Reports Second Quarter of Positive GAAP Net Income

Maintains Cost Efficient Operating Profile

DALLAS, Nov. 14, 2024 (GLOBE NEWSWIRE) -- Beneficient (NASDAQ: BENF) ("Ben” or the "Company”), a technology-enabled financial services holding company that provides liquidity and related trust and custody services to holders of alternative assets, today reported its financial results for the fiscal 2025 second quarter, which ended September 30, 2024.

Commenting on the fiscal 2025 second quarter results, Beneficient management said: "We are pleased to report our second consecutive profitable quarter as a public company, which we believe positions Ben as a leading solution for liquidity and primary capital in large and growing private investment markets. With our Board of Directors having authorized up to $5 billion of fiduciary financings to Customer ExAlt Trusts through ExchangeTrust transactions, our platform is designed for substantial growth as new opportunities are identified and negotiated. We believe that our comprehensive model will enable stockholders to benefit from the range of trust, custody and other services we provide as well as the underlying performance of the private equity assets held in trust.

"Additionally, we are pleased to have strengthened our balance sheet through a previously announced transaction whereby our subsidiary Beneficient Company Holdings, L.P. redesignated approximately $125.5 million of its preferred equity as non-redeemable. As a result of the transaction, which was approved by the Company's founders holding the majority of the preferred equity, Beneficient reclassified approximately $125.5 million of temporary equity to permanent equity as of September 30, 2024.”

Second Quarter Fiscal 2025 and Recent Highlights (for the quarter ended September 30, 2024 or as noted):

- Reported investments with a fair value of $335.0 million, increased from $329.1 million at the end of our prior fiscal year, served as collateral for Ben Liquidity's net loan portfolio of $260.7 million and $256.2 million, respectively.

- Revenues increased to $8.6 million in the second quarter of fiscal 2025 as compared to $(42.8) million in the same quarter of fiscal 2024. On a year-to-date basis, revenues for fiscal 2025 were $18.6 million as compared to $(45.5) million for fiscal 2024.

- Operating expenses declined to $22.3 million in the second quarter of fiscal 2025, which included a non-cash goodwill impairment of $0.3 million, as compared to $339.0 million in the second quarter of fiscal 2024, which included a non-cash goodwill impairment of $306.7 million. On a year-to-date basis, operating expenses for fiscal 2025 were $(12.0) million, which included the release of a loss contingency accrual of $55.0 million and non-cash goodwill impairment of $3.7 million, as compared to $1.5 billion in fiscal 2024, which included non-cash goodwill impairment of $1.4 billion.

- Excluding the non-cash goodwill impairment in each period, operating expenses declined 31.9% to $22.0 million in the second quarter of fiscal 2025 as compared to $32.3 million in the same period of fiscal 2024. On a year-to-date basis, excluding the non-cash goodwill impairment and the loss contingency release in each period, as applicable, operating expenses were $39.3 million for the first half of fiscal 2025 as compared to $89.2 million for the first half of fiscal 2024.

- Improved permanent equity from a deficit of $148.3 million as of June 30, 2024 to a deficit of $13.2 million as of September 30, 2024 through a combination of redesignating approximately $125.5 million of temporary equity to permanent equity and net income allocable to permanent equity classified securities of $5.3 million during the current fiscal period.

As a result of executing on our business plan of providing financing for liquidity, or early investment exits, for alternative asset marketplace participants, Ben organically develops a balance sheet comprised largely of loans collateralized by a well- diversified alternative asset portfolio that is expected to grow as Ben successfully executes on its core business.

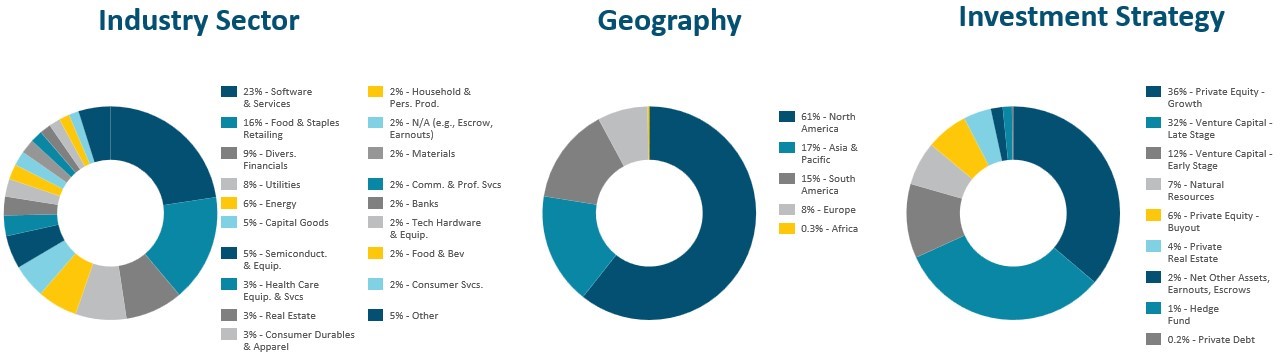

Ben's balance sheet strategy for ExAlt Loan origination is built on the theory of the portfolio endowment model for the fiduciary financings we make by utilizing our patent-pending computer implemented technologies branded as OptimumAlt. Our OptimumAlt endowment model balance sheet approach guides diversification of our fiduciary financings across seven asset classes of alternative assets, over 11 industry sectors in which alternative asset managers invest, and at least six countrywide exposures and multiple vintages of dates of investment into the private funds and companies.

As of September 30, 2024, Ben's loan portfolio was supported by a highly diversified alternative asset collateral portfolio providing diversification across approximately 240 private market funds and approximately 800 investments across various asset classes, industry sectors and geographies. This portfolio includes exposure to some of the most exciting, sought after private company names worldwide, such as the largest private space exploration company, an innovative software and payment systems provider, a venture capital firm investing in waste-to-energy and clean energy technologies, a technology company providing Net Zero solutions in the production of advanced biofuels, a designer and manufacturer of shaving products, a large online store for women's clothes and other fashionable accessories that has announced intentions to go public, a mobile banking services provider, and others.

Figure 1: Portfolio Diversification

Diversification Using Principal Loan Balance, Net of Allowance for Credit Losses

As of September 30, 2024, the charts below present the ExAlt Loan portfolio's relative exposure by certain characteristics (percentages determined by aggregate fiduciary ExAlt Loan portfolio principal balance net of allowance for credit losses, which includes the exposure to interests in certain of our former affiliates composing part of the Fiduciary Loan Portfolio).

As of September 30, 2024. Represents the characteristics of professionally managed funds and investments in the Collateral (defined as follows) portfolio. The Collateral for the ExAlt Loans in the loan portfolio is comprised of a diverse portfolio of direct and indirect interests (through various investment vehicles, including, limited partnership interests and private and public equity and debt securities, which include our and our affiliates' or our former affiliates' securities), primarily in third-party, professionally managed private funds and investments. Loan balances used to calculate the percentages reported in the pie charts are loan balances net of any allowance for credit losses, and as of September 30, 2024, the total allowance for credit losses was $315 million, for a total gross loan balance of $576 million and a loan balance net of allowance for credit losses of $261 million.

Business Segments: Second Quarter Fiscal 2025

Ben Liquidity

Ben Liquidity offers simple, rapid and cost-effective liquidity products through the use of our proprietary financing and trust structure, or the "Customer ExAlt Trusts,” which facilitate the exchange of a customer's alternative assets for consideration.

- Ben Liquidity recognized $12.0 million of interest income for the fiscal second quarter, an increase of 10.4% from the quarter ended June 30, 2024, primarily due to a slightly higher carrying value of loan receivables, which was driven by compounding interest, offset by an increase in the allowance for credit losses.

- Operating income for the fiscal second quarter was $2.9 million, improved from an operating loss of $0.5 million for the quarter ended June 30, 2024.

- Adjusted operating income(1) for the fiscal second quarter was $2.9 million, improved from adjusted operating loss(1) of $0.5 million in the quarter ended June 30, 2024. The increase in adjusted operating income(1) was primarily due to lower credit loss adjustments along with the higher revenues noted above.

Ben Custody provides full-service trust and custody administration services to the trustees of certain of the Customer ExAlt Trusts, which own the exchanged alternative assets following liquidity transactions in exchange for fees payable quarterly calculated as a percentage of assets in custody.

- NAV of alternative assets and other securities held in custody by Ben Custody during the fiscal second quarter increased to $385.1 million as of September 30, 2024, compared to $381.2 million as of March 31, 2024. The increase was driven by unrealized gains on existing assets, principally related adjustments to the relative share held in custody of the respective fund's NAV based on updated financial information received from the funds' investment manager or sponsor during the period, offset by distributions during the period.

- Revenues applicable to Ben Custody were $5.4 million for the fiscal second quarter, compared to $5.4 million for the quarter ended June 30, 2024. The similar amount of revenues for these periods was a result of stable NAV of alternative assets and other securities held in custody at the beginning of each applicable period, when such fees are calculated.

- Operating income for the fiscal second quarter increased to $4.3 million, from $1.3 million for the quarter ended June 30, 2024. The increase was primarily due to lower non-cash goodwill impairment in the fiscal second quarter of $0.3 million as compared to non-cash goodwill impairment of $3.1 million for the quarter ended June 30, 2024.

- Adjusted operating income(1) for the fiscal second quarter was $4.6 million, compared to adjusted operating income(1) of $4.4 million for the quarter ended June 30, 2024. The increase was primarily due to slightly higher revenues and slightly lower operating expenses.

Ben Liquidity

- Ben Liquidity recognized $22.8 million of interest income for the six months ended September 30, 2024, down 8.8% compared to the prior year period, primarily due to lower loans, net of the allowance for credit losses, resulting from higher levels of non-accrual loans and loan prepayments, partially offset by new loans originated.

- Operating income was $2.4 million for the six months ended September 30, 2024, increased from an operating loss of $1.2 billion in the prior year period. The prior period loss was driven by non-cash goodwill impairment totaling $1.1 billion and credit losses largely related to securities of our former parent company.

- Adjusted operating income(1) was $2.4 million for the six months ended September 30, 2024 compared to adjusted operating loss(1) of $14.3 million in the prior year period with the increase in adjusted operating income(1) primarily related to lower credit loss adjustments recognized in the current period and lower interest expense.

- Ben Custody revenues were $10.8 million for the six months ended September 30, 2024, down 17.6%, compared to the prior year period, primarily due to lower NAV of alternative assets and other securities held in custody.

- Operating income was $5.6 million for the six months ended September 30, 2024 compared to operating loss of $270.8 million in the prior year period, with the increase in operating income principally related to a significantly larger non-cash goodwill impairment in the prior year period of $281.8 million as compared to $3.4 million in the current year period.

- Adjusted operating income(1) for the six months ended September 30, 2024 was $9.0 million, compared to adjusted operating income(1) of $10.9 million in the prior year period with the decrease in adjusted operating income(1) primarily due to lower revenue related to lower NAV of alternative assets and other securities held in custody and slightly lower operating expenses during the current fiscal year period.

- As of September 30, 2024, the Company had cash and cash equivalents of $4.5 million and total debt of $124.1 million.

- Distributions received from alternative assets and other securities held in custody totaled $12.5 million for the six months ended September 30, 2024, compared to $26.3 million for the same period of fiscal 2024.

- Total investments (at fair value) of $335.0 million at September 30, 2024 supported Ben Liquidity's loan portfolio.

Board Update

On September 30, 2024, Patrick J. Donegan was appointed to the Board as an independent director and a member of various committees including the Audit committee of the Board. Mr. Donegan brings almost thirty years of compliance, legal, banking and capital markets experience to Ben, having held various senior compliance positions, including as Chief Compliance Officer, for bank holding companies and broker dealers and as Assistant General Counsel for a securities company. Over the course of his career, Mr. Donegan has attained eleven FINRA licenses and two certifications from the American Bankers Association, including the Certified Regulatory Compliance Mangers designation, and currently holds a Certified Anti-Money Laundering Specialist certification.

Consolidated Fiscal Second Quarter Results

Table 1 below presents a summary of selected unaudited consolidated operating financial information.

| Consolidated FiscalSecondQuarter Results ($ in thousands, except share and per share amounts) | Fiscal2Q25 September 30, 2024 | Fiscal 1Q25 June 30, 2024 | Fiscal2Q24 September 30, 2023 | Change % vs. Prior Quarter | YTD Fiscal 2025 | YTD Fiscal 2024 | Change % vs. Prior YTD | |||||||||||||

| GAAP Revenues | $ | 8,561 | $ | 10,046 | $ | (42,761 | ) | (14.8 | )% | $ | 18,607 | $ | (45,504 | ) | NM | |||||

| Adjusted Revenues(1) | 8,734 | 10,411 | (801 | ) | (16.1 | )% | 19,145 | 22 | NM | |||||||||||

| GAAP Operating Income (Loss) | (13,715 | ) | 44,338 | (381,764 | ) | NM | 30,623 | (1,537,734 | ) | NM | ||||||||||

| Adjusted Operating Loss(1) | (6,611 | ) | (4,725 | ) | (21,170 | ) | (39.9 | )% | (11,337 | ) | (45,690 | ) | 75.2 | % | ||||||

| Basic Class A EPS | $ | 2.98 | $ | 12.11 | $ | (115.95 | ) | (75.4 | )% | $ | 14.58 | $ | (521.17 | ) | NM | |||||

| Diluted Class A EPS | $ | 0.03 | $ | 0.17 | $ | (115.95 | ) | (82.4 | )% | $ | 0.18 | $ | (521.17 | ) | NM | |||||

| Segment Revenues attributable to Ben's Equity Holders(2) | 16,626 | 16,235 | 18,629 | 2.4 | % | 32,861 | 35,756 | (8.1 | )% | |||||||||||

| Adjusted Segment Revenues attributable to Ben's Equity Holders(1)(2) | 16,626 | 16,242 | 19,066 | 2.4 | % | 32,868 | 36,915 | (11.0 | )% | |||||||||||

| Segment Operating Income (Loss) attributable to Ben's Equity Holders | (9,192 | ) | 44,864 | (378,172 | ) | NM | 35,672 | (1,520,276 | ) | NM | ||||||||||

| Adjusted Segment Operating Loss attributable to Ben's Equity Holders(1)(2) | $ | (2,261 | ) | $ | (4,552 | ) | $ | (11,960 | ) | 50.3 | % | $ | (6,814 | ) | $ | (32,989 | ) | 79.3 | % | |

(1) Adjusted Revenues, Adjusted Operating Income (Loss), Adjusted Segment Revenues attributable to Ben's Equity Holders and Adjusted Segment Operating Income (Loss) attributable to Ben's Equity Holders are non-GAAP financial measures. For reconciliations of our non-GAAP measures to the most directly comparable GAAP financial measures and for the reasons we believe the non-GAAP measures provide useful information, see Non-GAAP Reconciliations.

(2) Segment financial information attributable to Ben's equity holders is presented to provide users of our financial information an understanding and visual aide of the segment information (revenues, operating income (loss), and adjusted operating income (loss)) that impacts Ben's Equity Holders. Ben's Equity Holders refers to the holders of Beneficient Class A and Class B common stock and Series B-1 Preferred Stock as well as holders of interests in BCH which represent noncontrolling interests. For a description of noncontrolling interests, see Item 2 of our Quarterly Report on Form 10-Q for the six months ended September 30, 2024, and Reconciliation of Business Segment Information Attributable to Ben's Equity Holders to Net Income Attributable to Ben Common Holders. Such information is computed as the sum of the Ben Liquidity, Ben Custody and Corp/Other segments since it is the operating results of those segments that determine the net income (loss) attributable to Ben's Equity Holders. See further information in table 5 and Non-GAAP Reconciliations.

Table 2 below presents a summary of selected unaudited consolidated balance sheet information.

| Consolidated Fiscal First Quarter Results ($ in thousands) | Fiscal 2Q25 As of September 30, 2024 | Fiscal 4Q24 As of March 31, 2024 | Change % | |||||

| Investments, at Fair Value | $ | 334,987 | $ | 329,119 | 1.8 | % | ||

| All Other Assets | 20,787 | 22,676 | (8.3 | )% | ||||

| Goodwill and Intangible Assets, Net | 13,014 | 16,706 | (22.1 | )% | ||||

| Total Assets | $ | 368,788 | $ | 368,501 | 0.1 | % | ||

Table 3 below presents unaudited segment revenues and segment operating income (loss) for business segments attributable to Ben's equity holders.

| Segment Revenues Attributable to Ben's Equity Holders(1) ($ in thousands) | Fiscal 2Q25 September 30, 2024 | Fiscal 1Q25 June 30, 2024 | Fiscal 2Q24 September 30, 2023 | Change % vs. Prior Quarter | YTD Fiscal 2025 | YTD Fiscal 2024 | Change % vs. Prior YTD | ||||||||||||

| Ben Liquidity | $ | 11,978 | $ | 10,849 | $ | 13,022 | 10.4 | % | $ | 22,827 | $ | 25,028 | (8.8 | )% | |||||

| Ben Custody | 5,386 | 5,382 | 6,490 | 0.1 | % | 10,768 | 13,065 | (17.6 | )% | ||||||||||

| Corporate & Other | (738 | ) | 4 | (883 | ) | NM | (734 | ) | (2,337 | ) | 68.6 | % | |||||||

| Total Segment Revenues Attributable to Ben's Equity Holders(1) | $ | 16,626 | $ | 16,235 | $ | 18,629 | 2.4 | % | $ | 32,861 | $ | 35,756 | (8.1 | )% | |||||

| Segment Operating Income (Loss) Attributable to Ben's Equity Holders(1) ($ in thousands) | Fiscal 2Q25 September 30, 2024 | Fiscal 1Q25 June 30, 2024 | Fiscal 2Q24 September 30, 2023 | Change % vs. Prior Quarter | YTD Fiscal 2025 | YTD Fiscal 2024 | Change % vs. Prior YTD | ||||||||||

| Ben Liquidity | $ | 2,905 | $ | (514 | ) | $ | (272,091 | ) | NM | ()[\]\\.,;:\s@\"]+)*)|(\".+\"))@((\[[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\])|(([a-zA-Z\-0-9]+\.)+[a-zA-Z]{2,}))$/;return b.test(a)}$(document).ready(function(){if(performance.navigation.type==2){location.reload(true)}$("iframe[data-lazy-src]").each(function(b){$(this).attr("src",$(this).attr("data-lazy-src"))});if($(".owl-article-body-images").length){$(".owl-article-body-images").owlCarousel({items:1,loop:true,center:false,dots:false,autoPlay:true,mouseDrag:false,touchDrag:false,pullDrag:false,nav:true})}var a=$("#display_full_text").val();if(a==0){$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:$("#cms_article_id").val()},dataType:"json",success:function(b){},error:function(b,d,c){}})}$(".read-full-article").on("click",function(d){d.preventDefault();var b=$(this).attr("data-cmsArticleId");var c=$(this).attr("data-productId");var f=$(this).attr("data-href");dataLayer.push({event:"paywall_click",paywall_name:"the_manila_times_premium",paywall_id:"paywall_article_"+b});$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:b,productId:c},dataType:"json",success:function(e){window.location.href=$("#BASE_URL").val()+f},error:function(e,h,g){}})});$(".article-embedded-newsletter-form .close-btn").on("click",function(){$(".article-embedded-newsletter-form").fadeOut(1000)})});$(document).on("click",".article-embedded-newsletter-form .newsletter-button",function(){var b=$(".article-embedded-newsletter-form .newsletter_email").val();var d=$("#ga_user_id").val();var c=$("#ga_user_yob").val();var a=$("#ga_user_gender").val();var e=$("#ga_user_country").val();if(validateEmail(b)){$.ajax({url:"/ajax/sendynewsletter",type:"POST",data:{email:b},success:function(f){$(".article-embedded-newsletter-form .nf-message").html(f);$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000);dataLayer.push({event:"newsletter_sub",user_id:d,product_name:"newsletter",gender:a,yob:c,country:e})},error:function(f,h,g){}})}else{$(".article-embedded-newsletter-form .nf-message").html("Please enter a valid email address.");$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000)}});$(document).on("click",".article-embedded-newsletter-form .nf-message",function(){$(this).removeClass("show");$(this).html("")});

| |||||||