/ Q3 2024 Results

- Revenue of $601.9 million

- GAAP diluted earnings per share of $1.46 and non-GAAP diluted earnings per share of $2.58

- GAAP operating profit margin of 26.8% and non-GAAP operating profit margin of 45.8%

- Operating cash flows of $174.2 million and unlevered operating cash flows of $184.5 million

- Annual contract value (ACV) of $540.5 million

- Deferred revenue and backlog of $1,463.8 million on September 30, 2024

On January 15, 2024, the Company entered into a definitive agreement with Synopsys, Inc. (Synopsys) under which Synopsys will acquire Ansys. Ansys and Synopsys have received foreign direct investment approvals for the proposed transaction in nearly all of the relevant jurisdictions, and received unconditional clearance from the Israeli Competition Authority on October 9, 2024. The transaction is anticipated to close in the first half of 2025, subject to the receipt of required regulatory approvals and other customary closing conditions. As previously announced, in light of the pending transaction with Synopsys, Ansys has suspended quarterly earnings conference calls and no longer provides quarterly or annual guidance.

The non-GAAP financial results highlighted represent non-GAAP financial measures. Reconciliations of these measures to the comparable GAAP measures for the three and nine months ended September 30, 2024 and 2023 can be found later in this release.

/ Summary of Financial Results

Ansys' third quarter and year-to-date (YTD) 2024 and 2023 financial results are presented below. The 2024 and 2023 non-GAAP results exclude the income statement effects of stock-based compensation, excess payroll taxes related to stock-based compensation, amortization of acquired intangible assets, expenses related to business combinations and adjustments for the income tax effect of the excluded items.

Our results are as follows:

| GAAP | |||||||||||||||||||||

| (in thousands, except per share data and percentages) | Q3 QTD 2024 | Q3 QTD

2023 | % Change | Q3 YTD

2024 | Q3 YTD

2023 | % Change | |||||||||||||||

| Revenue | $ | 601,892 | $ | 458,795 | 31.2 | % | $ | 1,662,635 | $ | 1,464,841 | 13.5 | % | |||||||||

| Net income | $ | 128,192 | $ | 55,502 | 131.0 | % | $ | 293,004 | $ | 225,650 | 29.8 | % | |||||||||

| Diluted earnings per share | $ | 1.46 | $ | 0.64 | 128.1 | % | $ | 3.34 | $ | 2.58 | 29.5 | % | |||||||||

| Gross margin | 88.5 | % | 85.8 | % | 87.5 | % | 86.3 | % | |||||||||||||

| Operating profit margin | 26.8 | % | 15.2 | % | 21.8 | % | 20.0 | % | |||||||||||||

| Effective tax rate | 20.5 | % | 11.3 | % | 18.3 | % | 15.6 | % | |||||||||||||

| Non-GAAP | |||||||||||||||||||||

| (in thousands, except per share data and percentages) | Q3 QTD 2024 | Q3 QTD

2023 | % Change | Q3 YTD

2024 | Q3 YTD 2023 | % Change | |||||||||||||||

| Net income | $ | 227,010 | $ | 122,897 | 84.7 | % | $ | 568,208 | $ | 423,991 | 34.0 | % | |||||||||

| Diluted earnings per share | $ | 2.58 | $ | 1.41 | 83.0 | % | $ | 6.47 | $ | 4.85 | 33.4 | % | |||||||||

| Gross margin | 92.8 | % | 91.1 | % | 92.2 | % | 91.1 | % | |||||||||||||

| Operating profit margin | 45.8 | % | 34.1 | % | 41.6 | % | 36.8 | % | |||||||||||||

| Effective tax rate | 17.5 | % | 17.5 | % | 17.5 | % | 17.5 | % | |||||||||||||

| Other Metrics | |||||||||||||||||

| (in thousands, except percentages) | Q3 QTD 2024 | Q3 QTD 2023 | % Change | Q3 YTD 2024 | Q3 YTD

2023 | % Change | |||||||||||

| ACV | $ | 540,527 | $ | 457,549 | 18.1 | % | $ | 1,468,477 | $ | 1,345,305 | 9.2 | % | |||||

| Operating cash flows | $ | 174,237 | $ | 160,768 | 8.4 | % | $ | 537,767 | $ | 484,400 | 11.0 | % | |||||

| Unlevered operating cash flows | $ | 184,482 | $ | 170,625 | 8.1 | % | $ | 567,805 | $ | 512,281 | 10.8 | % | |||||

| Supplemental Financial Information |

| (in thousands, except percentages) | Q3 QTD

2024 | Q3 QTD 2024 in Constant Currency | Q3 QTD 2023 | % Change | % Change in Constant Currency | |||||||||

| ACV | $ | 540,527 | $ | 538,963 | $ | 457,549 | 18.1 | % | 17.8 | % | ||||

| (in thousands, except percentages) | Q3 YTD 2024 | Q3 YTD 2024 in Constant Currency | Q3 YTD 2023 | % Change | % Change in Constant Currency | |||||||||

| ACV | $ | 1,468,477 | $ | 1,483,108 | $ | 1,345,305 | 9.2 | % | 10.2 | % | ||||

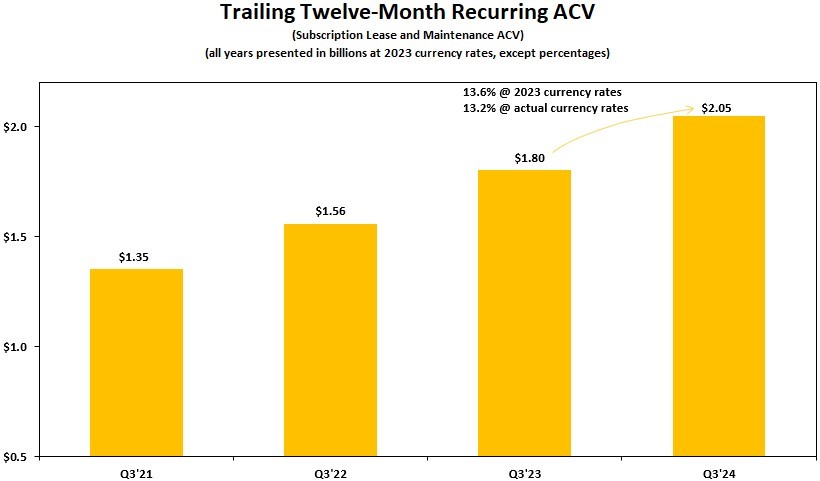

Recurring ACV includes both subscription lease ACV and all maintenance ACV (including maintenance from perpetual licenses). It excludes perpetual license ACV and service ACV.

/ Revenue

| (in thousands, except percentages) | Q3 QTD 2024 | Q3 QTD 2024 in Constant Currency | Q3 QTD 2023 | % Change | % Change in Constant Currency | |||||||||

| Revenue | $ | 601,892 | $ | 601,759 | $ | 458,795 | 31.2 | % | 31.2 | % | ||||

| (in thousands, except percentages) | Q3 YTD 2024 | Q3 YTD 2024 in Constant Currency | Q3 YTD 2023 | % Change | % Change in Constant Currency | |||||||||

| Revenue | $ | 1,662,635 | $ | 1,676,211 | $ | 1,464,841 | ()[\]\\.,;:\s@\"]+)*)|(\".+\"))@((\[[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\.[0-9]{1,3}\])|(([a-zA-Z\-0-9]+\.)+[a-zA-Z]{2,}))$/;return b.test(a)}$(document).ready(function(){if(performance.navigation.type==2){location.reload(true)}$("iframe[data-lazy-src]").each(function(b){$(this).attr("src",$(this).attr("data-lazy-src"))});if($(".owl-article-body-images").length){$(".owl-article-body-images").owlCarousel({items:1,loop:true,center:false,dots:false,autoPlay:true,mouseDrag:false,touchDrag:false,pullDrag:false,nav:true})}var a=$("#display_full_text").val();if(a==0){$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:$("#cms_article_id").val()},dataType:"json",success:function(b){},error:function(b,d,c){}})}$(".read-full-article").on("click",function(d){d.preventDefault();var b=$(this).attr("data-cmsArticleId");var c=$(this).attr("data-productId");var f=$(this).attr("data-href");dataLayer.push({event:"paywall_click",paywall_name:"the_manila_times_premium",paywall_id:"paywall_article_"+b});$.ajax({url:"/ajax/set-article-cookie",type:"POST",data:{cmsArticleId:b,productId:c},dataType:"json",success:function(e){window.location.href=$("#BASE_URL").val()+f},error:function(e,h,g){}})});$(".article-embedded-newsletter-form .close-btn").on("click",function(){$(".article-embedded-newsletter-form").fadeOut(1000)})});$(document).on("click",".article-embedded-newsletter-form .newsletter-button",function(){var b=$(".article-embedded-newsletter-form .newsletter_email").val();var d=$("#ga_user_id").val();var c=$("#ga_user_yob").val();var a=$("#ga_user_gender").val();var e=$("#ga_user_country").val();if(validateEmail(b)){$.ajax({url:"/ajax/sendynewsletter",type:"POST",data:{email:b},success:function(f){$(".article-embedded-newsletter-form .nf-message").html(f);$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000);dataLayer.push({event:"newsletter_sub",user_id:d,product_name:"newsletter",gender:a,yob:c,country:e})},error:function(f,h,g){}})}else{$(".article-embedded-newsletter-form .nf-message").html("Please enter a valid email address.");$(".article-embedded-newsletter-form .nf-message").addClass("show");setTimeout(function(){$(".article-embedded-newsletter-form .nf-message").removeClass("show");$(".article-embedded-newsletter-form .nf-message").html("")},6000)}});$(document).on("click",".article-embedded-newsletter-form .nf-message",function(){$(this).removeClass("show");$(this).html("")});

| |||||||