Without creating new demand, new discoveries can help curb emissions, drive value for the industry

LONDON and HOUSTON and SINGAPORE, Nov. 21, 2024 (GLOBE NEWSWIRE) -- Investment in oil and gas exploration has plummeted two-thirds in the last decade, but the industry still has a critical role to play in decarbonisation efforts and providing advantaged barrels in the energy transition, according to the latest Horizons report from Wood Mackenzie.

According to the report, "No country for old fields: Why high-impact oil and gas exploration is still needed” the world has plenty of current resources to meet demand, with approximately 3 trillion barrels of oil equivalent (boe) inventory. This translates to resource lives of more than 45 years for oil and over 60 years for gas.

"With so much in place, it begs the question - why is exploration still needed?” said Andrew Latham. "It's important to point out, that newly discovered fields would not increase demand, as demand neither grows when exploration succeeds nor shrinks when it fails. What can be said is that successful exploration cuts carbon intensity, lowers the cost of oil and gas to consumers, and adds value for both resource holders and explorers. As demand is proving resilient, investment in new supply is needed to displace dirtier alternatives.”

Cutting carbon

According to the report, lowering scope 1 and 2 emissions, or those created in the extraction and refining process, is better served by finding new fields than by cleaning up old ones. New fields are cleaner, thanks to modern decarbonisation technologies and higher facilities throughput.

Wood Mackenzie's Lens Upstream reveals that new fields about to begin production in the next few years will average scope 1 and 2 emissions intensity of 17 kgCO2e/boe over 2025-30. That compares with existing supply from mature fields averaging 28 kgCO2e/boe.

"Potential gains are not trivial,” said Latham. "Exploration through the current decade is on track to provide 12% of global oil and gas supply. If we assume that these new fields displace existing supply options with emissions intensity typical of older fields, then global scope 1 and 2 emissions in 2030 would be cut by around 6%, or 100 Mtpa CO2e.”

High-value performance

Economics has also driven activity. The industry's exploration performance has been attractive since upstream costs reset a decade ago.

"Exploration has been the most economic means of rejuvenating a portfolio with new fields, particularly for companies that seek advantaged resources, or those that are low carbon and high value,” said Latham. "Such prized assets are difficult to buy at a good price; it's much better to discover them.”

According to the report, full-cycle returns have been consistently in double digits every year since 2015, averaging 15%. New field discoveries are valued at much more than they cost to find, with net value creation of over US$160 billion since 2015, assuming an industry planning price of US$65/bbl Brent long term (almost double the current market value of supermajor BP).

Over the past five years, Wood Mackenzie calculates industry-average breakeven prices for exploration at around US$45 per boe (Brent, NPV10%) versus US$65 per boe for M&A. The gap for advantaged resources is even wider because of the shortage of such assets on the market.

Frontier and deepwater exploration most effective

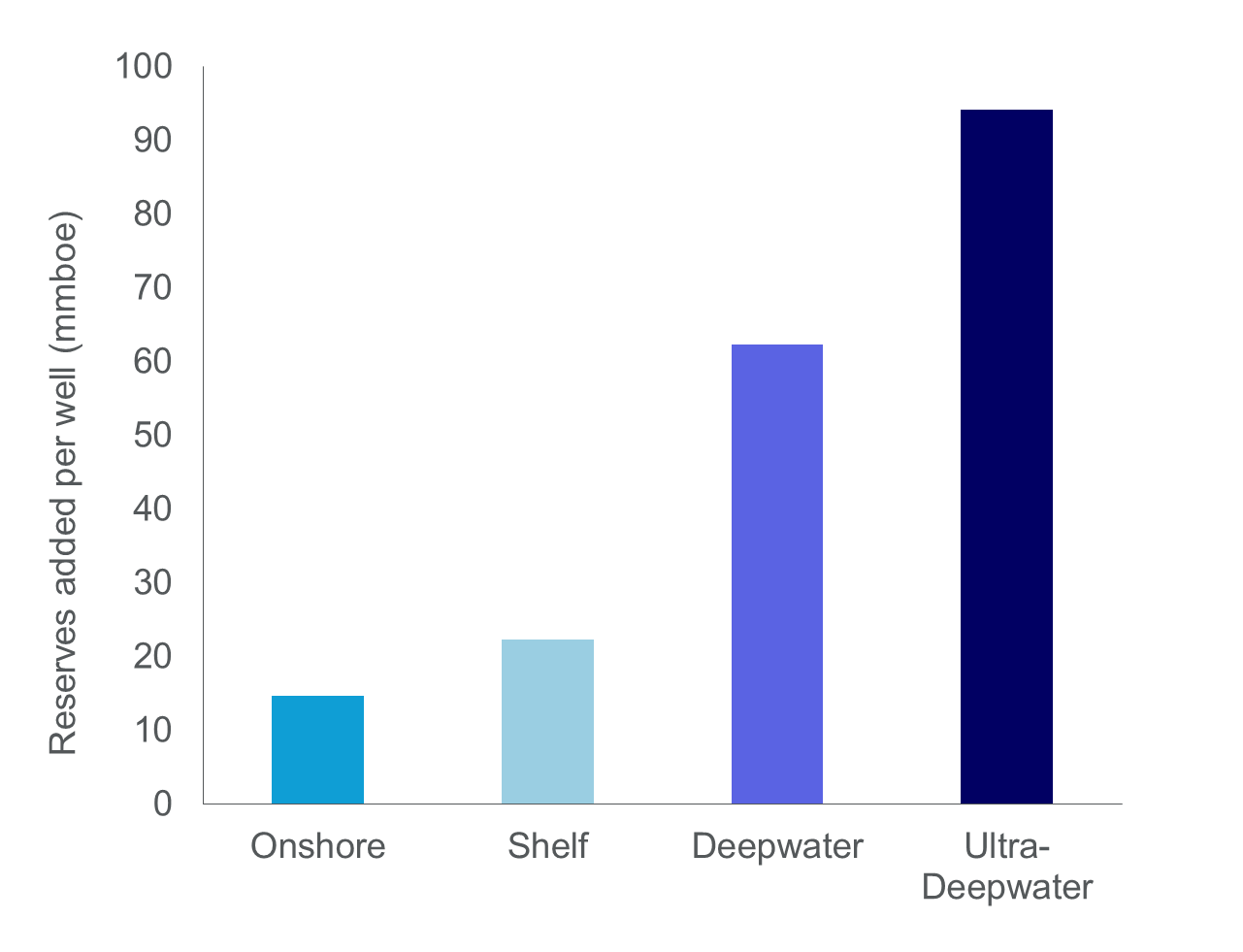

Frontier plays, defined as having no production from similar reservoirs in the same basin, stand out by resource scale. Even more so, deepwater exploration in frontier basins can offer the most effective plays. Frontier drilling added over 80 million boe per well, more than seven times wells in mature plays, with most in the deep offshore. Deepwater projects enjoy high recovery per well and tend to have lower emissions intensity (<15tCO2e/kboe) than shelf and onshore projects.

According to the report, deepwater will offer most new opportunities for exploration as most of the world's deepwater basins, in waters from 400 metres to over 3,000 metres, are barely drilled.

Resources per exploration well by water depth

"The Majors have jumped on the bandwagon of deepwater exploration, eager to unlock the next frontier,” said Latham. "They now hold nearly 70% of their net acreage in deepwater and dedicate a similar proportion of their exploration and appraisal spending to the sector.

"Increasingly, national oil companies are following suit, as government mandates to increase production and ensure domestic energy security prevail.”

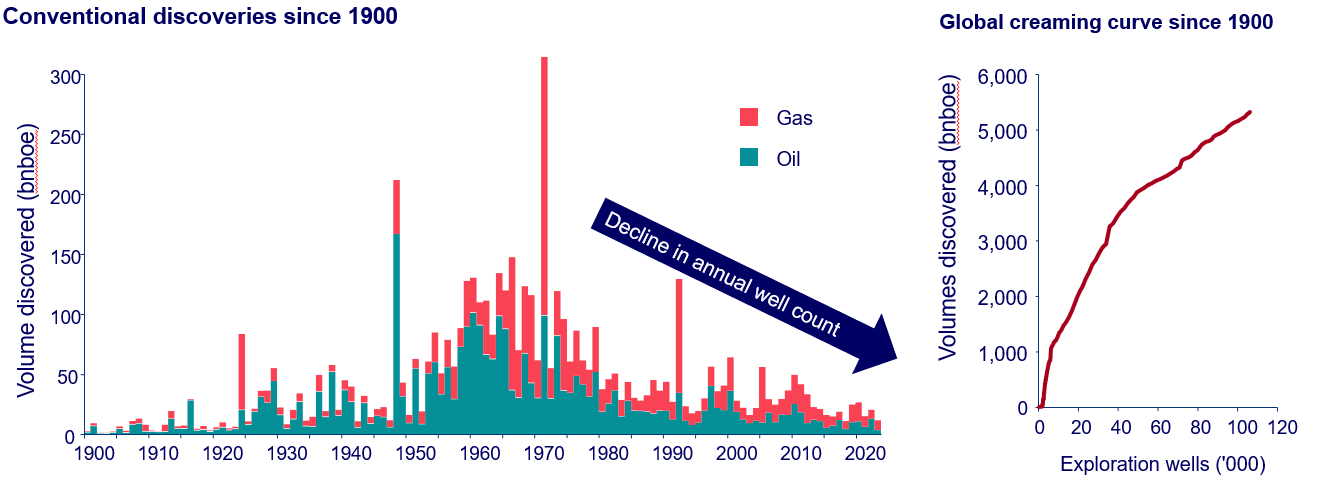

Within these untapped resources, there is still plenty of oil and gas to find. While the industry has been finding less in recent years compared with previous decades, that is down to drilling fewer wells.

The global creaming curve reveals a near straight-line trajectory with a steady gradient of around 30 million boe discovered per well, including the dry holes. It is a trend unchanged over the past four decades and more than 50,000 wells. An abrupt decline in such a long-established trend seems unlikely.

"Huge exploration opportunities still exist, but exploration does suffer from a serious image problem,” said Latham. "The widespread perception that exploration is bad for the climate threatens everything from access to opportunity and the social licence to operate to talent attraction and retention. That misconceptions abound in this regard does not mean they will be easily overcome. Exploration has a role to play in decarbonising oil and gas supply.”

For further information please contact Wood Mackenzie's media relations team:

Mark Thomton

+1 630 881 6885

Hla Myat Mon

+65 8533 8860

The Big Partnership (UK PR agency)

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header.

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That's why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years' experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers' decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.

Images accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/1d7064c0-062c-45f3-90d0-3ba1d994fa69

https://www.globenewswire.com/NewsRoom/AttachmentNg/759be251-f538-4398-a340-74dacfdfa04e