Total Quarterly Revenue of $4 million, up 9% year-over-year.

Record Backlog of $54.9 million.

Gross Margin of 42%.

Cost-Cutting Results in Over $3 Million in Recurring Annual Savings.

Continued Momentum in Military, Aerospace, and Waste Destruction Businesses

MONTREAL, Nov. 06, 2024 (GLOBE NEWSWIRE) -- PyroGenesis Canada Inc. ("PyroGenesis”) (http://pyrogenesis.com) (TSX:PYR) (OTCQX:PYRGF) (FRA:8PY), a high-tech company that designs, develops, manufactures and commercializes advanced plasma processes and sustainable solutions which are geared to reduce greenhouse gases (GHG) and address environmental pollutants, today announces its financial and operating results for the third quarter ended September 30, 2024.

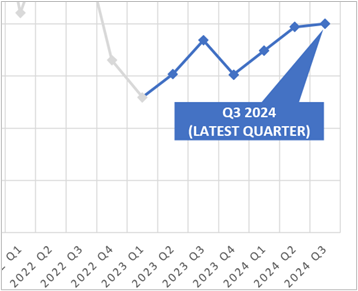

"2024 continues to demonstrate favourable momentum for PyroGenesis, both for revenue as well as for revenue backlog from our order book, which surged to a new all-time high at quarter's end because of continued confidence by recurring military and aerospace customers, and sustained interest in waste remediation - furthering 2023's resurgence of that business line,” said P. Peter Pascali, President and CEO of PyroGenesis. "The sequential revenue progress seen so far in 2024 has resulted in three consecutive quarters of year-over-year growth, with five of the last six quarters exceeding the previous quarter. And we've done this while cutting costs significantly.”

"Our third quarter 2024 results, with revenue up and costs way down, reflect the investments we've made in cost-cutting initiatives, a disciplined focus on operational efficiency, and of course the execution of our strategy that deploys our expertise in ultra-high temperature applications to multiple industries around the world. As we continue to grow revenue quarter to quarter while simultaneously reducing costs, we put ourselves in an even better position to expand market share over the long-term as energy transition and emission reduction efforts expand,” added Mr. Pascali. "With an escalating demand for significantly higher plasma torch power levels, as evidenced by our post-quarter end contract announcement of a $27 million 20MW plasma torch order, we are entering a new growth phase for plasma applications, and we will work diligently to ensure that the appropriate operational stage is set to unlock multi-year growth trajectories.”

PyroGenesis is also announcing that its name has changed from PyroGenesis Canada Inc. to PyroGenesis Inc. Additionally, the Company is pleased to announce that it has moved its headquarters to a larger office location in downtown Montreal. More information on the changes to the company name and headquarters is located further below.

KEY Q3 2024 FINANCIAL HIGHLIGHTS

- Revenue of $4 million, up 9% vs. Q3 2023, the 3rd straight quarter of year-over-year growth

- All-time High Revenue (Order) Backlog of $54.9 million of signed and/or awarded contracts as at November 6, 2024, reflecting rapid acceleration in the power needs for military, space exploration, and the heavy industry sectors undergoing energy transitioning

- Gross margin of 42%, a 13-point improvement from Q2 and 12-point improvement YOY

- EPS loss of $0.02, net loss of $3.9 million, an improvement of 38% compared to $6.3 million loss during the same quarter a year ago

- Post quarter end, in October 2024 [news release dated October 21, 2024], the Company announced a contract valued at approximately $27 million for the development of a plasma torch system powered at 20 megawatts, from an existing U.S. client which provides technology and test services geared to solving critical defense, military, aeronautics, and space exploration challenges. The client, which previously ordered a 4.5MW plasma torch system from PyroGenesis in August 2023 [news release dated August 1, 2023], regularly serves as a prime contractor for the U.S. government. A plasma torch at this 20 megawatts power level, based on PyroGenesis' own research, represents one of the most powerful (if not the most powerful) plasma torches ever produced commercially. The project was expected to start within 30 days of the news release, with an estimated duration of 3 years.

- Post quarter end, in October 2024 [news release dated October 31, 2024], the Company provided an update on the Repriced Warrants. As a result of the repricing, 1,457,500 of the Repriced Warrants have been exercised, for total proceeds to the Company of $1,093,125.

Q3 2024 continued the positive revenue growth trend that began in Q2 2023. Q3 2024 marks the 6th straight quarter of revenue improvement compared to the low revenue mark of Q1 2023, with five of those six quarters - including this Q3 2024 - surpassing the previous quarter's revenues:

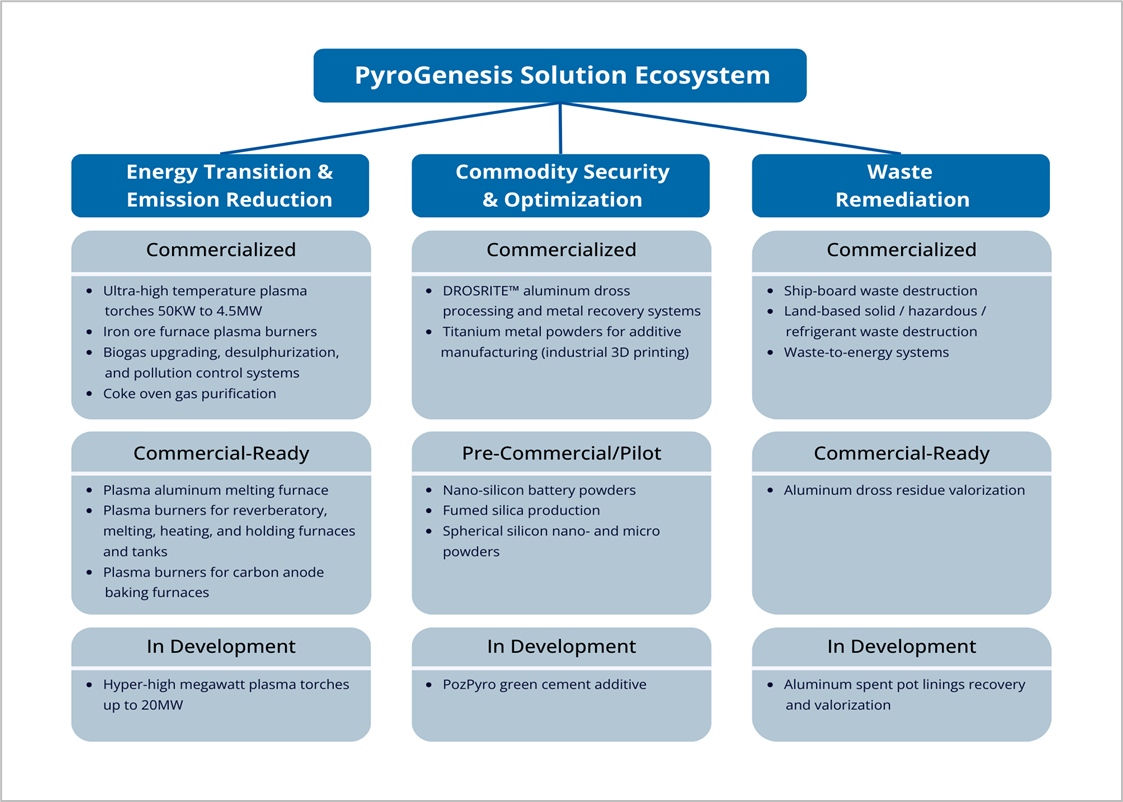

The Company operates primarily within three business verticals that align with economic drivers that are key to global heavy industry:

1. Energy Transition & Emission Reduction:

- fuel switching, utilizing the Company's electric-powered plasma torches and biogas upgrading technology to help heavy industry reduce fossil fuel use and greenhouse gas emissions,

- recovery of viable metals, and optimization of production methods/processes geared to increase output, maximize raw material usage, and improve the availability of critical minerals,

- safe destruction of hazardous materials, and the recovery and valorization of underlying substances such as chemicals and minerals.

The information below represents highlights from the past quarter for each of the Company's main business verticals.

Energy Transition & Emission Reduction

- In September, the Company acknowledged that EarthGrid, a plasma tunnel-boring technology and infrastructure development company, was its client, as part of an announcement congratulating EarthGrid on its signing of a joint venture with Enertech, a Kuwait-based investment entity, to deploy infrastructure projects in four phases across the United States, Europe and the Middle East. According to EarthGrid's own announcement on September 17, 2024, the first two phases of the projects consist of an estimated US$18 billion in US infrastructure projects. Previously, in a press release date January 16, 2020, PyroGenesis had announced that it had received a $667,000 non-refundable down payment under a master agreement for multi-year multi-plasma torch purchases from an undisclosed client, now revealed as EarthGrid. At the time of this earlier announcement, EarthGrid's name was withheld for competitive and confidentiality reasons.

- Post quarter end, in October 2024 [news release dated October 21, 2024], the Company announced a contract valued at approximately $27 million for the development of a plasma torch system powered at 20 megawatts, from an existing U.S. client which provides technology and test services geared to solving critical defense, military, aeronautics, and space exploration challenges. The client, which previously ordered a 4.5MW plasma torch system from PyroGenesis in August 2023 [news release dated August 1, 2023], regularly serves as a prime contractor for the U.S. government. A plasma torch at this 20 megawatts power level, based on PyroGenesis' own research, represents one of the most powerful (if not the most powerful) plasma torches ever produced commercially. The project was expected to start within 30 days of the news release, with an estimated duration of 3 years.

- In July, the Company announced that HPQ Polvere had signed a letter of intent with Evonik Corporation, a global specialty chemicals company. HPQ Polvere's primary initiative is the Fumed Silica Reactor (FSR) project that PyroGenesis has been designing, engineering, and constructing to convert quartz into fumed silica in a single and eco-friendly step. PyroGenesis previously announced in a press released dated May 30, 2024, its intent to exercise its right to convert its annual royalty rights into a 50% ownership stake of HPQ Polvere pursuant to a design and development agreement. The objective of HPQ Polvere's letter of intent with Evonik is to outline the basis of collaboration during the FSR pilot scale phase with the goal to validate the ability of the FSR to produce low-cost, low-carbon material acceptable to Evonik's specifications.

- In September, the Company announced the signing of a $1 million first-phase contract with an entity engaged in the production of graphite, for which PyroGenesis will design and deliver a customized pilot-scale plasma reactor and associated testing system. Upon the successful completion of the first phase, the next step would be negotiation of a contract for the development of a full-scale graphite production plant for which PyroGenesis has exclusive rights. Additionally, PyroGenesis has negotiated a 10% royalty on future gross revenues generated from an initial commercial graphite production plant built by the client, and a 5% royalty on any subsequent plants. Graphite is a critical mineral widely used across manufacturing.

- In July, the Company announced the signing of a 2-stage contract for a land-based plasma waste-to-energy system with a European consortium. The first stage consists of a conceptual and preliminary design phase for approximately $2 million, which commenced in Q3 2024 and is scheduled to last no more than one year. The design phase will determine the order of magnitude cost estimate of the system construction, expected to range between $120-160 million depending on the system's capacity and other details. The design of the Plasma Waste-to-Energy System is based on the Company's Plasma Resource Recovery System (PRRS), a waste-to-energy technology that eliminates toxic compounds while transforming waste into reusable products such as syngas and chemicals such as methanol.

- Post quarter end, in October 2024 [news release dated October 10, 2024], the Company announced the receipt of a purchase order of approximately $1,015,000 for after-sales component production related to the US Navy aircraft carrier contract. The components are scheduled to be produced and delivered to the client by March 2025.

- Through the quarter and most of 2024, the Company continued to monitor its selling, general and administrative expenses in order to maximize savings and reduce expenses. A year-to-date savings of over $3 million was realized mainly from a change in the directors' and officers' insurance, a reduction in professional fees, consulting and other expenses, along with adjustments to staffing and optimal use of employees. These are savings the Company will benefit from every year going forward.

- In July, the Company announced a repricing of up to 4,107,850 existing common share purchase warrants (the "Repriced Warrants”), wherein the exercise price of those Repriced Warrants was reduced to $0.75 per share. Of the Repriced Warrants, (i) 697,500 warrants were to expire on October 19, 2024, (ii) 2,380,350 warrants expire on March 7, 2025, and (iii) 1,030,000 warrants expire on July 21, 2025. The Repriced Warrants were also amended to provide that if at any time before their expiry date, the closing price of the Company's Common Shares on the Toronto Stock Exchange ("TSX”) is greater than $0.9375 (such amount being 125% of $0.75) over any 5 consecutive trading days, the Company will be entitled, within 15 days of the occurrence of such event, to accelerate the expiry date of the Repriced Warrants to the date that is 30 days following the date that notice of such acceleration is provided.

- In July, the Company announced the closing of a $2.8 million non-brokered private placement consisting of the issuance and sale of 3,505,750 units at a price of $0.80 per unit. Each unit consists if one common share of PyroGenesis, and one common share purchase warrant, entitling the holder to purchase one common share at a price of $1.20 during the twelve months following the closing date of the private placement.

- Post quarter end, in October 2024 [news release dated October 31, 2024], the Company provided an update on the Repriced Warrants. As a result of the repricing, 1,457,500 of the Repriced Warrants have been exercised, for total proceeds to the Company of $1,093,125.

- In July, the Company announced purchase of 100% control of Drosrite International, a US-based private company, for $1.00. Drosrite International had already been, on an accounting basis, a subsidiary of the Company, but legally a stand-alone entity. An exclusive agreement was entered into between PyroGenesis and Drosrite International on August 29, 2019, under which Drosrite International received the required rights from PyroGenesis to manufacture, market, sell and distribute Drosrite™ systems and technology to the Kingdom of Saudi Arabia, and certain other countries in the Middle East.

- In July, the Company announced that its subsidiary Drosrite International LLC was renamed PyroGenesis International LLC.

PyroGenesis' corporate name has changed from PyroGenesis Canada Inc. to PyroGenesis Inc. Simultaneously, the French version of its name has changed from PyroGènese Canada Inc. to PyroGènese Inc.

"This change to our name is a subtle but indicative change,” noted Mr. Pascali. "With sales across 21 countries and counting, this name change is part of an initiative to better express in all areas of communication that we are an internationally focused company with global reach.”

This name change does not involve any restructuring, change of control, or other corporate reorganization. This decision solely pertains to a more inclusive and internationally resonant brand image. The name change does not affect trading of the Company's shares. The shares will continue to trade on the TSX under the symbol PYR and through the OTCQX under the symbol PYRGF. It is currently expected that the new corporate name will be effective on the Canadian and US capital markets as of November 11, 2024, with no change to the stock symbols.

Additionally, the Company is pleased to announce that it has recently moved its headquarters to a larger office location in downtown Montreal. The move comes as a result of the Company having outgrown its previous headquarters after more than 30 years in Montreal's historic Griffintown neighbourhood. The new office location resides in the heart of downtown near Montreal Central Station, the Queen Elizabeth Hotel, and the Bell Centre arena (home of the Montreal Canadiens), and provides more modern amenities and a smarter office layout, while also providing easier access for employees and customers that use public transit.

PyroGenesis' new corporate headquarters are located at 1100 René-Lévesque Boulevard West, Montréal, Québec, Suite 1825, H3B 4N4. Phone numbers will remain the same, with 514-937-0002 as the main line.

FINANCIAL SUMMARY

1. Revenues

PyroGenesis recorded revenue of $4.0 million in the third quarter of 2024 ("Q3, 2024”), representing an increase of $0.3 million compared with $3.7 million recorded in the third quarter of 2023 ("Q3, 2023”). Revenue for the nine-month period ended September 30, 2024, was $11.4 million, an increase of $2.1 million over revenue of $9.3 million in the same period of 2023.

Revenues recorded in the three and nine-months ended September 30, 2024, were generated primarily from:

| Three months ended September 30 | Variation | Nine months ended September 30 | Variation | |||||||||||

| 2024 | 2023 | 2024 vs 2023 | 2024 | 2023 | 2024 vs 2023 | |||||||||

| High purity metallurgical grade silicon & solar grade silicon from quartz (PUREVAP™) | 221,627 | 415,415 | (193,788 | ) | 717,861 | 1,388,854 | (670,993 | ) | ||||||

| Aluminium and zinc dross recovery (DROSRITE™) | 503,230 | 118,745 | 384,485 | 1,493,918 | 324,296 | 1,169,622 | ||||||||

| Development and support related to systems supplied to the U.S. Navy | 344,540 | 1,003,592 | (659,052 | ) | 1,626,149 | 2,168,820 | (542,671 | ) | ||||||

| Torch-related products and services | 1,310,709 | 950,290 | 360,419 | 4,979,766 | 2,682,979 | 2,296,787 | ||||||||

| Refrigerant destruction (SPARC™) | 705,027 | 104,784 | 600,243 | 956,918 | 360,075 | 596,843 | ||||||||

| Biogas upgrading and pollution controls | 691,941 | 768,396 | (76,455 | ) | 899,950 | 1,419,362 | (519,412 | ) | ||||||

| Other sales and services | 225,615 | 324,503 | (98,888 | ) | 753,621 | 972,440 | (218,819 | ) | ||||||

| Revenue | 4,002,689 | 3,685,725 | 316,964 | 11,428,183 | 9,316,826 | 2,111,357 | ||||||||

Q3, 2024 revenues increased by $0.3 million, mainly as a result of:

- PUREVAP™ related sales generated revenue of $0.2 million, a decrease of $0.2 million compared to Q3, 2023 due to the completion of the project and with the successful silicon "pour” previously announced by the Company. As a result, minimal revenue was forecasted and realized in the current quarter,

- DROSRITE™ related sales increased by $0.4 million due to the rise in active client site trials across Europe, increased spare parts orders from existing clients, and higher revenue from storage and other ancillary revenue and transportation related to the DROSRITE units, at the request of the client,

- Development and support related to systems supplied to the U.S Navy decreased by $0.7 million compared to Q3, 2023, due to the current stage of the project, whereas, in the comparable period, significant advancement was made related to inspection, packaging and shipment of the equipment to our customer in order to move forward with installation and commissioning,

- Torch-related products and services increased by $0.4 million, due to the continued progress on the significant projects related to our 4.5MW and 1MW torch systems, and additional recurring monthly 24/7 onsite support,

- SPARC™ related sales increased by $0.6 million, due to substantial advancements in fabrication, assembly, and delivery preparation, installation and commissioning scheduled for early 2025.

- Biogas upgrading and pollution controls generated revenue of $0.7 million, a decrease of $0.1 million compared to Q3, 2023, due to the nature and status of the projects.

- PUREVAP™ related sales decreased to $0.7 million due to the completion of the project and current project phase, whereby lower revenue was expected,

- DROSRITE™ related sales increased to $1.2 million due to additional site trials for customers and the increase in spare parts orders from existing clients and the increase in storage revenue, other ancillary revenue and transportation related to the DROSRITE units,

- Development and support related to systems supplied to the U.S Navy decreased by $0.5 million due to the current stage of the project, with the advancements contingent upon the client's inspections scheduled for Q4, 2024, partially offset, by the increase in awarded contracts for spare parts and engineering services from clients that are third-party suppliers of the US Navy,

- Torch-related products and services increased by $2.3 million, due to the Company providing continuous 24/7 onsite support and the significant progress related to the current ongoing torch systems projects,

- SPARC™ related sales increased by $0.6 million, due to significant advancements, particularly the completion of long-lead major equipment, with focus now on preparing for installation and commissioning at the client's facility,

- Biogas upgrading and pollution controls related sales decreased by $0.5 million due to a decrease in project volume,

2. Cost of Sales and Services and Gross Margins

Cost of sales and services were $2.3 million in Q3, 2024, representing a decrease of $0.3 million compared to $2.6 million in Q3, 2023, primarily attributable to a $0.6 million reduction in direct materials, totaling $0.9 million, and a $0.2 million decrease in amortization of intangible assets, compared to $1.5 million and $0.2 million, respectively for the three-month period ended September 30, 2023. The decrease in direct materials is related to the decrease in recognition of costs related to the Company's DROSRITE™, PUREVAP™, and Biogas upgrading and pollution controls product lines, offset by the recognition of costs from the completion of the power supplies required for the Company's high-powered torch systems. However, the decrease was offset by the increase in employee compensation of $0.1 million increasing to $0.9 million (three-month period ended September 30, 2023 - $0.8 million), an increase of $0.2 million in subcontracting (three-month period ended September 30, 2023 - $0.1 million), attributed to additional work being subcontracted and the product mix related to the cost of sales and the increase in manufacturing overhead and other of $0.2 million, to $0.4 million (three-month period ended September 30, 2023 - $0.2 million).

The gross profit for Q3, 2024 was $1.7 million or 42% of revenue compared to a gross profit of $1.1 million for Q3, 2023, representing 30% of revenue. The increase in gross margin percentage was mainly due to the decrease on direct materials costs, and amortization of intangible assets.

During the nine-month period ended September 30, 2024, cost of sales and services were $7.9 million, an increase from $6.6 million for the same period in the prior year. The $1.3 million increase is primarily driven by a $1.4 million rise in direct materials related to the recognized costs of substantial items, namely power supplies. Employee compensation and manufacturing overhead and other increased by $0.2 million and $0.1 million, to $2.8 million and $0.9 million, respectively (nine-month period ended September 30, 2023 - $2.6 million and $0.8 million). This increase was partially offset by the decrease in amortization of intangible assets of $0.5 million to $0.1 million compared to $0.7 million for the same period in the prior year.

The amortization of intangible assets for Q3, 2024 was $0.02 million compared to $0.2 million for Q3, 2023, and during the nine-month period ended September 30, 2024, was $0.1 million compared to $0.7 million for the same period in the prior year. This expense variation relates mainly to the intangible assets in connection with the Pyro Green-Gas acquisition, which have been fully amortized by January 2024. These expenses were non-cash items, and the remaining intangible assets are composed of patents, and deferred development costs that will be amortized over the expected useful lives.

As a result of the type of contracts being executed, the nature of the project activity, as well as the composition of the cost of sales and services, the mix between labour, materials and subcontracts may be significantly different. In addition, due to the nature of these long-term contracts, the Company has not necessarily passed on to the customer, the increased cost of sales which was attributable to inflation, if any. The costs of sales and services are in line with management's expectations and with the nature of the revenue.

3. Selling, General and Administrative Expenses

Included within Selling, General and Administrative expenses ("SG&A”) are costs associated with corporate administration, business development, project proposals, operations administration, investor relations and employee training.

SG&A expenses for the third quarter of 2024 amounted to $5.0 million, reflecting a decrease of $2.6 million from Q3, 2023. This reduction is primarily attributed to several key factors. The expected credit loss and bad debt experienced a decrease of $2.0 million, primarily due a reduction in provisioned outstanding receivable. Additionally, professional fees were reduced by $0.3 million from the three-month period ended September 30, 2023, due to decreased reliance on external consultants, legal services, and other professional services. Other expenses showed a favorable variance of $0.3 million, driven by reductions in insurance expenses and marketing costs and an increase of $0.2 million in government grants due to higher levels of activities supported by such grants. The decreases were partially offset by the negative impact of $0.3 million due to changes in the foreign exchange charge on materials due to the variation of the U.S. dollar and the increase of employee compensation of $0.3 million from $2.1 million to $2.4 million for the three-month period ended September 30, 2024.

During the nine-month period ended September 30, 2024, SG&A expenses totaled $9.7 million, a significant decrease of $11.8 million from $21.6 million for the same period in the prior year. The key factors contributing to this decrease include the expected credit loss and bad debt provision, which varied favourably by $8.2 million. This was caused by the payment received from a customer whose balance was provisioned, and to higher credit loss expense recognized in Q3, 2023. Professional fees saw a significant reduction of $1.2 million due to less reliance on external consultants, legal services, and other professional services. Other expenses decreased by $1.0 million, as well, due to a favorable impact of $0.3 million on the foreign exchange charge on materials due to the variation of the U.S. dollar.

Share-based compensation expense for the three and nine-month periods ended September 30, 2024, was $0.2 million and $1.0 million, respectively (three and nine-month periods ended September 30, 2023 - $0.7 million and $2.4 million, respectively), a decrease of $0.5 million and $1.4 million respectively, which is a non-cash item and relates mainly to 2022, and 2023 grants not repeated in 2024.

Share-based payments expenses as explained above, are non-cash expenses and are directly impacted by the vesting structure of the stock option plan whereby options vest between 10% and up to 100% on the grant date and may require an immediate recognition of that cost.

4. Depreciation on Property and Equipment

The depreciation on property and equipment for the three and nine-month periods ended September 30, 2024, decreased to $0.09 million and $0.3 million, respectively, compared with $0.2 million and $0.5 million for the same periods in the prior year. The expense is comparable to the same quarters last year and the decrease is primarily due to the nature and useful lives of the property and equipment being depreciated.

5. Research and Development ("R&D”) Costs, net

During the three-months ended September 30, 2024, the Company incurred $0.2 million of R&D costs on internal projects, a decrease of $0.5 million when compared to Q3, 2023. The decrease in Q3, 2024 is primarily related to a decrease in employee compensation and in materials and equipment due to a reduction in R&D activities.

During the nine-months ended September 30, 2024, the Company incurred $0.7 million of R&D costs on internal projects, a decrease of $1.0 million when compared to the same period in the prior year. The decrease is mainly due to lower levels of R&D activities in the 2024 period.

In addition to internally funded R&D projects, the Company also incurred R&D expenditures during the execution of client funded projects. These expenses are eligible for Scientific Research and Experimental Development ("SR&ED”) tax credits. SR&ED tax credits on client funded projects are applied against cost of sales and services (see "Cost of Sales” above).

6. Finance Expenses (income), net

Finance expenses for Q3, 2024 totaled $0.3 million as compared with to $0.2 million for Q3, 2023, representing a variation of $0.1 million year-over-year. The increase in finance expenses in Q3, 2024 is mainly due to the increase in interest accretion on the balance due on the business combination of $0.1 million and the increase in interest and accretion related to the convertible loan, whereby this loan was only issued in December 2023.

During the nine-month period ended September 30, 2024, the finance expenses totaled $0.9 million as compared with an income of $1.6 million for the 2023 comparable period, representing a variation of $2.5 million year-over-year. This is caused by the 2023 favourable revaluation of the balance due on business combination due to two milestones that would not be achieved, thus a reversal of the liabilities was recorded. In addition, greater financial expenses were due to the interest and accretion for the convertible debenture and convertible loan, which were only outstanding for portion of 2023.

7. Strategic Investments

During the three-months ended September 30, 2024, the adjustment to fair market value of strategic investments for Q3, 2024 resulted in a gain of $0.04 million compared to a gain in the amount of $1.2 million in Q3, 2023, a favorable variation of $1.2 million. During the nine-months ended September 30, 2024, the adjustment to fair market value of strategic investments resulted in a loss of $0.2 million compared to a gain in the amount of $0.2 million for the same period in the prior year, a variation of $0.4 million. The decrease in variations for the three and nine-month periods ended September 30, 2024, is attributable to the variation of the market value of the common shares owned by the Company of HPQ Silicon Inc.

8. Other Income

During the nine-months ended September 30, 2024, Other Income includes a gain on settlement of legal proceedings with a third party which was also a customer of the Company's subsidiary, Pyro Green-Gas. As a result, the Company received a settlement of $1.5 million and recognized a gain of $1,180,335, included in Other Income, and the remainder as a reduction of accounts receivable.

9. Comprehensive loss

The comprehensive loss for Q3, 2024 of $3.9 million compared to a loss of $6.3 million, in Q3, 2023, represents a favourable variation of $2.3 million, and is primarily attributable to the factors described above, which have been summarized as follows:

- an increase in product and service-related revenue of $0.3 million arising in Q3, 2024, which generated a 42% gross margin, compared to 30% in Q3, 2023. As a result, gross profit is $1.7 million compared to $1.1 million for the same three-month period ended September 30, 2024,

- a decrease in SG&A expenses of $2.6 million arising in Q3, 2024, was primarily due to the expected credit loss and bad debt decrease, and also to lower professional fees, other expenses and increase in government grants. This was offset by increases in employee compensation, depreciation of right-of-use assets, and an unfavourable impact due to changes in the foreign exchange charge on materials,

- a decrease in share-based expenses of $0.5 million,

- a decrease in R&D expenses of $0.5 million due to a reduction of R&D activities,

- an increase in net finance expenses primarily due the interest and accretion on the convertible debentures, convertible loan and balance due on the business combination,

- a variation in the fair market value of strategic investments of $1.2 million.

- an increase in product and service-related revenue of $2.1 million, which generated a 31% gross margin, compared to 29% in 2023. As a result, gross profit is $3.6 million compared to $2.7 million for the same nine-month period of 2023,

- a decrease in SG&A expenses of $11.8 million was primarily due to the favourable impact of the expected credit loss and bad debt decrease and also to the decrease in professional fees, travel, depreciation of property, other expenses and foreign exchange,

- a decrease in share-based expenses of $1.4 million

- a decrease in R&D expenses of $1.0 million primarily due to decreased R&D activities,

- an increase in net finance expenses primarily due to the revaluation of balance due on business combination of $2.1 million in 2023 not repeated in 2024 and in the increase of accretion and interest on the convertible debentures and convertible loan,

- a variation in the fair market value of strategic investments of $0.4 million.

As at September 30, 2024, the Company had cash of $0.04 million, included in the net working capital deficiency of $10.4 million. Certain working capital items such as billings in excess of costs and profits on uncompleted contracts do not represent a direct outflow of cash. The Company expects that with its liquidity position and its access to capital markets it will be able to finance its operations for the foreseeable future.

The Company's term loan balance at September 30, 2024 was $303,127 and decreased by $100,952 since December 31, 2023, due mainly to the complete reimbursement of a loan. The decrease from January 1, 2023, to December 31, 2023 was mainly attributable to the accretion on the Economic Development Agency of Canada loan, which is interest free and will remain so, until the balance is paid over the 60-month period ending March 2029. In July 2023, the Company closed a brokered private placement for $3,030,000, bearing interest at 10%. On December 20, 2023, the Company closed a non-brokered private placement of a convertible loan for gross proceeds of $1,250,000 and bears interest at 3%. The average interest expense on the other term loans and convertible debenture is approximately 10%. The Company does not expect changes to the structure of term loans and convertible debentures and loans in the next twelve-month period. The Company maintained one credit facility which bears interest at a variable rate of prime plus 2%, therefore 8.45% at September 30, 2024. The Company will continue to reimburse the existing credit facility in 2024.

OUTLOOK

Consistent with the Company's past practice, and in view of the early stage of market adoption of our core lines of business, the Company is not providing specific revenue or net income (loss) guidance for 2024.

The following is an outline of the many factors that impact the Company's strategy and future success, plus key developments that are expected to impact subsequent quarters.

Overall Strategy

PyroGenesis provides technology solutions to heavy industry that leverage the Company's expertise in ultra-high temperature processes. The Company has evolved from its early beginnings as a specialty-engineering firm to being a provider of a robust technology eco-system for heavy industry that helps address key strategic goals.

The Company believes its strategy to be timely, as multiple heavy industries are committing to major carbon and waste reduction programs at the same time as many governments are increasingly supportive - from both a policy and financial perspective - of environmental technologies and infrastructure projects. Additionally, both industry and government are developing strategies to ensure the availability of critical minerals during the coming decades of

increased output demand.

While there can be no guarantees, the Company believes the evolution of its strategy beyond greenhouse gas emission reduction, to an expanded focus that encapsulates the key verticals listed in the section "Q3 2024 Production and Sales Highlights”, both (i) improves the Company's chances for success while (ii) also providing a clearer picture of how the Company's wide array of offerings work in tandem to support heavy industry goals.

PyroGenesis' market opportunity is significant, as major industries such as aluminum, steelmaking, manufacturing, cement, chemicals, defense, aeronautics, and government seek factory-ready, technology-based solutions to help steer through the challenging landscape of increasing demand, tightening regulations, and material availability.

As more of the Company's offerings reach full commercialization, PyroGenesis will remain focused on attracting influential customers in broad markets while at the same time ensuring that operating expenses are controlled to achieve profitable growth.

Key Performance Indicators

The Company uses key performance indicators (KPIs) to monitor, analyze, and optimize organizational output and performance, with KPIs specific to different parts of its production and manufacturing (such as cycle time, capacity utilization, yield, changeover time, and scrap), plus a different set of KPIs designed to evaluate the broader corporate results and uptake, identify trends affecting the business, and make strategic decisions. This latter category of KPIs includes:

Industry Depth: number of customers within an industry and/or amount and % of revenue from that industry. To date, the Company's greatest depth has been with the aluminum, military, and government industries.

New Industry Engagement: as the energy transition and carbon/GHG-reduction trends grow, more industries are realizing the benefit of using PyroGenesis' technology. Over the past five years the Company has begun to penetrate the mining and metal, iron ore, aerospace, automotive, general parts manufacturing, steel, materials (especially silica and silicon), chemical, and cement industries, among others.

Customer Depth: the number of projects with a single customer and/or amount of revenue from that customer. The Company treats most customer identities as confidential unless otherwise approved or suggested by the customer.

New Customer Engagement: as a relatively small company with technology that is potentially of interest across thousands of companies in many different industries, the Company takes a cautious approach when engaging with new customers. Primarily, the Company evaluates the potential customer's access to capital, operational history, and reputation when weighing engagement. With regard to net new technology ideas or start-up customers, PyroGenesis considers the long-term commercialization potential of the idea, the possibility of revenue sharing or royalties, and access to capital. Aligning to the Company's three tier business model is imperative, though exceptions can be made.

Studies Undertaken: scientific and engineering studies have been a key part of new customer acquisition for much of the Company's history. A study such as a computational fluid dynamics (CFD) study is often the first phase requirement for a potential customer in investigating the potential future use of the Company's technology. Since transitioning from a legacy fossil fuel-based system to the Company's all-electric plasma can be a transformative and often expensive proposition, a study allows a potential new client to better understand the future technological fit and prospective budgetary requirements, while also gaining an understanding of the high-quality working relationship with the Company. The wide array of different specs, uses, industries, and in-factory customization of furnace, heating, and melting machinery, mandates ground-up studies for most new initiatives. The Company's experience conducting studies and its exposure to more and different types of systems, especially over the last 5 years, has allowed the Company to further streamline and perfect its study process as a route to new business. The number, type, and duration of studies undertaken during each quarter varies.

Monthly Recurring Revenue: ongoing, repeating revenue is a major goal for the Company. To date, after-sale parts and components (such as those related to consumable aspects of plasma torches) have represented the largest revenue and growth potential on a recurring basis. As the energy transition trend grows and more plasma systems are sold, recurring revenue is expected to represent a much larger percentage of overall revenue. Other areas targeted for recurring revenue include sales of titanium metal powders, revenue from tolling contracts in areas such as aluminum dross treatment and metal recovery, and co-venture/royalty agreements such as those related to waste remediation.

Revenue Mix: PyroGenesis has established a technology eco-system comprised of a number of inter-related solutions, often referred to in previous Company communications as a "multi-legged stool”. This type of diversification offers a measure of protection to the Company in both difficult and rapidly changing economic environments. As such, the Company targets a wide versus a narrow mix of revenue sources.

Growth Mix: new revenue is currently driven by existing customers. A key goal for the Company is to develop an optimal mix of existing and new customers.

Cost Controls and Efficiencies

PyroGenesis has been, and continues to, scrutinize both potential and existing projects to ensure that the utilization of labour and financial resources are optimized. The Company continues to only engage in projects that reflect significant benefits to PyroGenesis and the risks of which are defined. The Company intends to intensify its focus on project and budgetary clarity during this period of elevated inflationary pressures, by identifying alternative suppliers while constantly adjusting project resources. The early-stage project assessment process has also been refined to allow for faster "go / no-go” decisions on project viability.

Enhanced Sales and Marketing

Against the backdrop of its 3-tiered strategy, the Company continues to increase sales, marketing, and R&D efforts in-line with - and in some cases ahead of - the growth curve for industrial change related to greenhouse gas reduction efforts.

Macroeconomic Conditions

With some continued uncertainty in the macroeconomic environment, including ambiguity in the banking sector with regard to interest rate adjustments, and the continued inflationary pressures causing shifting demand dynamics across various industries at different times, it may be difficult to assess the future impact these events and conditions will have on our customer base, the end markets we serve, and the resulting effect on our business and operations, both in the short term and in the long term.

Despite these uncertainties, we continue to believe there is an accelerated need for PyroGenesis' solutions in the industries we serve as heavy industry continues to decarbonize / transition their energy sources, manufacture utilizing both lighter metals (such as aluminum) and additive manufacturing, and deal with tighter hazardous waste regulations.

While we expect these uncertainties and other macroeconomic conditions to continue to impact the variability in our quarter-to-quarter revenue, we believe our diversity in both customer base and solution set will continue to be a strong mitigating factor to these challenges. Additionally, the Company's ongoing efforts to reduce costs through various measures including the sourcing of more high quality, cost-competitive suppliers, further bolsters the Company against cost fluctuations.

The various military conflicts in the Middle East and Eastern Europe continue to create some level of global economic uncertainty, as well as supply chain disruptions that can change at any time. However, it's important to note that the Company does not have any operations, customers or supplier relationships in Russia, Belarus or Ukraine, and as such are not directly impacted at a customer level in these countries. The Company does have customer relationships and projects in Poland and will continue to monitor the situation in the region regarding challenges to the completion of current projects, which at this time are not inhibited.

As always, the Company monitors the potential impact macroeconomic events and conditions could have on the business, operations, and financial health of the Company.

Generally, the Company believes that broad-based threats to global supply chains increase awareness and interest in the many solutions the Company offers. This is particularly true within the minerals and metals industries, as manufacturers seek alternatives to off-shore suppliers as well as technologies that could optimize output or recycle critical material from byproducts or waste - solutions that the Company currently offers.

Business Line Developments

The upcoming milestones which are expected to confirm the validity of our strategies are outlined below. Please note that these timelines are estimates based on information provided to us by the clients/potential clients, and while we do our best to be accurate, timelines can and will shift, due to protracted negotiations, client technical and resource challenges, or other unexpected situations beyond our or the clients' control:

Business Line Developments: Near Term (0 - 3 months)

Financial

- Payments for Outstanding Major Receivables:

Regarding the outstanding receivable under the Company's existing $25 million+ Drosrite™ contract: and as previously announced, PyroGenesis had agreed to a strategic extension of the payment plan, by the customer and its end-customer, geared to better align the pressures on the end-user's operating cash flows created by increased business opportunities.

- Plasma Torches for Metal Manufacturing:

The Company is in advanced discussions with one of the world's largest producers of metal products to design and develop a plasma-based solution for use in improving precision in the manufacturing process.