Nova completes US NASDAQ Listing and Completes 2024 Estelle Drilling and Surface Exploration Programs with Results Incoming

Caufield, Australia, Oct. 30, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited ("Nova” and the "Company”) (Nasdaq NVA) (ASX: NVA), (FRA: QM3)), a gold and critical minerals exploration stage company focused on advancing the Estelle Gold Project in Alaska, U.S.A.

Highlights

Estelle Gold Project

| ● | During the quarter Nova commenced and completed its 2024 Estelle drilling and surface exploration programs, with initial results received back from the laboratory in early October and more incoming. | ||

| ● | High-Grade Gold Continues at RPM: | ||

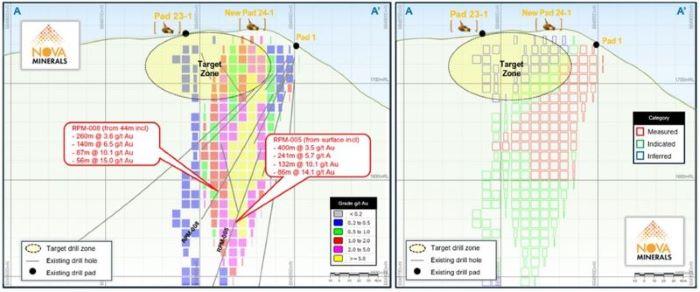

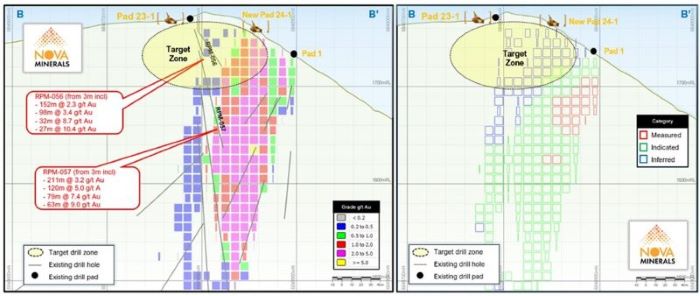

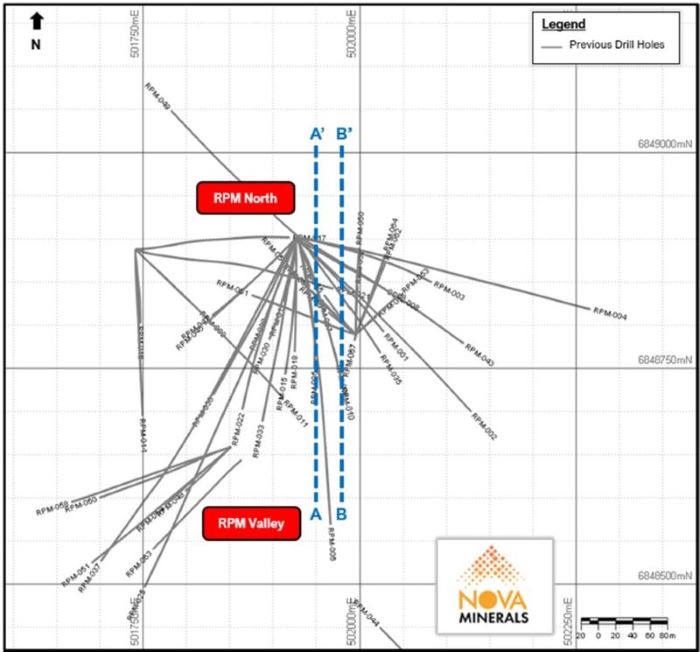

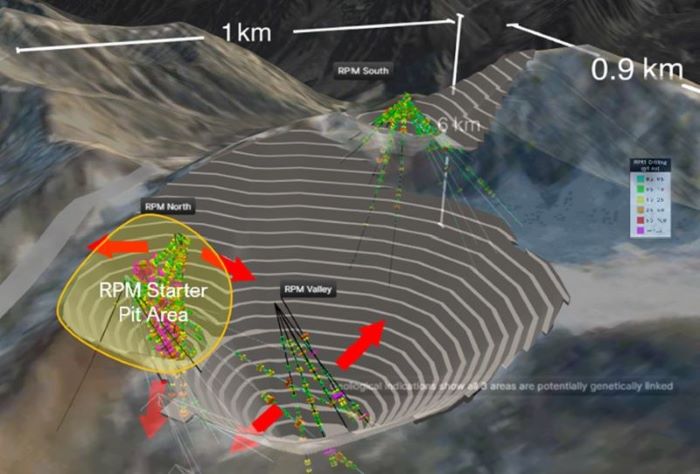

| ○ | The 2024 drill program, which comprised of 21 holes and used the Company owned Reverse Circulation (RC) rig to keep costs to a minimum, was a highly targeted program focused on Pre-Feasibility stage drilling at the high-grade RPM deposit to continue to increase and prove-up resources to the higher confidence Measured and Indicated categories. The majority of the shallow drilling was allocated to advance the high-grade RPM starter pit area (Figure 10) and to further delineate the at-surface, high-grade (1 g/t Au to > 5 g/t Au) zone encountered there during the 2022-2023 drilling, while upgrading inferred resources and testing for potential near surface extensions of the high-grade gold system to the south and west (Figures 1 to 3). | ||

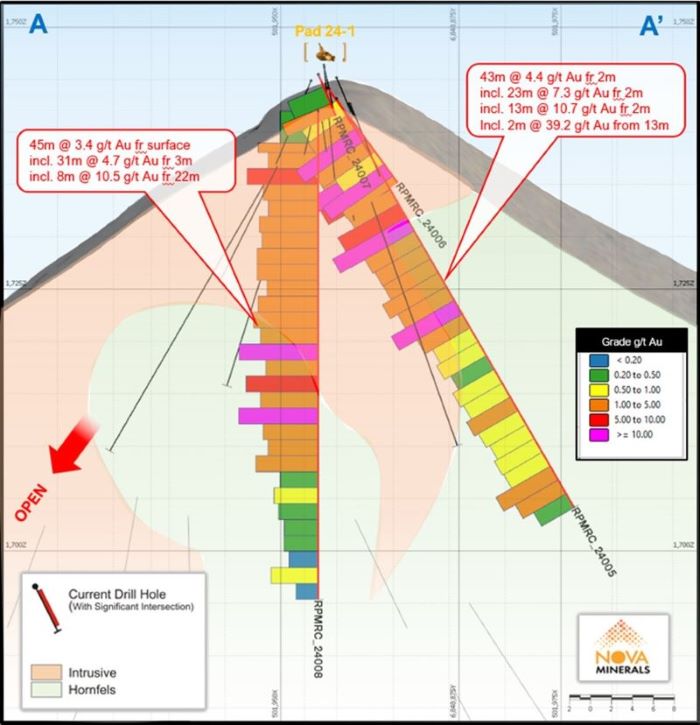

| ○ | Initial results received in early October for the first 8 holes confirmed continuity of the near surface high-grade mineralization at RPM North with multiple broad intersections grading > 5 g/t Au from surface and sample interval grades up to 39 g/t Au. All holes ended in mineralization with highlight results including (ASX Announcement: 9 October 2024 and Figures 4 to 6): | ||

| ▪ | RPMRC-24005: 43m @ 4.4 g/t Au from 2m, including 13m @ 10.7 g/t Au from 2m and 2m @ 39.2 g/t Au from 13m. | ||

| ▪ | RPMRC-24008: 45m @ 3.4 g/t Au from surface, including 131m @ 4.7 g/t Au from 3m and 8m @ 10.5 g/t Au from 22m. | ||

| ○ | Extensive surface exploration sampling program was conducted around the wider RPM area to potentially extend existing and delineate additional high-grade mineralized zones, with results expected back in October. | ||

| ● | Antimony Discoveries Advanced: |

| ○ | Stibium: |

| ● | Extensive surface exploration sampling program conducted at Stibium to follow up on the high-grade up to 60.5% Sb (Antimony) discovered in 2023 (ASX Announcement: 10 October 2023) with results expected back in October. Massive stibnite, the primary ore mineral for antimony containing approximately 72% Sb, observed to be widespread in surface mapping and sampling at Stibium. | ||

| ● | 2,500kg bulk sample of a >2m wide quartz breccia vein ,where sample E408569 from 2023 returned 12.7 g/t Au and 2.1% Sb (Antimony) (ASX Announcement: 10 October 2023 and Figure 7), collected at Stibium for metallurgical test work. | ||

| ○ | Styx: | ||

| ● | Extensive surface exploration sampling program conducted at Syx to follow up on the high-grade up to 21.7% Sb (Antimony) discovered in 2023 (ASX Announcement: 10 October 2023) with results expected back in October. Large vein (~1m thick) containing massive stibnite (~20%) in outcrop discovered at Styx (Figure 8). | ||

| ● | 500kg bulk sample of potential antimonious material containing stibnite collected from Styx for metallurgical test work. | ||

| ○ | Test work to develop a process flow sheet and plant design in anticipation of a fast track standalone antimony production scenario at Stibium. | ||

| ○ | Nova has submitted a proposal to the US Dept. Of Defense (DoD) for potential grant funding to fast track Estelle's antimony production. | ||

| ○ | Nova CEO Christopher Gerteisen, at the invitation of the US Dept. of Defense (DoD), attended another DoD related conference in September to discuss Estelle's near-term antimony production potential and illustrate how Nova could potentially help the US establish and fully secure domestic critical minerals supply chains. | ||

| ● | Another Extensive Surface Sampling Exploration Program Completed in 2024: | ||

| ○ | Over 500 soil and 225 rock samples collected as part of the extensive 2024 surface exploration and mapping program targeting gold, antimony and other critical minerals from traverses at Stibium, Wombat, West Wing, Muddy Creek, RPM, Styx, and the new claims added in 2023. Assay results, which will be reported by area once received and processed, are expected back in October and November. | ||

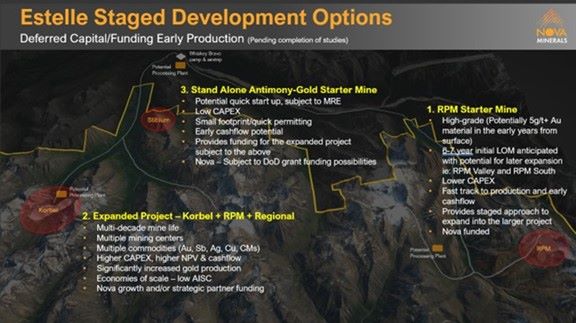

| ● | Estelle Staged Development Optionality: | ||

| ○ | Estelle is a major mineralized trend, hosting gold, antimony, silver, copper, and other critical elements and Nova is working to begin production as early as possible with the potential to operate for decades supplying the minerals the world needs. | ||

| ○ | The Pre-Feasibility Study (PFS) currently underway is considering a strategy to achieve production as soon as possible with a scalable operation, subject to market conditions and strategic partners (Figure 9), by; | ||

| 1. | Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit for potential near term cashflow at high margins to self-fund expansion plans; and/or |

| 2. | Develop the higher capex larger mining operation with increased gold production, cash flow, and mine life, which is of interest to potential future large gold company strategic partners. |

| 3. | With China announcing export restrictions on antimony, the Company is also investigating the possibility to fast track the Stibium gold-antimony prospect development option with potential US Dept. of Defense (DoD) support. |

| ○ | Environmental studies progressing and Lidar survey completed for detailed technical studies, infrastructure, and access road design. |

| ● | Snow Lake Lithium, in which the Company owns a 23.75% share, provided an update on the exploration programs it is currently undertaking at its Black Lake and Engo Valley uranium projects, and also at its Shatford Lake lithium project. |

| ● | Nova continues to hold circa $9.4m in cash and liquid investments, including $6.1m in the bank and valuable positions in both Snow Lake Lithium Ltd and Asra Minerals Limited, at the end of the quarter. |

| ● | During the quarter, the Company completed its US NASDAQ listing with an associated approximate US$3.3m capital raising before costs, with the ADSs trading under the ticker symbol NVA and the Company's warrants trading under the ticker code NVAWW. |

| ● | The Company also subsequently raised a further US$2.4m before costs in late September for resource and exploration field programs, including additional drilling and exploration, feasibility studies to progress the RPM starter mine option, and general working capital. |

| ● | Richard Beazley, an internationally experienced mining professional and director with over 35 years of experience in senior corporate, operational and project development roles, was formally appointed as Non-Executive Chairman in July. |

| ● | In return for Nebari's support in reducing the month end cash covenant from USD$2m to AUD$1m and providing Nova with the option to extend the convertible facility for an additional 12 months to 29 November 2026, Nova has agreed, subject to shareholder approval at the upcoming AGM, to amend the conversion price of the convertible note from A$0.53 to A$0.25. |

| ● | At the end of September Nova announced its 2024 annual and sustainability reports. |

| ● | Effective from 1 October 2024 the Company has agreed to increase Craig Bentley's monthly directors fee by $6,667. The increase reflects the significant extra work required now that Nova is also listed in the US, and also takes into account the additional roles Craig has been undertaking for marketing, website development, etc, which has saved the Company thousands of dollars each month in external contractor payments. |

| ● | The Company subsequently announced that its Annual General Meeting (AGM) will be held virtually at 10am (AEDT) on Thursday, 14 November 2024. |

| ● | Notable investing and operating cash flow items during the quarter included: Exploration and evaluation costs of $1.5m principally related to the 2024 drilling and surface exploration program, $742k for audit, tax and legal fees, the majority of which were related to the Company's US NASDAQ listing, and $240k for other US listing related costs, including NASDAQ fees. |

| ● | Payments to related parties in Q1 FY25 were $218K and included CEO and Executive remuneration and non-executive director fees. |

| ● | Remaining drill results for 13 holes and other exploration activity from the 2024 field program |

| ● | Updates on potential critical minerals grant and funding options from the US Department of Defense and US Department of Energy |

| ● | Material PFS test work results and trade-off studies as they become available |

| ● | Updated global MRE including the drilling undertaken in both 2023 and 2024 |

| ● | Metallurgical test work ongoing |

| ● | Environmental test work ongoing |

| ● | West Susitna Access Road updates |

Figure 1. RPM North Section A-A' 1950mE looking West showing existing drill traces and selected results, and the 2024 drill target zone - Left image: Block model (Au Grade), Right image: Block model (Resource classification).

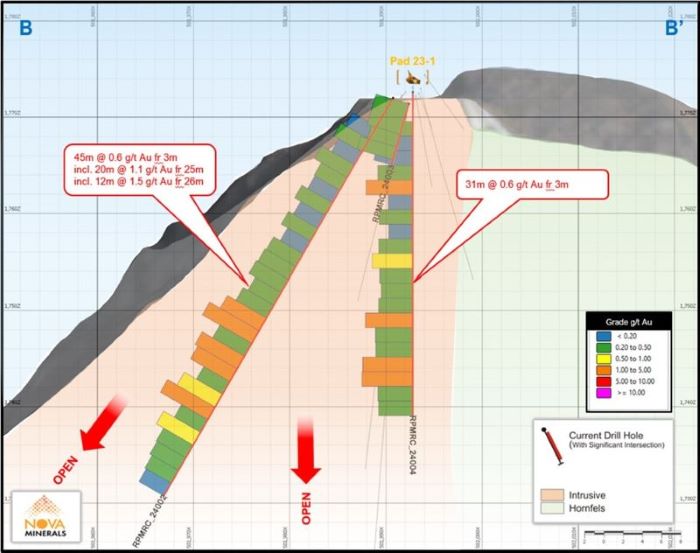

Figure 2. RPM North Section B-B' 1975mE looking West showing existing drill traces and selected results, and the 2024 drill target zone - Left image: Block model (Au Grade), Right image: Block model (Resource classification).

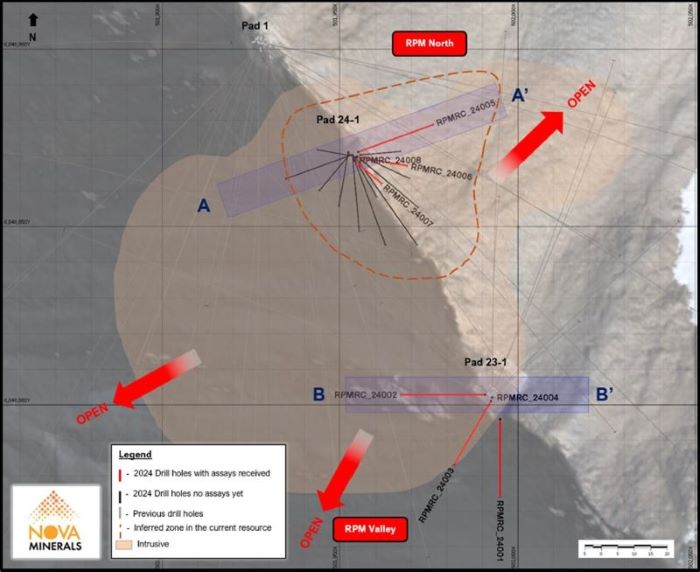

Figure 3. RPM North and RPM Valley plan view, with all drill holes to date, showing section view lines for figures 1 and 2.

2024 Drill Program - Initial Results from 8 Holes

Figure 4. RPM North Section A-A'_070azi showing continuity of mineralization with 2024 drill results

Figure 5. RPM North Section B-B'_270azi showing continuity of mineralization

Figure 6. RPM North plan view with all drill holes to date, including the 2024 drilling and section view lines for figures 4 and 5.

'Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.'

Figure 7. Nova CEO, Mr Christopher Gerteisen at Estelle inspecting potential antimonious bulk samples containing massive stibnite, which are being sent for metallurgical test work.

Figure 8. Large vein (~1m thick) strike 088, dip 82 SE containing massive stibnite (~20%) in outcrop at Styx. Stibnite bearing veins are observed in hornfels host rocks in contact with quartz monzonite intrusives.

Figure 9. Estelle development optionality

Figure 10. RPM area showing potential RPM starter pit

New Videos Released on the Company's Website During the September 2024 Quarter

| ● | 26 July 2024 | - Nova Announces Closing of US$3.3m NASDAQ IPO |

| ● | 29 July 2024 | - Formal Appointment of Nova Independent Chairman |

| ● | 31 July 2024 | - Estelle Gold Project Drilling & Company Update |

| ● | 21 August 2024 | - Estelle Gold-Antimony Project Update |

| ● | 10 September 2024 | - Bulk Testing Potential Antimony Material at Estelle |

| ● | 20 September 2024 | - RPM PFS Update with Positive Variation on Funding |

| ● | 26 September 2024 | - Nova Announces Closing of US$2.4m NASDAQ Offering |

| ● | 30 September 2024 | - 2024 Annual Report |

| ● | 30 September 2024 | - 2024 Sustainability Report |

Top 20 Shareholders as at 28 October 2024

| Rank | Name | A/C designation | 10/28/2024 | %IC | ||||

| 1 | HSBC CUSTODY NOMINEES (AUSTRALIA) LIMITED1 | 38,612,123 | 12.42% | |||||

| 2 | BNP PARIBAS NOMS PTY LTD | 15,215,239 | 6.19% | |||||

| 3 | BNP PARIBAS NOMINEES PTY LTD | 8,165,297 | 3.14% | |||||

| 4 | SL INVESTORS PTY LTD | 6,441,393 | 2.64% | |||||

| 5 | SWIFT GLOBAL LTD | 5,669,833 | 2.33% | |||||

| 6 | KUSHKUSH INVESTMENTS PTY LTD | 5,300,000 | 2.18% | |||||

| 7 | BNP PARIBAS NOMINEES PTY LTD | 5,085,670 | 1.84% | |||||

| 8 | CITICORP NOMINEES PTY LIMITED | 4,252,849 | 1.96% | |||||

| 9 | MR JAGDISH MANJI VARSANI | 4,100,000 | 1.68% | |||||

| 10 | KAOS INVESTMENTS PTY LIMITED | 3,352,692 | 1.30% | |||||

| 11 | NEBARI GOLD FUND 1 LP | 3,198,294 | 1.31% | |||||

| 12 | MR MAHMOUD EL HORR | 2,600,000 | 1.03% | |||||

| 13 | KREN ENTERPRISE PTY LTD | 2,450,000 | 1.03% | |||||

| 14 | MURTAGH BROS VINEYARDS PTY LTD | 2,440,000 | 0.89% | |||||

| 15 | MR JUSTIN BRUCE GARE & MRS KRISTIN DENISE PHILLIPS | 2,408,510 | 1.03% | |||||

| 16 | MR CRAIG EDWIN BENTLEY | 2,259,669 | 0.93% | |||||

| 17 | MURTAGH BROS VINEYARDS PTY LTD | 2,167,380 | 0.89% | |||||

| 18 | LETTERED MANAGEMENT PTY LTD | 2,050,000 | 0.84% | |||||

| 19 | KIKCETO PTY LTD | 2,028,924 | 0.83% | |||||

| 20 | PATRON PARTNERS PTY LTD | 1,983,214 | 0.81% | |||||

| Total - Top 20 | 119,781,087 | 45.27% | ||||||

| Balance of Register (5,544 holders) | 152,155,794 | 54.73% | ||||||

| Grand Total | 271,936,881 | 100.00% |

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations, presentations and videos all available on the Company's website.

This announcement has been authorized for release by the Executive Directors.

| Christopher Gerteisen CEO and Executive Director | Craig Bentley Director of Finance, Compliance & Investor Relations M: +61 414 714 196 |

Mr Vannu Khounphakdee P.Geo., who is an independent consulting geologist of a number of mineral exploration and development companies, reviewed and approves the technical information in this release and is a member of the Australian Institute of Geoscientists (AIG), which is ROPO accepted for the purpose of reporting in accordance with ASX listing rules. Mr Vannu Khounphakdee has sufficient experience relevant to the gold deposits under evaluation to qualify as a Competent Person as defined in the 2012 edition of the 'Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Vannu Khounphakdee is also a Qualified Person as defined by S-K 1300 rules for mineral deposit disclosure. Mr Vannu Khounphakdee consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

The information in the announcement dated today that relates to exploration results and exploration targets is based on information compiled by Mr. Hans Hoffman. Mr. Hoffman, Owner of First Tracks Exploration, LLC, who is providing geologic consulting services to Nova Minerals, compiled the technical information in this release and is a member of the American Institute of Professional Geologists (AIPG), which is ROPO, accepted for the purpose of reporting in accordance with ASX listing rules. Mr. Hoffman has sufficient experience relevant to the style of mineralization and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 edition of the 'Australian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr. Hoffman consents to the inclusion in the report of the matters based on information in the form and context in which it appears.

The Exploration results were reported in accordance with Clause 18 of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (2012 Edition) (JORC Code).

Nova Minerals confirms that it is not aware of any new information or data that materially affects the information included in the relevant market announcements, and in the case of the exploration results, that all material assumptions and technical parameters underpinning the results in the relevant market announcement continue to apply and have not materially changed.

Forward-looking Statements and Disclaimers

This news release contains "forward-looking information” within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward looking information can be identified by the use of forward-looking terminology such as "plans”, "expects” or "does not expect”, "is expected”, "budget” "scheduled”, "estimates”, "forecasts”, "intends”, "anticipates” or "does not anticipate”, or "believes”, or variations of such words and phrases or indicates that certain actions, events or results "may”, "could”, "would”, "might” or "will be” taken, "occur” or "be achieved.” Forward-looking information is based on certain factors and assumptions management believes to be reasonable at the time such statements are made, including but not limited to, continued exploration activities, Gold and other metal prices, the estimation of initial and sustaining capital requirements, the estimation of labour costs, the estimation of mineral reserves and resources, assumptions with respect to currency fluctuations, the timing and amount of future exploration and development expenditures, receipt of required regulatory approvals, the availability of necessary financing for the Project, permitting and such other assumptions and factors as set out herein. apparent inconsistencies in the figures shown in the MRE are due to rounding

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in Gold prices; sources and cost of power and water for the Project; the estimation of initial capital requirements; the lack of historical operations; the estimation of labour costs; general global markets and economic conditions; risks associated with exploration of mineral deposits; the estimation of initial targeted mineral resource tonnage and grade for the Project; risks associated with uninsurable risks arising during the course of exploration; risks associated with currency fluctuations; environmental risks; competition faced in securing experienced personnel; access to adequate infrastructure to support exploration activities; risks associated with changes in the mining regulatory regime governing the Company and the Project; completion of the environmental assessment process; risks related to regulatory and permitting delays; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalisation and liquidity risks including the risk that the financing necessary to fund continued exploration and development activities at the Project may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of the Company; the risk of litigation.

Although the Company has attempted to identify important factors that cause results not to be as anticipated, estimated or intended, there can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Forward looking information is made as of the date of this announcement and the Company does not undertake to update or revise any forward-looking information this is included herein, except in accordance with applicable securities laws.

Tenement Holdings as at 30 September 2024

A list of Nova's Tenement Holdings, as at the end of the Quarter, is presented in the schedules below, with additional notes.

<| Tenement/Claim/ADL Number | Location | Beneficial % Held | ||||

| 725940 - 725966 | Alaska, USA | 85 | % | |||

| 726071 - 726216 | Alaska, USA | 85 | % | |||

| 727286 - 727289 | Alaska, USA | 85 | % | |||

| 728676 - 728684 | Alaska, USA | 85 | % | |||

| 730362 - 730521 | Alaska, USA | 85 | % | |||

| 737162 - 737357 | Alaska, USA | 85 | % | |||

| 740524 - 740621 | Alaska, USA | 85 | % | |||

| 733438 - 733598 | Alaska, USA | 85 | % | |||