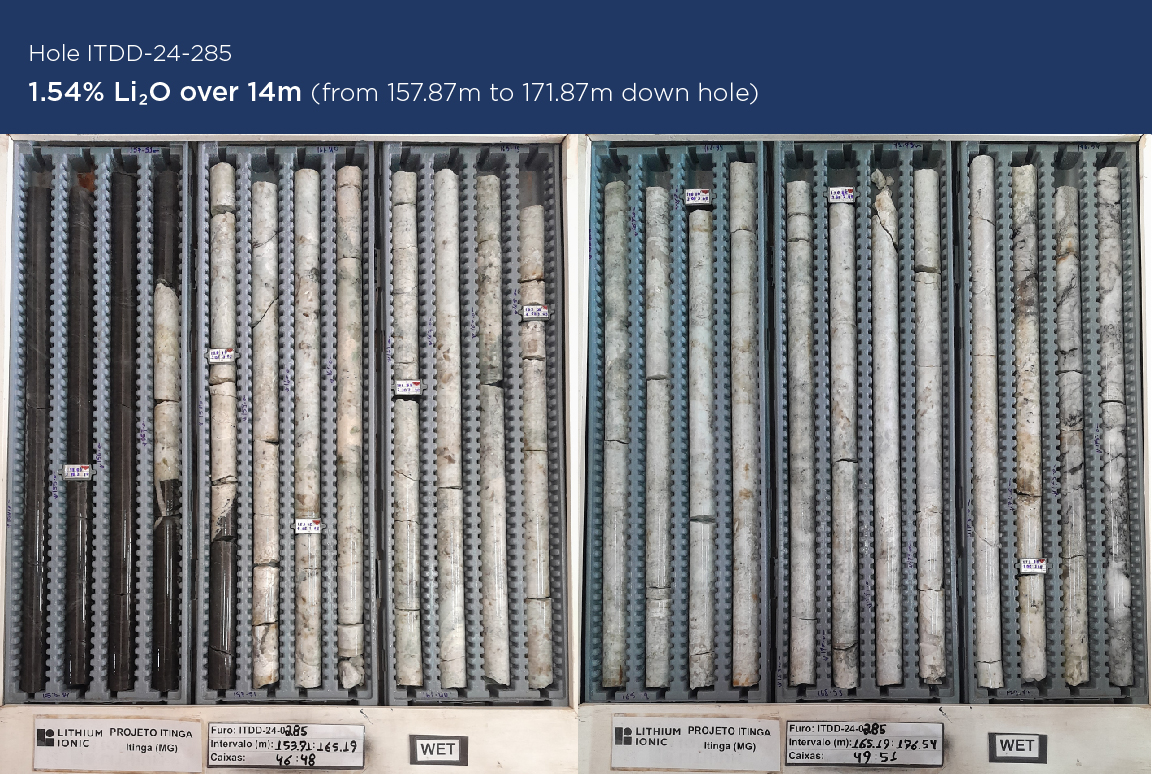

Figure 3. Core Photos, Hole ITDD-24-285

View Figure 1 here: https://www.globenewswire.com/NewsRoom/AttachmentNg/79bd06a7-b95d-4086-8555-8fd96c898c5a

Table 1. Bandeira Drill Results

| Hole ID | Az | Dip | From | To | Metres | Li2O (%) |

| ITDD-24-267 | 150 | -62 | 35.48 | 39.00 | 3.52 | 0.97 |

| ITDD-24-268 | 0 | -90 | 83.74 | 103.34 | 19.60 | 1.33 |

| including | 83.74 | 90.63 | 6.89 | 1.37 | ||

| including | 94.87 | 103.34 | 8.47 | 1.81 | ||

| and | 124.62 | 126.57 | 1.95 | 2.37 | ||

| and | 155.94 | 159.57 | 3.63 | 0.91 | ||

| and | 165.32 | 167.32 | 2.00 | 1.10 | ||

| and | 176.52 | 179.57 | 3.05 | 0.73 | ||

| ITDD-24-269 | 150 | -64 | 88.72 | 93.47 | 4.75 | 2.28 |

| ITDD-24-270 | 0 | -90 | 70.65 | 77.32 | 6.67 | 2.11 |

| and | 110.03 | 122.03 | 12.00 | 1.09 | ||

| including | 110.03 | 115.03 | 5.00 | 1.59 | ||

| and | 142.75 | 146.48 | 3.73 | 2.01 | ||

| ITDD-24-271 | 0 | -90 | 70.38 | 73.38 | 3.00 | 0.89 |

| ITDD-24-272 | 150 | -60 | 67.38 | 70.00 | 2.62 | 1.62 |

| ITDD-24-273 | 0 | -90 | 141.35 | 142.71 | 1.36 | 0.86 |

| ITDD-24-274 | 150 | -85 | 185.82 | 188.21 | 2.39 | 0.74 |

| ITDD-24-275 | 150 | -65 | 156.38 | 159.55 | 3.17 | 0.74 |

| and | 206.21 | 215.17 | 8.96 | 1.32 | ||

| including | 206.21 | 210.09 | 3.88 | 1.07 | ||

| including | 213.70 | 215.17 | 1.47 | 2.49 | ||

| ITDD-24-277 | 0 | -90 | 26.73 | 33.73 | 7.00 | 0.83 |

| and | 193.17 | 194.64 | 1.47 | 0.77 | ||

| and | 206.04 | 211.57 | 5.53 | 0.99 | ||

| ITDD-24-278 | 330 | -55 | 101.24 | 104.96 | 3.72 | 1.83 |

| ITDD-24-279 | 330 | -55 | 96.09 | 99.46 | 3.37 | 0.94 |

| ITDD-24-280 | 330 | -70 | 137.41 | 153.41 | 16.00 | 1.77 |

| including | 140.41 | 149.41 | 9.00 | 2.36 | ||

| ITDD-24-281 | 0 | -90 | NSR | |||

| ITDD-24-282 | 0 | -90 | 85.72 | 89.24 | 3.52 | 1.60 |

| and | 138.05 | 152.05 | 14.00 | 1.30 | ||

| and | 187.84 | 189.40 | 1.56 | 1.25 | ||

| and | 200.75 | 211.82 | 11.07 | 1.34 | ||

| and | 250.50 | 252.56 | 2.06 | 0.50 | ||

| and | 264.64 | 269.20 | 4.56 | 1.79 | ||

| and | 283.28 | 286.21 | 2.93 | 0.98 | ||

| ITDD-24-283 | 330 | -75 | 105.10 | 119.10 | 14.00 | 1.81 |

| and | 135.79 | 138.79 | 3.00 | 1.80 | ||

| and | 146.03 | 149.28 | 3.25 | 1.35 | ||

| and | 193.34 | 200.02 | 6.68 | 0.62 | ||

| and | 209.93 | 211.33 | 1.40 | 1.28 | ||

| and | 218.85 | 222.81 | 3.96 | 0.79 | ||

| ITDD-24-285 | 0 | -90 | 115.78 | 119.50 | 3.72 | 0.81 |

| and | 157.87 | 171.87 | 14.00 | 1.54 | ||

| ITDD-24-286 | 330 | -75 | 25.25 | 31.25 | 6.00 | 1.11 |

| ITDD-24-287 | 150 | -55 | 124.47 | 127.47 | 3.00 | 1.31 |

|

|